Premium Stock Analysis Tool

Over 45,000 stocks, more than 15 valuation methods and one clear fair value - all in a single tool. Start with 5 free stock analyses, no credit card required.

Market → Sector → Stock

Build your portfolio top-down

Invest in a cheap market, pick the most attractive sectors and then select the best stocks for a balanced portfolio. Fairvalue Calculator guides you step by step through this top-down process - from the overall market all the way down to each single position.

1. Market Valuation

Market Valuation: See at a glance how expensive the market is

Fair value, key metrics and market-relative performance.

The market analysis tool condenses thousands of data points into a single fair value score for the overall market. Values below 1 indicate an undervalued market, values above 1 indicate overvaluation. You also receive a suggested cash allocation so you can be more cautious when markets are expensive and more aggressive when they are cheap.

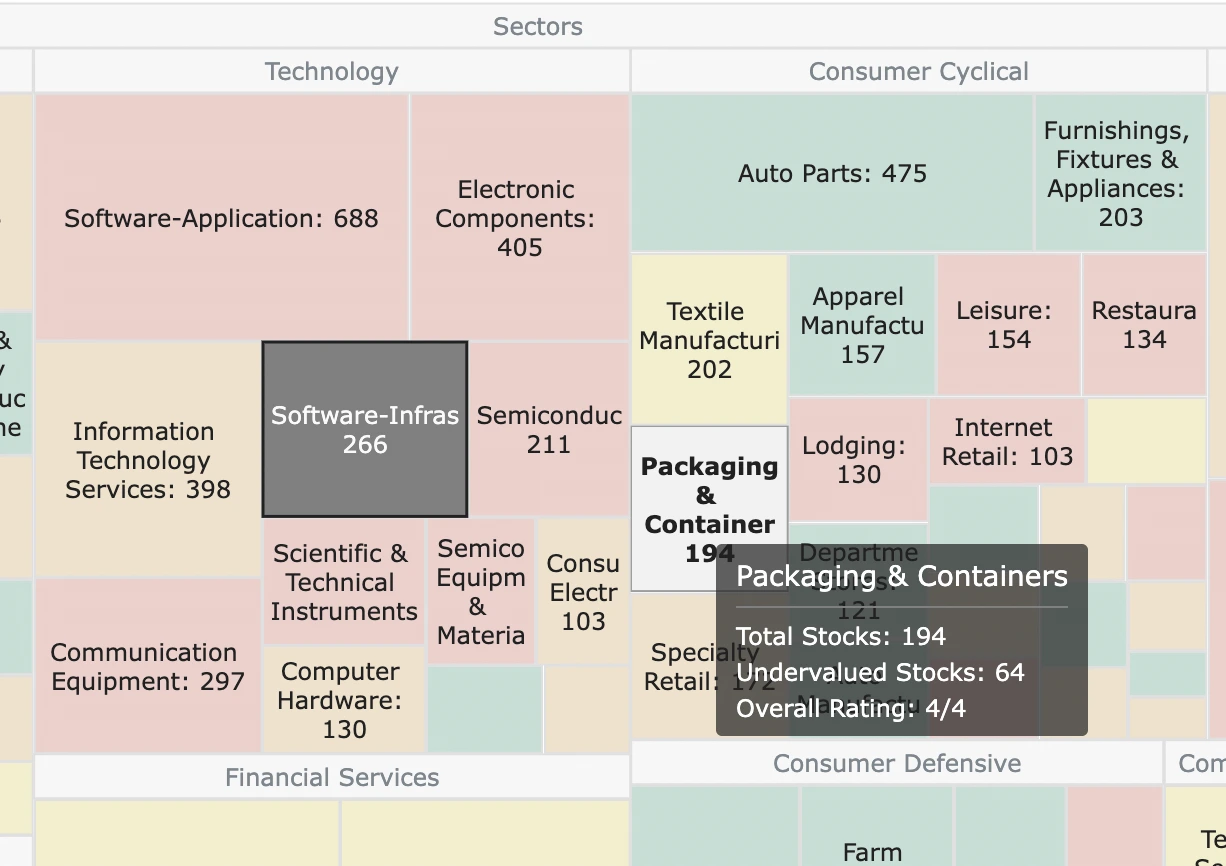

2. Sector Valuation

Sector Valuation: Find the most attractive sectors

Fair value, key metrics and market-relative performance.

