Discounted Cashflow DCF Calculator

Use this Simplified Online Discounted Cashflow DCF Calculator to calculate the fair value of a stock.

Paste earnings per share (EPS or earnings per share) and sales growth in this Discounted Cashflow DCF Calculator and get the DCF true value of the stock (fair value). Earnings per share and sales growth can be found via a Google search, in the annual report on the company’s website under “Investors Relations”, or on relevant stock portals.

In our Premium Tool, a large number of different evaluation models are used and the required data is loaded automatically.

Discounted Cashflow Valuation: A Calculator for Everyone.

When it comes to investing in stocks, one of the most important factors to consider is a company’s value. This can be difficult to determine, especially for individuals who may not have a background in finance. However, by understanding the basics of discounted cash flow (DCF) valuation, you can gain a better understanding of a company’s worth and make more informed investment decisions.

What is Discounted Cash Flow Valuation?

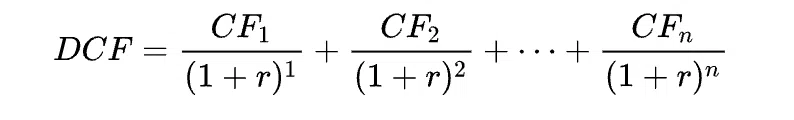

Discounted cash flow (DCF) valuation is a method used to determine the value of an investment by estimating the future cash flows it is expected to generate, and then discounting those future cash flows to their present value. This allows investors to determine the present value of a company’s future earnings, taking into account the time value of money. In simpler terms, DCF valuation allows you to determine how much money a company is expected to make in the future, and then adjust that amount based on how far into the future those earnings are expected to occur. This method can be used to value any investment, including stocks, real estate, and bonds.

How does DCF Valuation work?

DCF valuation is based on two key components: the company’s future cash flows and the discount rate. The future cash flows represent the expected earnings of the company over a certain period of time, typically 5 to 10 years. The discount rate, on the other hand, represents the cost of capital, or the rate of return an investor would expect from a similar investment. (Note: In this calculator we have used average values to make the calculator easier to use.)

The future cash flows are then discounted by the discount rate, which allows us to calculate the present value of those cash flows. This present value is then used to determine the value of the investment, which can be compared to the current market price to determine if the investment is overvalued or undervalued.

Discounted Cashflow DCF Formula and example:

For example, let’s say a company is expected to generate $100 in cash flows (CF) each year for the next five years, and the discount rate (r) is 10%. The present value of these cash flows would be calculated as follows:

- $100 / (1 + 10%) = $90.91 (present value for year 1)

- $100 / (1 + 10%)^2 = $82.64 (present value for year 2) $100 / (1 + 10%)^3 = $75.13 (present value for year 3)

- And so on, until all five years have been discounted.

The present value of all five years of cash flows would then be added together to determine the total present value of the investment.

Why use DCF Valuation?

DCF valuation is a useful tool for investors because it provides a more accurate picture of a company’s true value compared to other methods, such as price-to-earnings (P/E) ratios or market capitalization. DCF valuation takes into account a company’s expected future earnings, which can be a more reliable indicator of value than current market prices. Additionally, DCF valuation is useful for investors who are looking to make long-term investments, as it allows them to see how much a company is expected to grow and earn over a period of years, rather than just a snapshot of its current market price.

Conclusion Discounted Cashflow:

In conclusion, DCF valuation is a valuable tool for investors who are looking to determine the true value of a company and make informed investment decisions. While it may seem complicated at first, with a basic understanding of the concept and a little practice, anyone can use DCF valuation to evaluate potential investments.

It’s difficult to determine an exact “fair value” for every stock as it depends on various factors including the company’s future financial performance, competition, market conditions and more. DCF valuations can provide an estimate of “fair value” by calculating the company’s future expected cash flows and then discounting them to today’s value.

However, it is important to note that estimates of future cash flows and the discount rate involve uncertainties that may lead to inaccurate estimates of fair value. It’s also important to note that “fair value” is an estimate only and may not necessarily match the actual market value of the stock. A stock’s market valuation is determined by supply and demand in the market, and can change based on factors such as news, market trends, and more. With that in mind, it’s important to conduct comprehensive due diligence before investing in any stock, including reviewing the company’s financial performance, competitive landscape, industry trends, and more.

In our Premium Tools we combine 12 different valuation models and combine than with our own estimates to present fair values to more than 45.000 stocks. These estimates are more precise than only counting on one valuation method.

Automatic Valuations to 45.000+ Stocks.

100% Satisfaction - 0% Risk - Cancel Anytime.