Discount Rate Calculator for DDM and DCF

Discount Rate in Stock Valuation Models: Use "CAPM" for Discounting Dividends (DDM) and "WACC" for Discounting Cashflows (DCF).

CAPM Discount Rate Calculator

Estimate the cost of equity with CAPM: re = rf + β × (E[Rm] − rf).

Tip: You can also set E[Rm] = rf + ERP (equity risk premium). For example rf 3% & ERP 5% ⇒ E[Rm] 8%.

Top 10 DCF Stocks: Fair Value Strategy

This list is updated daily by our Stock Screener Tool, covering more than 60,000 stocks worldwide. Discover this and many other Top-Lists inside the Fairvalue Calculator Premium Tool – try it now for free!

CAPM for Dividend Discount Model (DDM) Valuation:

What is the Discount Rate (r) in Dividend Discount Model?

To determine the discount rate in the Dividend Discount Model, start with your desired return as an investor – typically between 6% and 12%, depending on risk. Stable companies justify a lower rate (around 6–7%), while riskier or fast-growing stocks require higher rates (up to 12%).

Discount Rate Formula (Using CAPM)

Discount Rate = Risk-Free Rate + Beta × ( Expected Market Return – Risk-Free Rate )

r = Rf + β × ( Rm – Rf )

Where Rf = Risk-Free Rate | β = Beta of the Company | Rm = Expected Market Return

Example Calculation:

Risk-Free Rate (Rf) = 3% Beta (β) = 1.2 Expected Market Return (Rm) = 8%

r = 3% + 1.2 × (8% – 3%) = 3% + 1.2 × 5% = 3% + 6% = 9%

Alternatively, you can calculate the cost of equity using the CAPM formula: Discount Rate = risk-free rate + (beta × market premium).

-

The risk-free rate is the return of a completely safe investment like government bonds.

-

The company’s beta measures how volatile the stock is compared to the market.

-

The expected market return is the average return of the entire market, usually 7–9% annually.

To calculate the discount rate using the CAPM formula, you’ll need three key inputs: the risk-free rate, the company’s beta, and the expected market return.

The risk-free rate represents the return of a completely safe investment, typically measured by long-term government bonds like the 10-year U.S. Treasury yield. You can find this rate on financial websites such as TradingEconomics or MarketWatch by searching for “10-Year Treasury Yield.”

The company’s beta measures how volatile a stock is compared to the overall market. A beta of 1 means the stock moves in line with the market, while a beta above 1 indicates higher volatility. You can easily find a company’s beta on Yahoo Finance: search for the company, go to the Statistics section, and look for “Beta (5Y Monthly).” Brokers and financial data platforms like Morningstar also provide this value.

The expected market return reflects the average annual return of the entire stock market, often assumed to be between 7% and 9% based on long-term historical data. Unlike the other two inputs, the expected market return is a general assumption rather than a company-specific figure.

Using these three metrics, you can calculate a company-specific discount rate to apply in valuation models like the Dividend Discount Model or Discounted Cashflow.

CAPM (Capital Asset Pricing Model) is a widely used method to set the discount rate more objectively, reflecting both market conditions and the individual company’s risk. As a simple rule: The more uncertain the dividends, the higher your discount rate should be.

WACC for Discounted Cashflow Model (DCF) Valuation:

💡 WACC Calculator

Weighted Average Cost of Capital (after-tax debt cost). Enter equity/debt costs and weights.

Note: For consistency, ensure proportions add to 100%. Typical range: 60–80% equity, 20–40% debt.

