Joel Greenblatt Ranking Value Rechner

Ranking Calculator, Magic Formula & "The Little Book That Beats The Market"

Joel Greenblatt

Joel Greenblatt, born in 1957 in New York, embarked on a remarkable journey that led him to become a renowned figure in the world of finance. A Harvard University graduate with an MBA, Greenblatt began his career as an investment banker at Morgan Stanley before venturing into entrepreneurship. In 1983, he took a bold step by founding his own investment firm, Gotham Capital. However, it was his groundbreaking book, “The Little Book That Beats The Market,” that truly catapulted him to global fame.

The book introduced the Magic Formula, a method of ranking stocks based on the sum of earnings yield and return on capital, proving to be a game-changer for investors. During the period from 1988 to 2004, before the financial crisis struck, Greenblatt achieved an astonishing average annual return of 30.8%. This remarkable feat surpassed the S&P 500 Index’s performance in the same timeframe by more than threefold, solidifying his reputation as a masterful investor. Explore the secrets behind Greenblatt’s success and unlock the potential for financial growth.

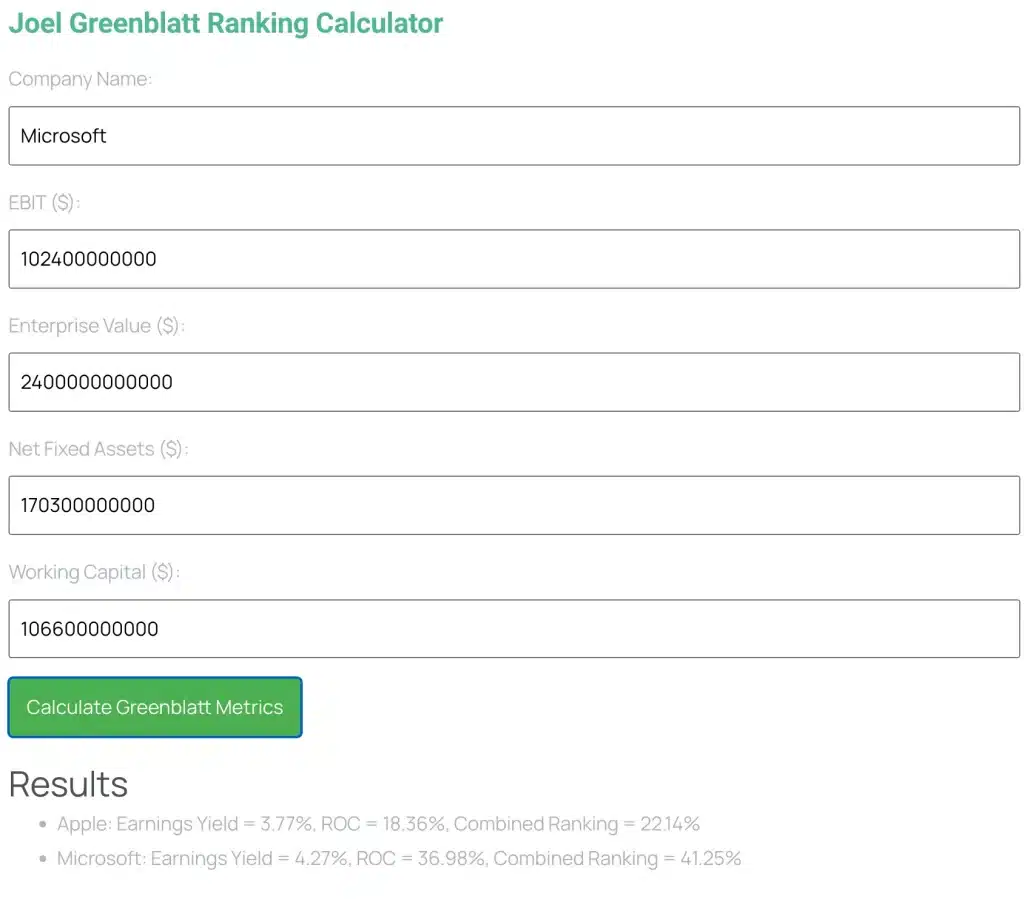

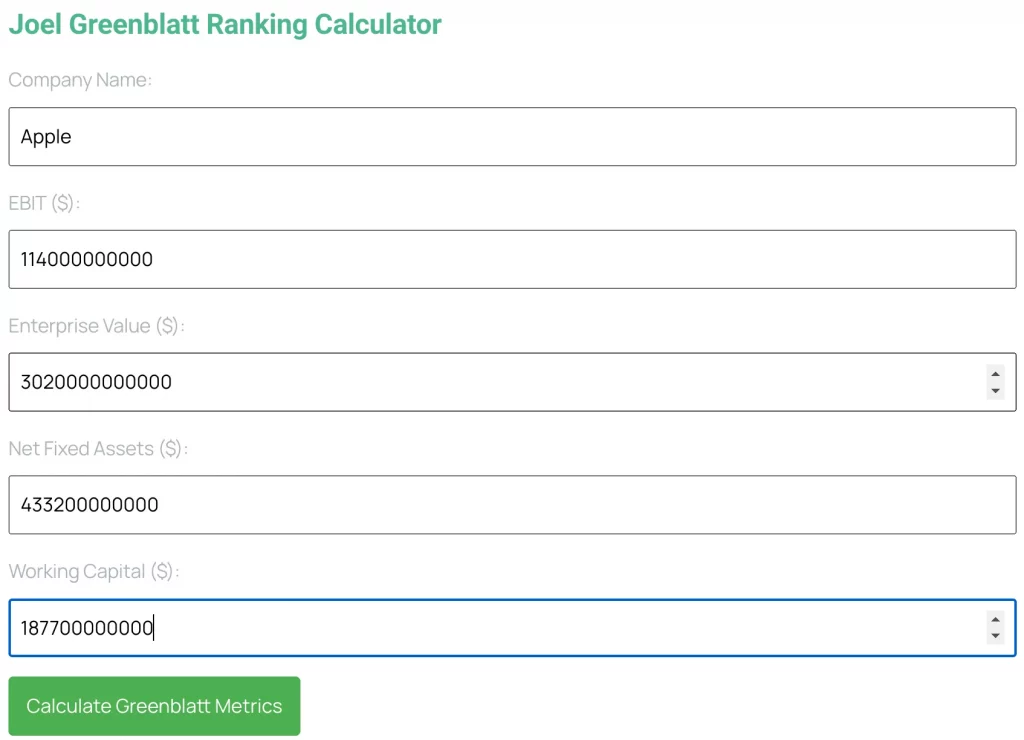

Joel Greenblatt Ranking Calculator

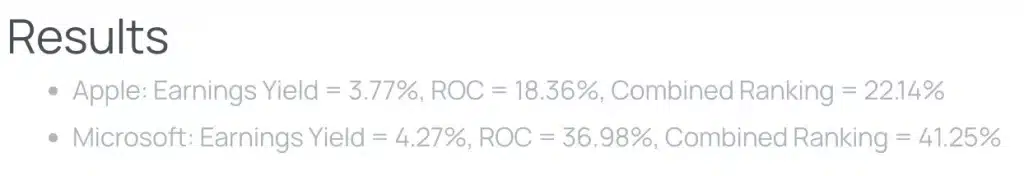

Results

The Little Book That Beats the Market

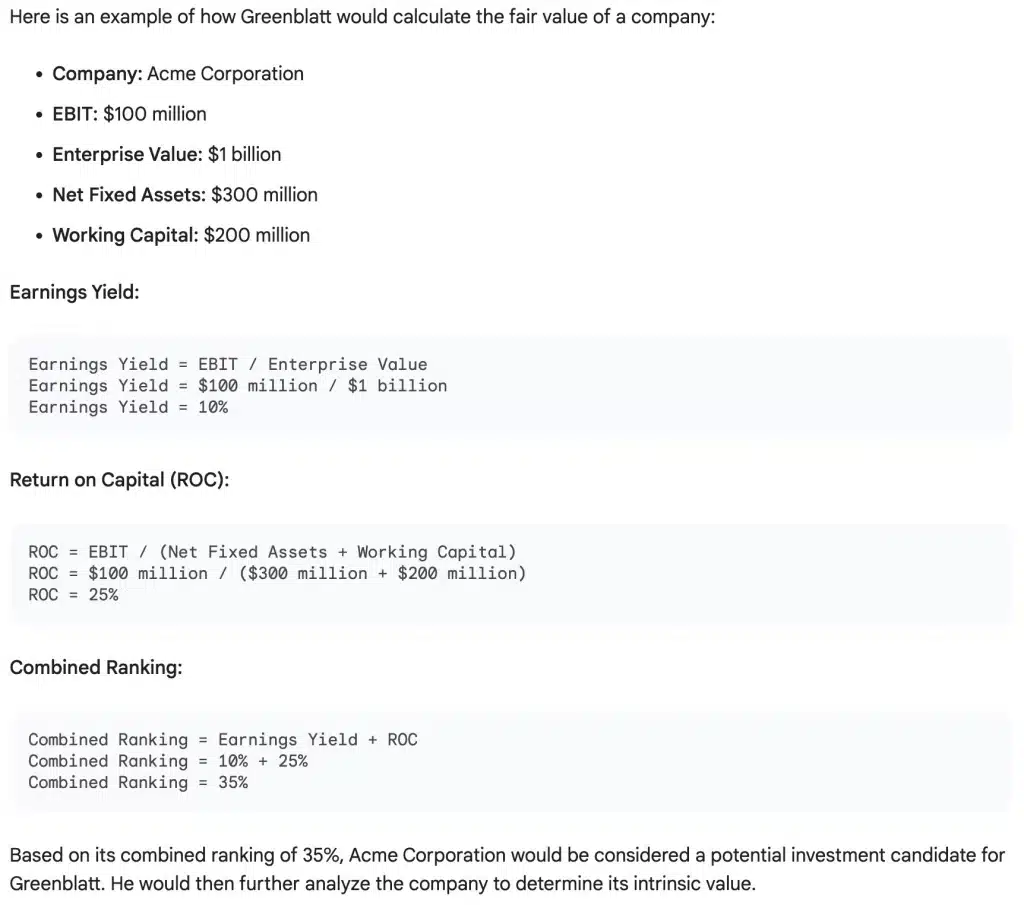

