Advanced Fair Value Calculator

Custom model for precise stock valuation: Combining earnings, cashflow, growth, margins, and book value into one accurate Fair Value.

Top 10 Stocks: Fair Value Strategy

This list is updated daily by our Stock Screener Tool, covering more than 60,000 stocks worldwide. Discover this and many other Top-Lists inside the Fairvalue Calculator Premium Tool – try it now for free!

Get Even More Value!

- Try Premium for Free

- Instantly discover the Fair Value for over 45,000 stocks – fully automated, zero effort.

- The Pro Tool for serious investors: Automated stock analysis using 10+ valuation models.

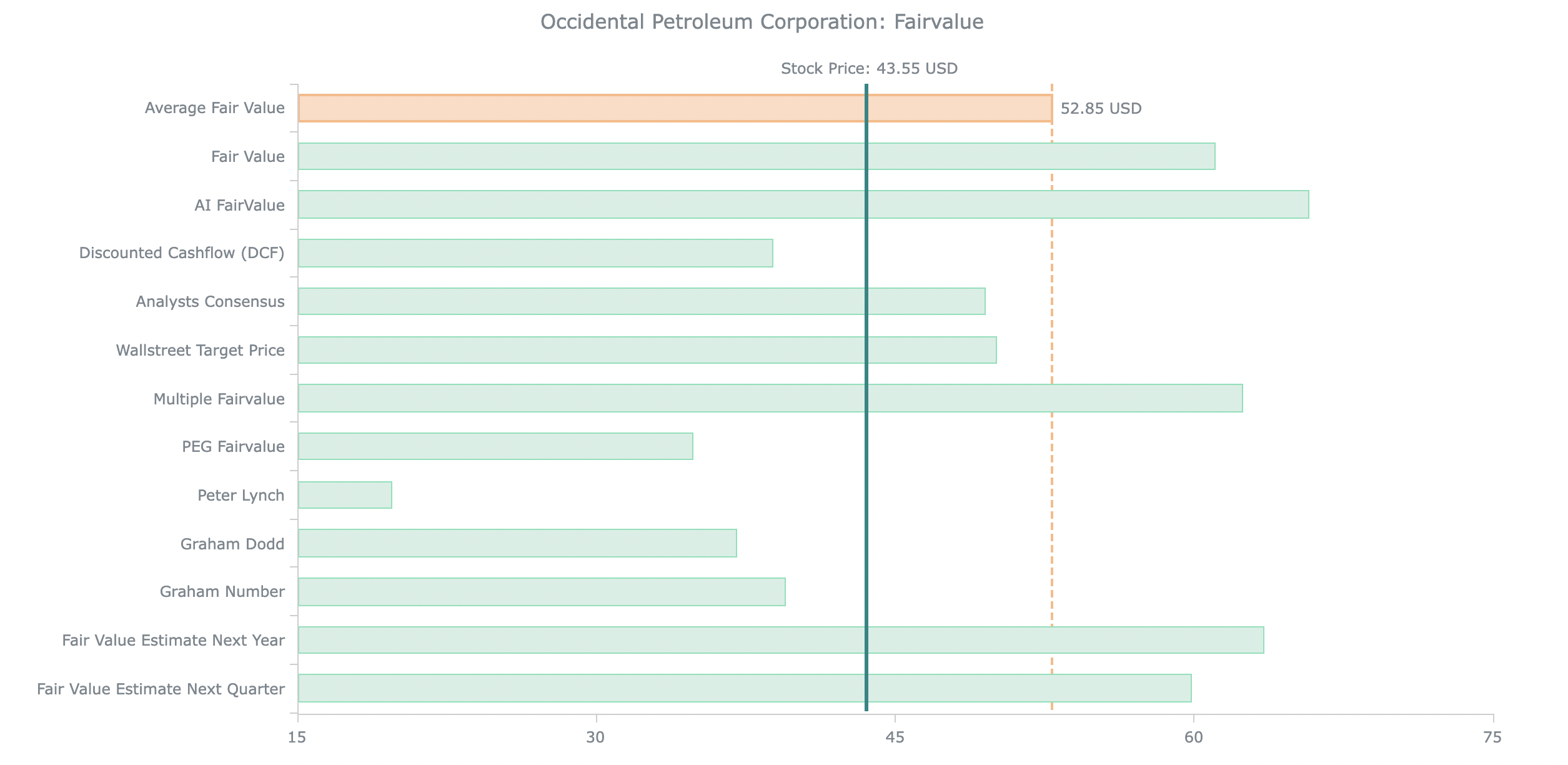

- A powerful algorithm combines AI and over ten valuation models to calculate an average Fair Value – based on DCF, Buffett, Graham, PEG ratio, Peter Lynch, multiples, P/B, P/S and more!

How to Use the Advanced Fair Value Calculator

Paste the financial metrics into this calculator and get a more accurate estimate of the stock’s true value (Fair Value). To find out more about the individual key figures, use the other free online calculators and insert their results into this calculator. The individual values can be found via a Google search, in the annual report on the company’s website under “Investors Relations” or on relevant share portals.

Save time and work and use our Premium Tool, where a large number of different evaluation models are used and the required data is loaded automatically. Find instantly more than 45.000 Fair Values.

Head to our Key Ratio Calculators to learn more about the data you have to insert into this calculator. If this is too complicated for you, we also offer a Simple Fair Value Calculator, which is less accurate but much easier to handle. Paste the key financial data into this Advanced Fair Value Calculator to get a precise intrinsic value using our proprietary multi-factor model. Unlike simple calculators, this tool considers multiple financial aspects together to deliver a more accurate fair value. You can find required data via Google, official company reports under “Investor Relations,” or financial portals like Yahoo Finance.

- Enter Earnings Per Share (EPS):

Input the company’s current or projected net earnings per share. - Enter Cashflow Per Share:

Provide the latest or estimated annual cashflow per share. - Enter Growth Rate (%):

Input the expected annual growth rate of earnings or revenue for the next few years. - Enter Return On Equity (%):

Insert the current return on equity. - Enter Margin (%):

Insert the company’s current or average operating margin or net margin. - Enter Book Value Per Share:

Provide the company’s latest book value per share. - Let the Tool Work:

The calculator uses our proprietary algorithm to weight these key factors, generating an estimated fair value based on your inputs. - View Your Result:

The result shows the advanced fair value – giving you a refined estimation of whether the stock is undervalued or overvalued based on multiple combined factors. - For Instant, Automated Results:

Use our Premium Tool where all required data for 45,000+ stocks is automatically loaded and processed using our advanced model.

Where to Find the Required Data:

- EPS: Found in Investor Relations reports, Yahoo Finance, or broker platforms.

- Cashflow Per Share: Found in annual reports or financial portals.

- Growth Rate: Use analyst estimates or company guidance (often found in investor presentations).

- Margins: Operating or net margins can be found in financial statements or key ratios sections online.

- Book Value Per Share: Typically available in the balance sheet section of investor reports or finance sites.

- Or simply use the Premium Tool to retrieve and calculate everything automatically.

This is How You Calculate the Fair Value in a More Accurate Way

Note that all inserted values must be positive. To determine a more accurate fair value, you can use the additional free calculators or our Premium Tools. The formula used in this calculator is derived from the discounter cash flow method and has been optimized using specially developed algorithms.

This more accurate Fair Value Calculator will help you determine the value of a stock more precisely. To do this, enter the necessary key figures into the calculator. Note that all entered values must be positive in order to get a meaningful result. Start your free trial now and enjoy more than 20 key financial ratios and valuation models to more than 45000 stocks worldwide. Unlock the Premium Tools to analyze automatically more than 45,000 stocks.

💬 Comment by Dr. Peter Klein, Founder of Fairvalue Calculator:

After publishing the Basic Fair Value Calculator, I received a lot of feedback – especially from investors analyzing high-growth or highly profitable companies – that the simple model often fell short. This pushed me to go one step further and develop a more sophisticated formula, which I’ve never made public, but which powers this calculator.

Often imitated, never matched: As traffic and user interaction on the site increased, it didn’t take long before similar tools started appearing around the world. Today, many platforms offer Fair Value calculators – but most rely solely on the traditional discounted cash flow (DCF) model.

I've been working with valuation models since 2005 and was one of the first to publish such tools online. Meanwhile, our Premium Tool uses automated data feeds, artificial intelligence, and more than a dozen valuation models – including our own proprietary algorithm. It blends these models in a unique way that’s not easy to replicate.

I’m not bothered that others have copied the idea – after all, I was inspired by legends like Benjamin Graham and Warren Buffett. I didn’t reinvent the wheel – but I refined it. And when major financial platforms now follow similar principles, I take that as a compliment.

What keeps me calm and confident is knowing: I’m the original source of these ideas – and I have plenty more to come. 💡

As we say in Austria:

“If you want quality leather, go to the blacksmith – not the apprentice.” 😄

Stick with the original – skip the detours.

👉 Learn more about Fairvalue Calculator, our vision, and me.

More Online Fair Value Calculators

Additionally, we offer a calculator for each respective key ratio and financial metric to us before using this more accurate fair value calculator. If you have trouble finding the information you need to fill out our calculators head to Education and “Find Fundamental Data”. There you will learn how to find all the information you need to estimate a fair value and where to find the data you need to use our calculators. In our Premium Tools, we load these data automatically and calculate the fair values to more than 45,000 stocks worldwide.

FAQ: Advanced Fair Value Calculator

Granular cash-flow modeling, clean EV adjustments and robust scenario & sensitivity tools for professional-grade valuations.

What makes the Advanced Calculator different? ▾

How do I model revenues and margins realistically? ▾

- Use volume × price or segment growth if drivers differ.

- Fade to mid-cycle margins over time (avoid peak/trough extrapolation).

- Reflect operating leverage in SG&A/R&D as % of sales if applicable.

CapEx, depreciation and working capital—best practice? ▾

Which tax and share count should I use? ▾

- Apply a normalized effective tax rate (exclude one-offs).

- Use diluted weighted-average shares and model dilution/buybacks if material.

How should I set the discount rate or WACC? ▾

Terminal value: perpetual growth or exit multiple? ▾

How do I treat cash, debt and other adjustments? ▾

How should I set scenarios and sensitivities? ▾

- Base: mid-cycle growth/margins and normalized reinvestment.

- Bear: slower growth, lower margins, higher discount rate.

- Bull: prudent upside on growth/efficiency and stable reinvestment.

- Run 2-way sensitivity (e.g., discount vs terminal).

How do I deal with one-offs and accounting differences? ▾

How do I interpret the result and set a Margin of Safety? ▾

What’s a practical workflow around this page? ▾

- Context: Check Market Valuation and Sector Valuation.

- Screen: Build a shortlist in the Stock Screener.

- Model: Use this Advanced Calculator; cross-check in Stock Valuation.

- EV: Compute clean EV via the EV Calculator.

- Decide: Act only if your MoS is adequate; manage sizing in the Portfolio Manager.