EBIT Margin Ratio Calculator

Awesome EBIT Margin Profitability Calculator and Formula.

Paste the company’s earnings before interest and taxes and the total revenue into this EBIT Ratio Calculator to receive the EBIT Margin Ratio. Find these key data in the financial reports yourself or use the Premium Tools to automatically load these data.

EBIT margin is a financial ratio that measures a company’s profitability by dividing its earnings before interest and taxes (EBIT) by its revenue.

It’s expressed as a percentage and used in fundamental analysis to assess a company’s financial health and potential for future growth. A higher EBIT margin suggests better efficiency and profitability, while a low EBIT margin may indicate challenges in controlling costs.

What is the Ebit Margin Ratio?

EBIT margin as the name suggests is a ratio of EBIT (Earnings Before Interest and Taxes) to the total revenue of the company.

Quoted in %, it is a measure of operational efficiency of the company. Consequently a higher margin is better than a lower margin. It is unique in that it indicates how well the company is doing in its operations and whether it is generating money primarily from operations as compared to other income as well as eliminate the bias of taxation and debt on profit numbers during evaluation.

Its importance shall be explained in detail as we move forward and as always knowledge is easily processed when accompanied by an example so let us look at one while we try to understand this ratio in detail.

While evaluating companies, we ideally want to measure how their operations run against each other. Different industries tend to have different structures, costs, regulations and other operational constraints and thus it would not be fair to compare companies across different sectors with each other using operational metrics since an IT company will operate differently from an automobile company and a retail store chain. EBIT thus is ideal to compare operational efficiencies within the same industry. Things become granular however since even within the same industry, different companies tend to have different business models and thus different operational metrics which again make comparison difficult.

Within the automobile sector a passenger vehicle company like Chrysler & Ford will have a different structure and operations to a commercial vehicle company like Volvo or Daimler. EBIT helps identify cost and market leadership amongst companies with likeminded business models in order to identify the strongest company. Also while evaluating companies internationally, net profit numbers and thus margins will not be a fair comparison as different countries tend to have different taxes as well as interest rates for their debt.

An operationally superior company in a high tax country might have less net profit margin than its competitor in a low tax country which can lead to an incorrect evaluation and consequently and incorrect investment. EBIT Margin helps measure how the company is doing viz. a viz. its operations and whether it is making money from its operations or not. For e.g. you would want a stock exchange to make money from equity transactions and not from other investments or side businesses as was the case of Bombay Stock Exchange.

Another name for EBIT is Return on Sales and it helps you identify companies generating their highest return on sales once you remove the impact of debt and taxes from the evaluation. That is not to say that debt and taxes are inconsequential. However, as an investor you would only want to invest in market leaders with strong operations and efficient cash conversion and that can be found only via EBIT Margin.

EBIT Margin Ratio Formula:

EBIT Margin = (EBIT / Total Revenue) * 100

EBIT Margin is quoted in percentage terms in the lines of Return on Equity. It is the ratio of Earnings Before Interest and Taxes of the company divided by the Total Revenue of the company.

Example:

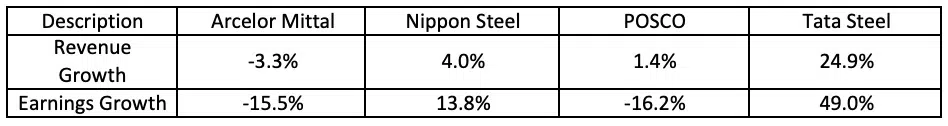

It is no surprise that Tata Steel has done really well in this commodity bull market with it being operationally strong as well as showing strong revenue growth as well as earnings growth. POSCO has done well too despite showing an earnings decline due to its high EBIT margin. Arcelor Mittal is amongst the top 2 steel producers in the world by volume and its share performance reflects that volume leadership. In the case of Nippon steel, as the saying goes, rising tide raises all boats and Nippon Steel stock has been the beneficiary of the commodity market rally despite its subpar performance.

What you shold be looking for:

EBIT Margin like any other financial metric or ratio is not a universal solution for evaluating companies. It comes with its own set of limitations and drawbacks and as such it should be used in conjunction with other financial ratios to undertake a complete evaluation of the company under consideration. Its largest drawback is its hyper local comparison.

Forget same sector, companies need to have the same business models as well which makes it completely irrelevant in fields having constant innovation namely technology, pharmaceuticals and biotech. This margin does not take into account depreciation of assets. This is an important financial metric to be left out. Depreciation numbers provide a lot of information about company’s assets, namely whether it is continuously upgrading and innovating vs it using old and inefficient machinery.

It can be mitigated to some extent by comparing EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) margin instead of EBIT Margin. EBITDA can be arrived at by adding depreciation. Finally economies of scale come into the picture. Larger companies by virtue of their size are expected to have better operational margins although not necessarily true all the time.

The only way to improve operational margin is to improve sales or cut costs. One of the easiest ways to cut costs is to have a large scale which distributes your fixed costs over a larger base. Thus larger companies often tend to have an operational advantage over their smaller counterparts especially in commodities businesses. Thus a filter basis EBIT margin will often filter out young but promising companies in favor or larger well established ones.

There is not much ambiguity when it comes to evaluating companies via EBIT margin. The higher the margin the better. All companies with EBIT margins above industry average should make the initial shortlist. It also helps to look at margins of previous years as well in order to eliminate any seasonal or cyclical bias that may have crept in.

For e.g. a food company depending on agricultural products as inputs may have superior EBIT margins one year due to a bumper crop which will suppress crop prices and thus input costs but their margins over a period of 5 years will highlight the true picture of their operational capabilities which one good year might hide.

Conclusion:

EBIT margin is a starting point to separate the wheat from the chaff so as to speak. Using EBIT margin, one can filter out companies with strong operations and then deep dive into them further to evaluate via other financial ratios. Always remember that no single ratio is the holy grail of investment selection.

One must build a consensus of various financial ratios like P/E, P/B, and ROE etc. alongside EBIT margin in order to arrive at an investment decision. Alternatively, join our premium membership and we will do all of this work for you, providing you various fair values right on your very own premium dashboard.

With the Premium Tools of the Fair Value Calculator, you no longer have to look for the fundamental key figures yourself. All financial data for more than 45,000 stocks worldwide are automatically loaded and processed in the database. In addition, you can use the stock screener to find cheap fair value stocks even more easily.