Stock Valuation

Find the Best Value Stocks in the World with This Tool

In the Fair Value Stocks Database, in addition to market and industry data for the overall stock market, numerous data points for each individual stock are also available.

With over 45,000 stocks in the database and millions of data points, the tools can identify undervalued stocks worldwide.

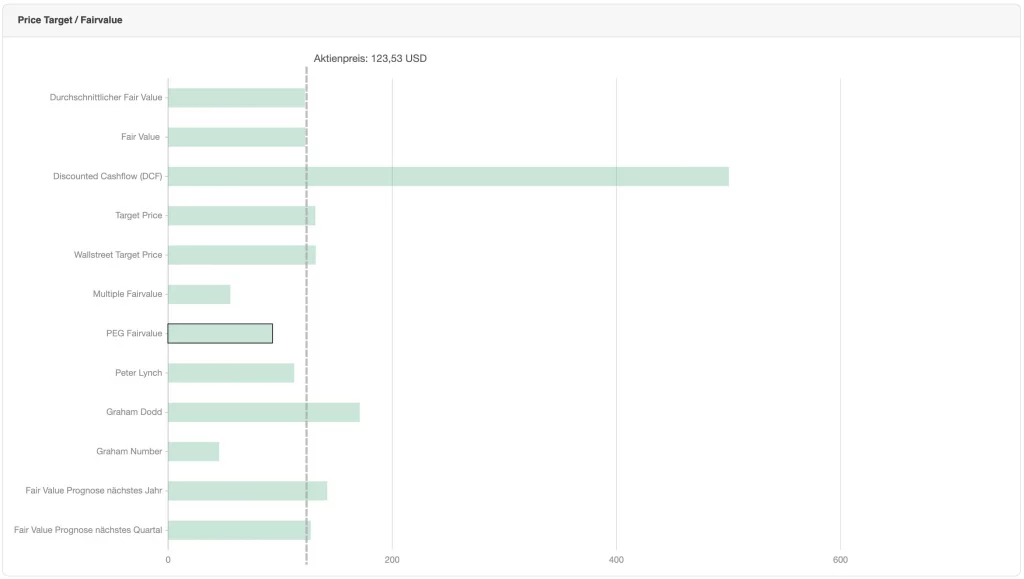

Fifteen different valuation models generate an estimation of the fair value. Stocks that have a higher fair value than their current market price should be considered for purchase.

Additional valuation and quality tools provide quick and easy information about the stock.

What are Good Fair Value Stocks?

Good stocks according to the Fair Value Calculator strategy exhibit positive quantitative and qualitative characteristics, as well as an attractive valuation. Investments should be made in such stocks during favorable market conditions. The Fair Value Calculator assists in identifying these stocks, suitable industries, and the appropriate market environment.

High Fair Value

Fundamental Strength

Sales Growth

Great Performance

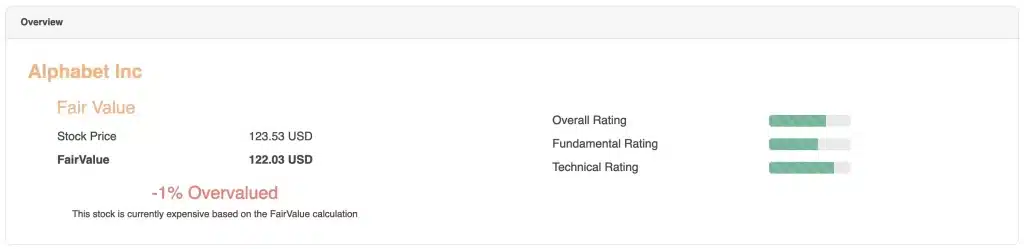

High Fair Value (True Value)

Fair Value: The true intrinsic value of the stock, which is compared to the current market price. The deviation from the current market price is represented in percentages, and depending on whether the stock is currently undervalued or overvalued, the deviation is depicted as undervalued or overvalued.

- Is the stock worth more than its current cost?

Fundamental Strength

Fundamental, Technical, and Overall Evaluation: The overall evaluation combines the fundamental and technical assessment. It encompasses both fundamental characteristics and the trend of price development in the stock market. The color coding allows for quick identification of whether each characteristic applies to the stock.

- Does the stock have good fundamental metrics and is the stock price moving favorably?

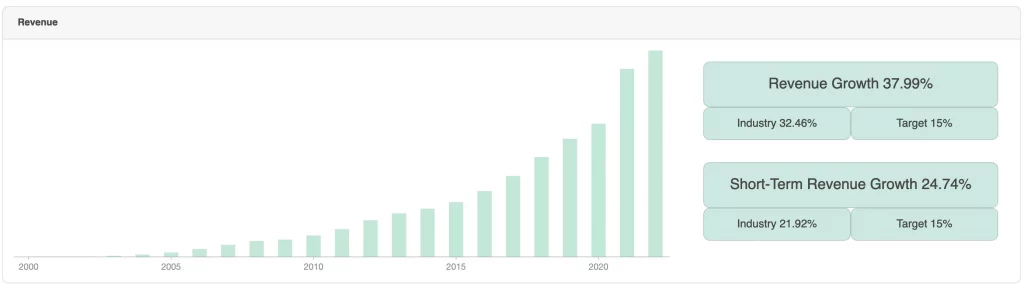

Sales Growth

In addition to solid fundamental metrics, increasing revenue growth is also one of the key factors that contribute to a good stock. Long-term and short-term growth numbers are available for each stock, which in turn influence the Fair Value. Furthermore, a sector comparison and general target for this metric are directly accessible.

- Does the stock have consistent and steady growth?

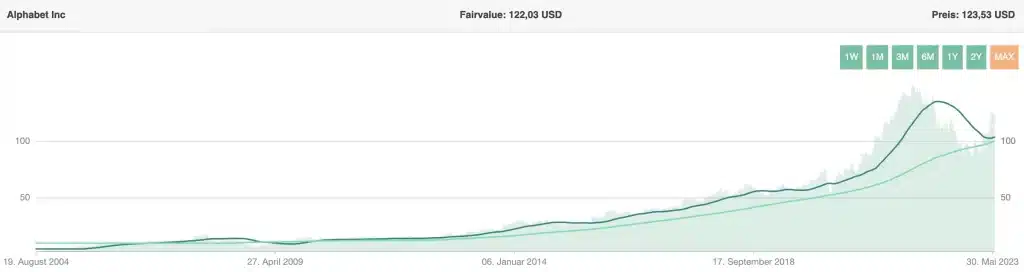

Great Performance

In addition to fundamental stock analysis, technical aspects are also considered in the stock evaluation. This allows for a quick assessment of whether the stock has performed well in a long-term uptrend based on the chart. An additional technical evaluation provides information on how well the stock has performed compared to the overall market.

- Has the stock outperformed the overall market?

Recent News

View current news about the respective stock and access the corresponding company profile to quickly get an overview of the latest updates about the company.

How the Fair Value is Calculated

A variety of valuation models are applied to each stock to determine the average Fair Value. Furthermore, all fundamental metrics are taken into account, which are visible both in the peer group comparison and in the online calculators.

Peer Groups

With the multiples, you can compare the important financial metrics with representatives of the same industry. Finding stocks that compare better to their peers is crucial in stock valuation!