With the sector analysis tool we introduce a new way to discover great sectors to invest in. By combining valuation metrics such as P/E and PEG with relative performance versus the overall market, it highlights undervalued sectors that can withstand a weak trend or benefit disproportionately from a strong one.

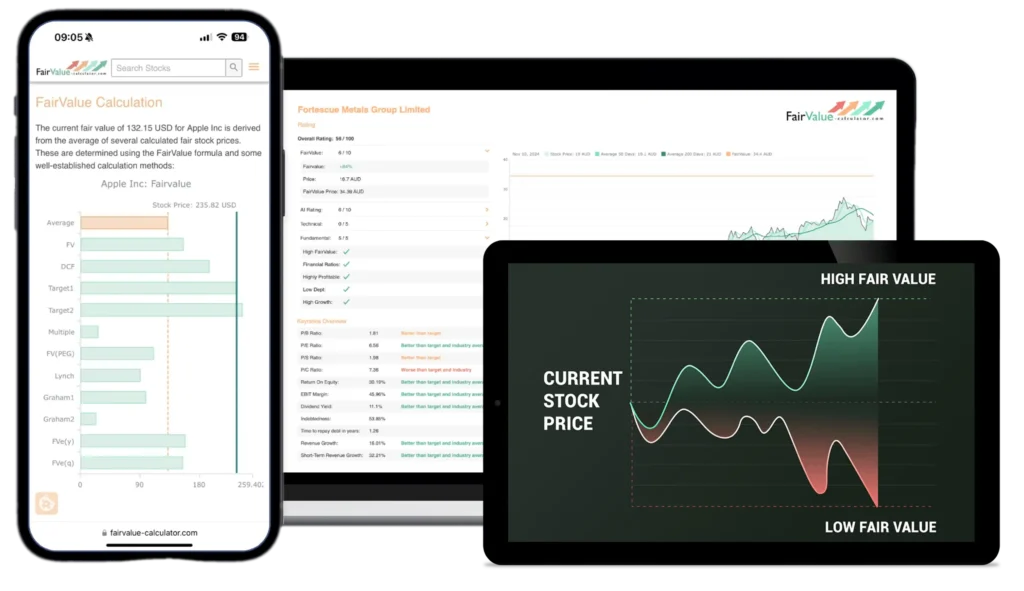

3. Stock Valuation

Stock Valuation: Discover the most attractive single stocks.

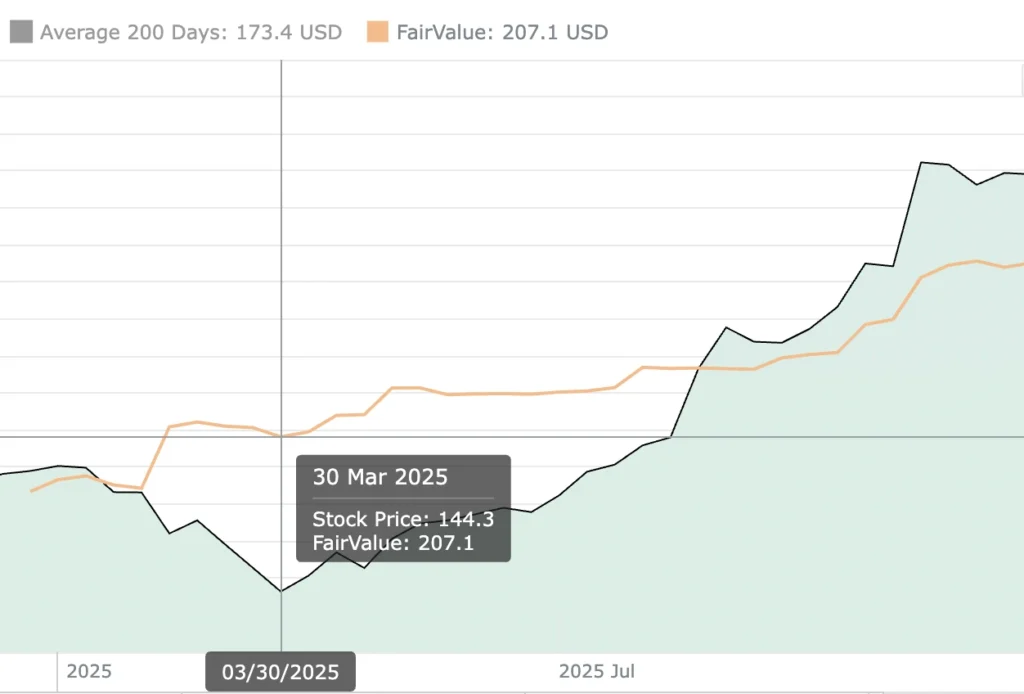

Stock Price: $144 < Fair Value: $207

Alphabet Inc.

The Fairvalue Calculator shows at a glance whether a stock is cheap or expensive. If the current price is below its Fair Value, it may signal an attractive buying opportunity. On each stock detail page you’ll find all key metrics, ratings and charts you need to assess the risk-reward profile and make confident, data-driven investment decisions.

4. Stock Screener

Stock Screener: Filter thousands of stocks at once by fair value, key metrics, quality and performance.

5. Portfolio Manager

Portfolio Manager: Build a balanced portfolio.

Fair value, risk and diversification at a glance.

With the portfolio manager, you combine your favourite stocks into a clear, visual portfolio. You instantly see fair value, weightings, sector allocation and performance – and can quickly spot where it makes sense to add, trim or rebalance positions.

Start your Free Trial

Analyze 5 stocks for free in your trial - no credit card, no risk. Upgrade to the full, unlimited version any time.

free Trial

6 Monate

14 Tage Free

- 5 Free Stock Analyses

- Test All Fair Value Models

- Stock Search & Watchlist

- Preview Screener & Ratings

- No Credit Card, Zero Risk

UNLIMITED - ANNUAL

12 Monate

30 Tage Free

- Unlimited Stock Analyses

- Fair Value Models & AI Ratings

- 50,000+ Stocks Worldwide

- Stock Screener With Strategies

- Portfolio Manager

- AI Copilot With Ready Prompts

- Market & Sector Analysis

- Annual Billing

- Full Version - Best Price

UNLIMITED – MONTHLY

1 Monat

7 Tage free

- Unlimited Stock Analyses

- Fair Value Models & AI Ratings

- 50,000+ Stocks Worldwide

- Stock Screener With Strategies

- Portfolio Manager

- AI Copilot With Ready Prompts

- Market & Sector Analysis

- Monthly Billing

- Full Version - Most Flexible

100% Satisfaction - 0% Risk.

Safe Checkout.

Cancel Anytime.

Instant Access.

Dr. Peter Klein, BA

Founder

"We have come such a long way already. Originally, I wanted to develop this tool only for myself - to better understand the markets and to discover companies that often remain unnoticed. From the very beginning, I poured a lot of heart and passion into this project. But the unexpectedly strong feedback motivated me to make the Fairvalue Calculator accessible to everyone who values solid, data-driven analysis. Since then, I have been working with great dedication to continuously improve the tool. In the end, it’s all about creating real value - not just for myself, but for everyone who shares this passion."

This tool can do more than conventional services and is even cheaper.

Tommy haffman

via google.comI am a web designer, you guys are very inspiring. I wish to see more work from you, maybe more freebies. Using fairvalue products made my investing a lot easier!

Marc Antoine

via twitter.comI use these tools to weigh up whether a stock tip is really a trustworthy tip.

Carla Megan

via MailYou have created a really great tool. Keep it up! I'm curious what comes next!

Sara Smith

via google.comEven as a beginner, I understand the instructions of the software.