Graham Number Calculator

Graham Formula and Calculator: Up to what price should you buy the stock.

Insert earnings per share (EPS) and book value per share into this calculator and get the Graham number. Earnings per share and the book value per share can be found via a Google search, in the annual report on the company’s website under “Investor Relations” or on financial websites.

In our Premium Tool, a large number of different evaluation models are used and the required data is loaded automatically. Find the Graham Number to more than 45,000 stocks worldwide.

Graham Number:

Should I still buy the stock or is it already too expensive? Anyone who has ever bought shares and wants to buy a share that has already risen knows that moment when you ask yourself exactly that question. Graham’s Number provides the answer to exactly this question: Up to what price can I buy the stock? With this online calculator, you can quickly and easily determine the maximum buying price of every stock worldwide. To do this, just add the earnings per share and the book value per share into the calculator. Remember that earnings and book value should be positive.

Graham Number = Highest price that should be paid for a stock, stocks below the Graham Number offer good value.

What is the Graham Number?

The Graham Number originates from the legendary stock market expert (and teacher of Warren Buffett) Benjamin Graham. As the inventor of fundamental security analysis and the first to adopt the value approach, he and Warren Buffett were able to accumulate an incredible fortune and make stock market history.

The Graham Number measures the upper limit of the stock price at which a stock should be bought using earnings per share and book value per share. The Graham Number can also be used to find cheap, undervalued stocks that are worth purchasing. The final number is theoretically the maximum price that a defensive investor should pay for the given stock.

In other words, a stock priced below the Graham Number would be considered good value if it also meets several other criteria. The Number represents the geometric mean of the maximum amount one would pay based on earnings and based on book value.

Graham writes: “The current price should not be more than 1.5 times the last reported book value. However, a multiplier of earnings below 15 could justify a correspondingly higher multiplier of assets. As a rule of thumb, we suggest that the product of the multiplier times the ratio of price to book value should not exceed 22.5. (This figure corresponds to 15 times earnings and 1.5 times book value. It would admit an issue selling at only 9 times earnings and 2.5 times asset value, etc.) — Benjamin Graham, The Intelligent Investor, Chapter 14 (The “Intelligent Investor” by Benjamin Graham is a classic book on value investing.

It offers practical advice and guidance to help investors make sound investment decisions based on the principles of fundamental analysis. Graham emphasizes the importance of thoroughly analyzing a company’s financial health, earnings, and growth potential, rather than blindly following market trends, in order to make informed investment choices and achieve long-term success.)

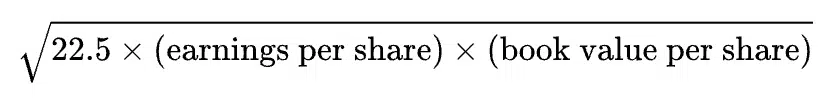

Graham Number Formula:

The Graham number is calculated from the combination of book value and earnings per share. Anchored in the formula are Benjamin Graham’s requirements that a share should have a lower price-to-earnings ratio (P/E) than 15 and a lower price-to-book value (P/B) ratio than 1.5. (15 * 1.5 = 22.5):

Root of (22.5 * earnings per share * book value per share)

The formula is stored in this online calculator and the user only needs to enter the earnings per share and the book value per share into the calculator. The result is the maximum price that should be paid for one share, according to Benjamin Graham. Here again the same Ben Graham formula as picture:

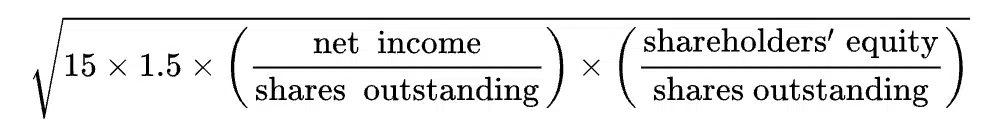

Earnings per share is calculated by dividing net income by shares outstanding (total number of issued shares). Book value is another way of saying shareholders’ equity (shareholders’ equity is the amount that the owners of a company have invested in their business). Therefore, book value per share is calculated by dividing equity by shares outstanding. The Graham number formula can also be written as follows:

Root of (15 * 1.5 * ((net income / shares issued) * (equity /shares issued))

Limitations of the Graham Number

Since the Graham number only uses earnings per share and book value per share, it lacks the interpretation of other important parameters such as profitability, management quality, margins, and growth opportunities. The Graham number is well suited for a first quick look at the possible maximum share price, but you should still include other key figures and also address the quality of the share.

In order to deal with further key figures, we have developed the Fairvalue Calculator, an extended calculator with 7 fundamental key figures, which takes other influencing factors into account. If the search for the fundamental key figures is too complicated for you, you can also opt for the premium membership in the Fairvalue Calculator. The fundamental key figures are loaded automatically and all kinds of fair values are calculated and displayed. Plus, you get many more tools to help you invest.

In addition to a stock screener and a market & industry analysis, a quality test is also available with which you can, for example, check the quality of a company that Graham does not address with the Graham number.