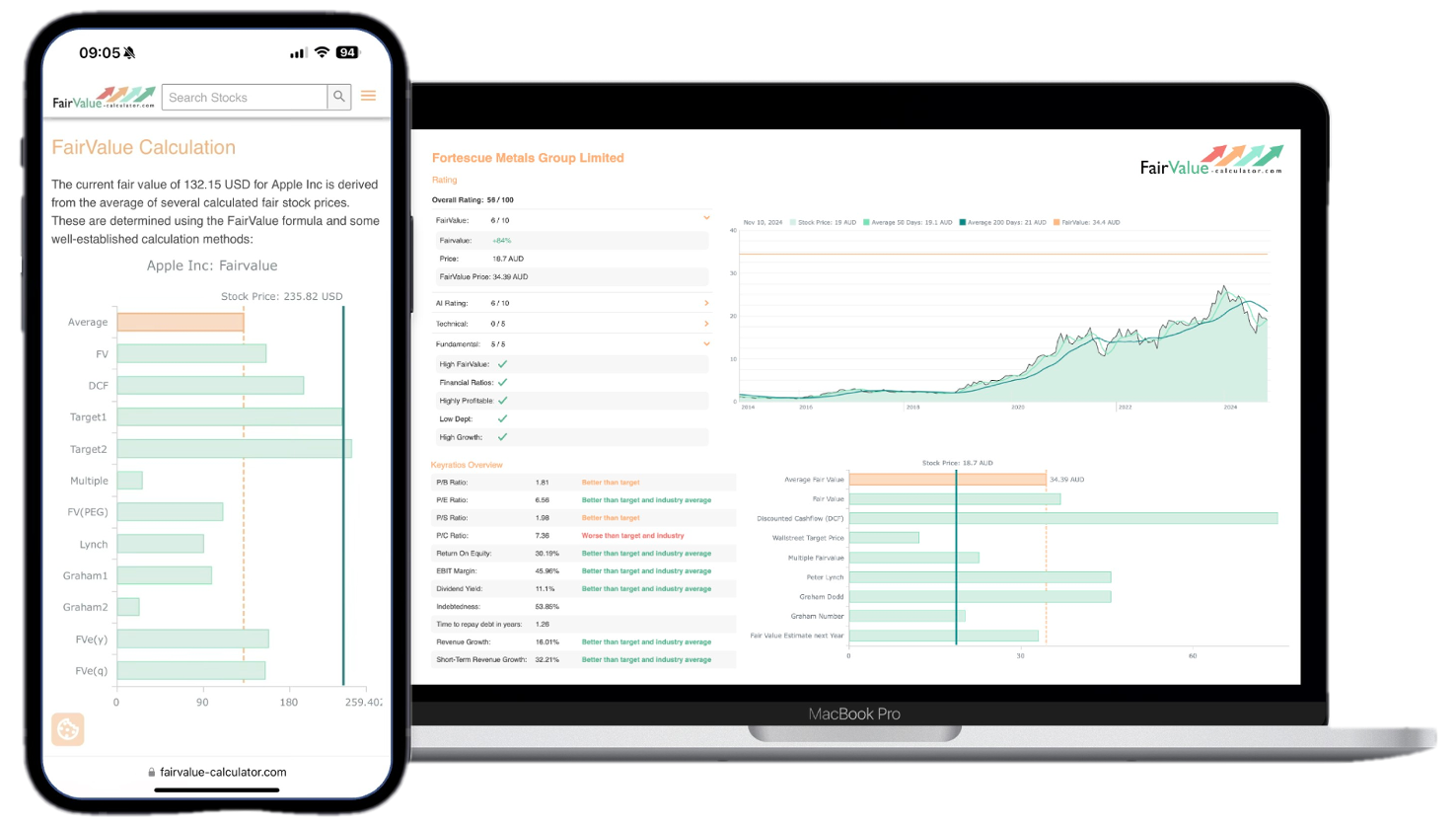

- Try Premium for Free

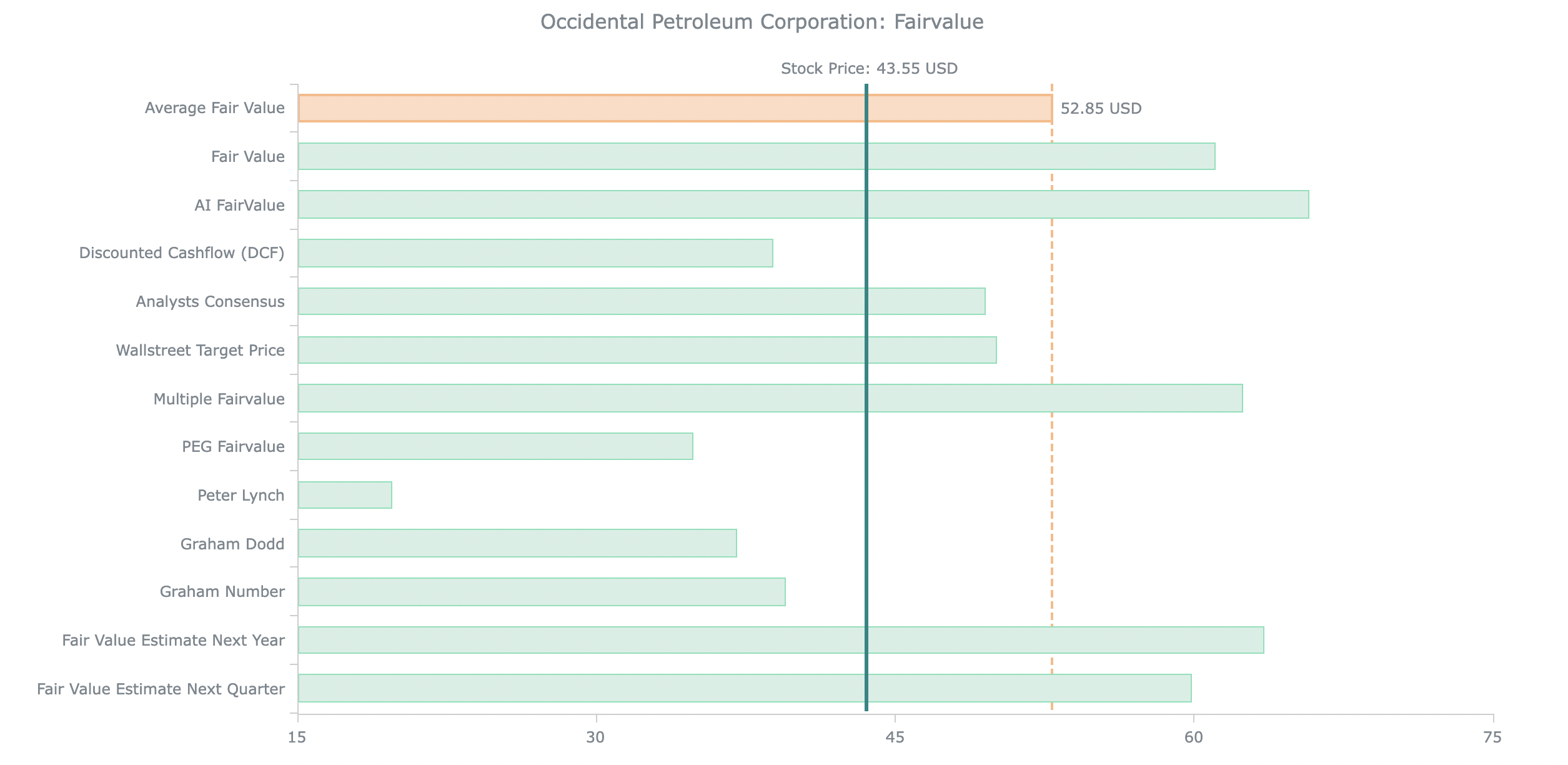

- Instantly discover the Discounted Cashflow Fair Value for over 45,000 stocks – fully automated, zero effort.

- The Pro Tool for serious investors: Automated stock analysis using 10+ valuation models, including the Discounted Cashflow Fair Value.

- A powerful algorithm combines AI and over ten valuation models to calculate an average Fair Value – based on DCF, Buffett, Graham, PEG ratio, Peter Lynch, multiples, P/B, P/S and more!

What is the Discount Rate (r) in Discounted Cashflow Model?

To determine the discount rate for a Discounted Cashflow (DCF) analysis, calculate the Weighted Average Cost of Capital (WACC). WACC combines the company’s cost of equity and after-tax cost of debt, weighted by their respective proportions in the company’s capital structure. Unlike the Dividend Discount Model, where the discount rate reflects the investor’s required return, WACC reflects the company’s actual blended financing cost from both equity investors and debt holders.

WACC Formula (Weighted Average Cost of Capital)

WACC = ( E / (E + D) ) × Cost of Equity + ( D / (E + D) ) × Cost of Debt × ( 1 – Tax Rate )

WACC = ( E / V ) × Re + ( D / V ) × Rd × (1 – Tc)

Where E = Equity | D = Debt | V = E + D

Re = Cost of Equity | Rd = Cost of Debt | Tc = Corporate Tax Rate

Example Calculation:

Equity (E) = $700,000 Debt (D) = $300,000 Cost of Equity (Re) = 9% Cost of Debt (Rd) = 4% Tax Rate (Tc) = 25%

WACC = (0.7 × 9%) + (0.3 × 4% × (1 – 0.25)) = 6.3% + 0.9% = 7.2%

To calculate the WACC (Weighted Average Cost of Capital) for your DCF valuation, follow these 4 steps:

- Cost of Equity (%):