Greenblatt’s investment strategy is rooted in Value Investing, an approach that seeks to acquire undervalued stocks. He employs a unique method for evaluating stocks, which he aptly named the Magic Formula. The Magic Formula is built on two straightforward metrics:

EBIT/EV: The ratio of Earnings before Interest and Taxes (EBIT) to Enterprise Value (EV), also known as Earnings Yield.

Return on Capital (ROC): The return on invested capital.

According to Greenblatt, stocks with high EBIT/EV and ROC values are considered undervalued. He strategically acquires these stocks and holds onto them for the long term. Uncover the insights behind Greenblatt’s Magic Formula and discover the potential for identifying investment opportunities in undervalued assets.

Joel Greenblatt: Microsoft and Apple

Joel Greenblatt Magic Formula

Joel Greenblatt’s “Magic Formula” is an investment strategy presented in his book, “The Little Book That Still Beats the Market.” The formula combines two financial metrics, Earnings Yield and Return on Capital, to evaluate companies.

The concept is to identify companies that are attractive both in terms of earnings relative to market value and exhibit a high return on invested capital. The formula is expressed as follows: Magic Formula Rank = Earnings Yield Rank + Return on Capital Rank.

Unlock the potential of Greenblatt’s Magic Formula and explore how it can guide you in identifying companies with a compelling combination of earnings and return on capital for investment success.

Joel Greenblatt's Perspective on Dividends

