Evidence-Based High Quality & Premium Stock Analysis Tool.

We have done our homework and put the results of the Fairvalue-Calculator through their paces in every conceivable way. It's not about luck, it's about statistical facts.

Value Premium

Live Tests

Backtests

Sample Portfolios

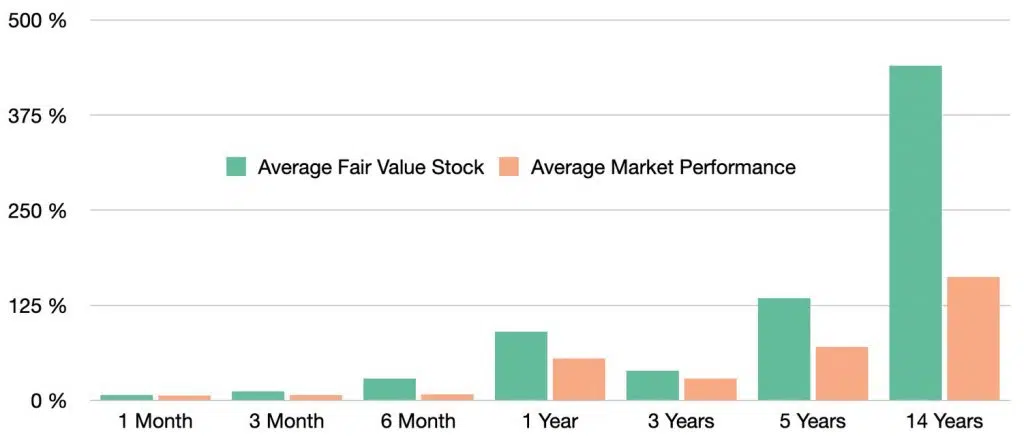

7-9% annual outperformance in the long run.

In average all our tests combined show an annual outperformance for Fair Value stocks relative to their markets of 7-9% in the longterm, which confirms the scientific suspicion of an existence of the value premium.

83% of stocks with higher Fair Value than recent market price hit their Fair Value during 5.5 years.

In our modified analysis where also growth data are calculated into the Fair Values presented in our Premium Tool we seem to find another edge against historical studies. In average randomly selected fair value stocks hit their fair value after 5.5 years in 83% of the time.

This impressive performance of the last 17 years is no guarantee for future outperformance, but it seems like the fairvalue-calculator does a good job by selecting stocks and compile them to a great stock portfolio. Additionally the fairvalue calculator delivers tools that show you the best time for high cash reserves or when to get fully invested. This boosts the performance again.

Empirical Evidence

Check below our backtests, livetests and historical studies as evidence for our method.

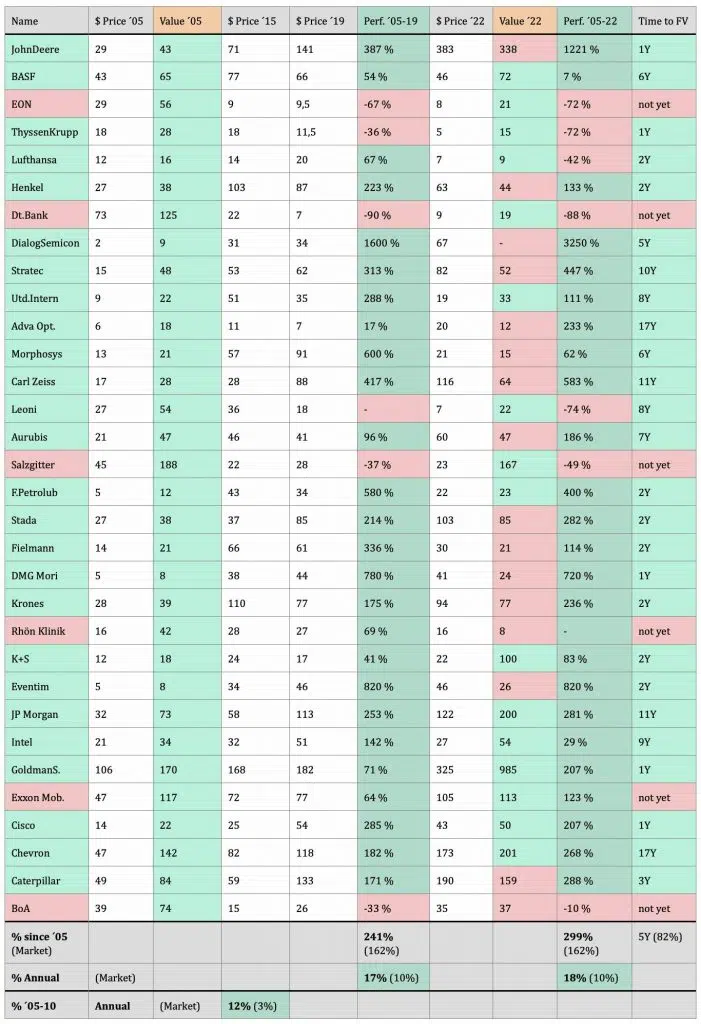

Simple random Sample 17y.

In this first sample we have chosen 32 stocks randomly from USA and Germany in the year 2005. All 32 stocks have shown a higher fair value back in 2005. From 2005 to 2010 these stocks performed with an average annual return of 12%. In the meanwhile the market (average of DAX and DOW indices) made 3%, quite a poor performance due to the financial crisis back in 2008. Nevertheless these Fair Value stocks could outperform the market by 9%. The same happened from 2005 to 2019 (7% outperformance) and from 2005 to 2022 (8% outperformance). With an average annual stock market performance of 9% and an outperformance of Fair Value stocks of 8% we could expect returns of 17% per year in the long run.

26 of the 32 stocks could reach their calculated Fair Values with impressive performances. The other 6 have not yet hit their Fair Values in these 17 years. Hitting Fair Value appears to happen after 5.5 years on average.

Increased Sample Size.

Now that you have seen how we tracked outperformance in the simple first test, here an automated test that we ran with the help of our database. Within the database we track more than 35000 stocks worldwide with their fair values and their relative performance to the market.

We ran innumerable automated test that always showed comparable results to the first simple test above. For sure it depends which markets and sectors you are invested in, but to choose the right market timing and sectors we also deliver the market- and sector-tool within our membership to help you with that.

Studies about Value Investing.

A systematic review of literature and studies shows the same results as we found. Value investing is a promising way to identify great stocks.

Journal of Accounting Resaearch, Vol 38, 2000.

"Value Investing - The Use of Historical Financial Statement Information to seperate Winners from Losers."

Joseph Piotroski investigated value shares between 1976 and 1996. Based on fundamental analysis and an calculation of the true value of stocks based on historical data from the market reports of companies, the author assumes an annual outperformance of 7.5%.

As mentioned by Piotroski, FAMA 1998 shows that historical data from business reports are not priced in efficiently on the market. (This means that there seems to be an inefficiency between real market data and stock market prices, and this inefficiency allows opportunities to be identified and exploited for a higher returns in the portfolio.)

Frankel & Lee 1998.

"The strategy presented in Frankel & Lee requires investors to purchase stocks whose prices appear to be lagging fundamental values." - Over a 3-year period, Frankel and Lee showed that investing in undervalued stocks produced a higher return. (This underlines that Fair Value Stocks should be held for at least 3-5 years to hit their fair values.)

Warren Buffett.

"Price is what you pay, value is what you get.”

Unleash Your Stock Data Instantly.

100% Satisfaction - 0% Risk - Cancel Anytime.