Price to Sales P/S Ratio Calculator

P/S Ratio: Price to Sales Ratio Calculator and Formula.

Insert the Stock Price and the Revenue per Share into this Price to Sales P/S Ratio Calculator.

The required data can be found via a Google search, in the annual report on the company’s website under “Investors Relations” or on relevant financial websites like Yahoo Finance.

Revenue per Share is the total revenue divided by the shares outstanding.

In our Premium Tool, different evaluation models are used and the required data is loaded automatically. Find all financial ratios to more than 45.000 stocks worldwide.

What is the P/S Ratio?

The price to Sales ratio is a relative valuation metric that uses the share price and revenue of a company to determine whether the company under consideration is undervalued or overvalued when compared to its peers as well as the average of the industry in which it operates. Like other relative valuation metrics, the ratio on its own provides no useful information for most parts.

There are a couple of exceptional cases which shall be highlighted below. Generally, for it to provide requisite valuation information about a company, it has to be compared with the same ratio for other companies operating in the same sector or industry as the company under consideration. Knowledge is easily processed when accompanied by an example so let us look at one while we try to understand this ratio in detail.

Price to Sales Ratio Formula:

Formula:

P/S Ratio = Stock Price / Revenue Per Share

or

P/S Ratio = Market Capitalization of the Company / Total Annual Revenue of the Company

Revenue (Sales) per Share Calculator:

At its core, the P/S ratio highlights what the market is pricing investors willing to pay for each unit of revenue per share. For e.g. a share price of € 100 and a Revenue/Sales per Share of € 50 has a P/S of 2. This means that you are willing to pay € 2 per € 1 of sales per share. When comparing the P/S of one company with its peers and industry, you determine whether you are paying more for that revenue or less. You want to be paying less so that when the market recognizes the stock’s fair value, you get higher returns.

Example:

Revenue is no indication of a profit. Once costs, debt, and taxes come into the picture, the scenario might have changed and the company might even be at a loss. To really highlight the impact of the P/S ratio on valuations, let us look at an industry where on a normal day and under normal circumstances revenue to profit transition is a certainty: Insurance.

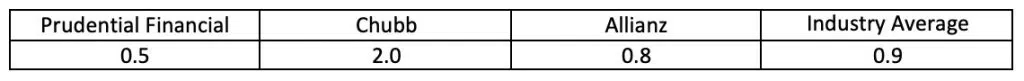

We shall look at the P/S ratio of three well-known insurance companies across the globe: Prudential Financial Inc. (USA), Chubb Ltd. (Switzerland), and Allianz SE (Germany). The currency will not have an impact on the ratio as we shall be considering both revenue as well as the price of a share in their respective currencies.

Let us start with Prudential Financial first. Its P/S is almost half of the Industry Average as well as much less than its peers. It is considered undervalued because you need to pay only $0.5 for $1 of revenue as compared to the industry average of $0.9 for that same $1 revenue. Chubb on the other hand has a P/S ratio almost double the industry average and several times its peers.

It is considered highly overvalued as you are expected to pay $2 for every $1 of revenue as compared to the industry average of $0.9. Allianz on the other hand is fairly valued as its P/S is in line with the industry average. Similar to other ratios, P/S is affected by a change in share price or underlying revenue.

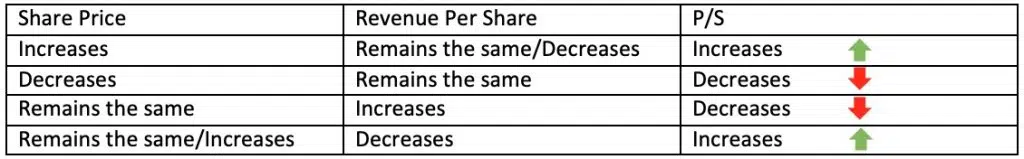

If the share price goes up P/S will go up assuming revenue remains the same and vice versa if the share price goes down. Similarly, P/S will go down on an increase in revenue assuming the share price remains the same. The following table will highlight this relationship clearly.

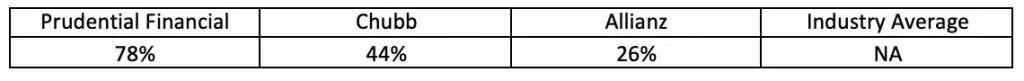

One can observe that Prudential Financial has generated a healthy 78% return. Its sharp rise in share price is accompanied by a rise in revenue and there is a lot of potential on the upside for the stock because assuming revenue were to remain the same, the stock price will have to almost double for it to reach the industry average. An interesting aspect that will be noticed is that Chubb which is highly overvalued has generated a higher return than Allianz which was fairly valued and therein lies the first issue with the ratio which we shall see now.

What you should be looking for:

P/S as a standalone number is no indication of undervaluation or overvaluation. But unlike other ratios, P/S has an upper ceiling to its number. A P/S ratio of up to 2 or even 3 will need comparison with its peers and industry average to determine undervaluation or overvaluation. However, a P/S rising from 4 and upwards is a clear sign of overvaluation and froth in the company.

If the entire sector is operating at those levels, the sector is probably overheated and is expected to be in trouble soon enough. Similarly, too low a P/S is a sign that the company is not converting its revenue to profits well enough. The P/S ratio measures company valuation in terms of revenue without comparing profitability. Loss-making companies can come across as undervalued by this measure.

In our above example, it is obvious by performance that Chubb has better conversion of revenue to profits than Allianz and the same can be seen from their Net Profit margins. Chubb has a Net Profit Margin of 10% as compared to Allianz’s Net Profit Margin of 6% (Source: Yahoo Finance). Additionally, a P/S ratio does not take into account the leverage aspect of the companies in question. A company using leverage may generate higher revenue than one without again incorrectly valuing the leveraged company.

Conclusion:

P/S ratio is a quick to calculate and easy to understand valuation metric that can help sift through companies and shortlist undervalued companies. However it is not a standalone metric to decide valuation.

One must look at other metrics like Price to Book value and Price to Cash flow as well alongside other metrics. We have over 12 such key financial ratio calculators on our website, all available for free. Calculate the key ratios and build a consensus through them to determine whether a company is truly undervalued or overvalued. Alternatively, join our Premium Tools and we will do all of this work for you, providing you various fair values right on your very own premium dashboard.

In my experience, P/S is generally used by Venture Capitalists and Angel Investors looking to invest in startups who have begun generating revenue but are yet to turn a profit. As a valuation metric for well established, publicly listed business, it is better to apply it to industries where a revenue generally leads to profits under normal circumstances like Insurance, Banks, Software services etc.

However this should not be the end all but only a starting point for you as an investor to dig deeper into the company operations and see if the revenue is generating a profit. Then build a consensus with other ratios to make an informed investment decision.