Joel Greenblatt, a prominent value investor and author of “The Little Book That Beats the Market,” expounds his views on dividends within the framework of his renowned “Magic Formula.” This strategy, detailed in his book, has historically led to outperforming the stock market.

Within Greenblatt’s Magic Formula, one of the key metrics is dividend yield. He regards dividends as a form of “yield guarantee,” providing investors with a consistent payout irrespective of stock price fluctuations.

Greenblatt contends that dividend payments serve as a significant signal of a company’s quality. His argument posits that companies consistently distributing dividends typically possess robust business models and solid earnings. Through his research, Greenblatt has observed that companies with high dividend yields generally outperform the broader stock market.

This outperformance is likely attributed to the lower risk profile of these companies and their ability to provide investors with a steady income stream. Encouraging investors to allocate a portion of their portfolios to dividend-paying stocks, Greenblatt believes these stocks offer an excellent avenue for regular returns while minimizing risk.

Several direct statements from Joel Greenblatt emphasize his stance on dividends: “Dividends are a gift from heaven,” “Dividends are one of the reasons I buy stocks,” and “Dividend stocks are one of the best ways to generate regular income.” In summary, Greenblatt is a staunch advocate for dividends, viewing dividend-paying stocks as an effective means to achieve consistent returns while simultaneously mitigating risk.

Greenblatt-Model and Many More

Find all Valuation Models in Our Premium Tools: