Savings Calculator

Calculate Your Savings Plan Returns Online: Use our Savings Plan Calculator for Quick Savings Results and to plan your retirement savings!

Savings Calculator

This Savings Plan Calculator is versatile and is suitable for a wide range of investments that generate returns or interest, including bonds, stocks, funds, ETFs, and certificates.

It offers a universal application for all interest-bearing securities. To use the calculator, input the following values:

- Initial Capital: Original amount of money invested;

- Return /Yield: Referring to the annual percentage gain or return generated over time;

- Period (Years): Referring to the period over which the investment calculations will occur;

- Yearly Contribution: Referring to the amount an investor contributes each year to a savings plan or investment.

Calculate Your Retirement Savings:

Retirement savings are crucial to ensure a comfortable and stress-free retirement. It’s important to start saving early and regularly to build a significant nest egg. One of the best ways to save for retirement is through a 401(k) plan. This is a tax-advantaged savings account that allows you to contribute a portion of your pre-tax income. If your employer offers a 401(k) match, it’s important to contribute at least enough to receive the full match.

Additionally, consider diversifying your retirement savings by opening an Individual Retirement Account (IRA). Both traditional and Roth IRAs offer tax benefits and can help you reach your retirement savings goals. Remember, the earlier you start saving for retirement, the more time your money will have to grow, so don’t wait!

The path to building sustainable wealth begins with wise financial decisions, and a savings plan plays a central role in this journey. By making regular contributions, you establish a solid foundation to achieve long-term financial goals. But how do you maximize the return on your investments? Enter the Fair Value Calculator.

A savings plan allows you to systematically save money and utilize this capital for future investments. However, to unlock the full potential of your investments, it is crucial to understand the fair value of your assets. This is where the Fair Value Calculator comes into play, a powerful tool that helps you determine the real value of your investments.

With the Fair Value Calculator, you can not only assess the current market value of your assets but also identify potential opportunities and risks. This tool empowers you to make informed decisions, boosting your returns and accelerating the growth of your wealth.

A savings plan combined with the Fair Value Calculator is an unbeatable team for achieving your financial goals. By saving systematically and keeping an eye on the fair value of your investments, you create a solid foundation for the long-term growth of your wealth. Start today and shape your financial future intelligently.

Unbelievable - The Power of Returns in a Savings Plan!

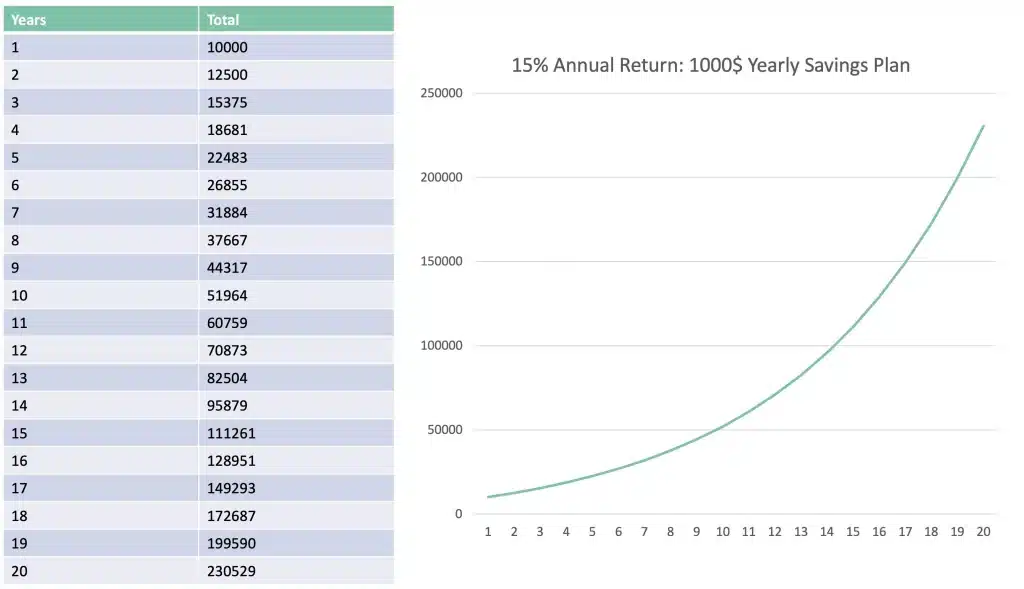

The return from the savings plan at 9% is already impressive. Now, let’s explore calculations with a 15% return. The following graphs and charts illustrate that the rate of return is just as crucial as regular savings amounts in boosting investment returns! Notice the significantly steeper rise in capital with a 15% return in the savings plan.

Boost Your Returns!

The Fairvalue-Calculator valuation method enables you to make more informed investment decisions by identifying undervaluations of stocks. The Fair Value Calculator opens up the opportunity to recognize market trends and adjust your strategy accordingly.

The Fair Value Calculator focuses on the long-term perspective. Instead of solely concentrating on short-term market fluctuations, this approach encourages considering the potential value of your investments over time.

Take advantage of the Fair Value Calculator to strengthen your financial decision-making. Start now with a thorough and objective evaluation of your investments to achieve your long-term financial goals!”

Compound Calculator Formula

The formula used in the savings plan calculator allows the calculation of future capital based on the entered initial capital, interest rate or return, duration, and annual savings rate. The formula is based on the concept of compound interest, taking into account both the growth of the initial capital through the interest rate and the continuous contributions through the annual savings rate.

Total = Initial * (1 + Return / 100)^Years + Contribution * ((1 + Return / 100)^Years – 1) / (Return / 100)