Use the result from the CAPM Calculator above. This reflects the expected return required by shareholders. - Cost of Debt (% after taxes):

Check your company’s annual report or investor presentations for the average interest rate on its debt. Adjust it for tax savings using this formula:

Cost of Debt × (1 – Tax Rate).

Alternatively, find it on Marketscreener or Morningstar. - Equity and Debt Proportions (%):

Use the company’s balance sheet or data portals like Marketscreener or morningstar to find how much of the company is financed with equity vs. debt. Example: 70% equity, 30% debt. Also use the Debt to Equity Ratio Calculator to learn more about this chapter.

Top 10 DCF Stocks: Fair Value Strategy

This list is updated daily by our Stock Screener Tool, covering more than 60,000 stocks worldwide. Discover this and many other Top-Lists inside the Fairvalue Calculator Premium Tool – try it now for free!

Discount Rate Calculator: How It Works and Why It’s Important

A Discount Rate Calculator is a valuable tool for finance professionals, students, and anyone interested in analyzing the time value of money. This calculator simplifies the process of determining the discount rate, which is the rate of return needed for a given future value (FV) to equal its present value (PV) over a specified number of periods.

Below, we’ll explain how this calculator works, its practical applications, and the fundamental financial concepts it’s based on.

💬 Comment by Dr. Peter Klein, Founder of Fairvalue Calculator:

Picking the “right” discount rate is where many valuations quietly fail. Early on, I used one fixed number for every company—looked tidy, felt smart, and produced very wrong results. The lesson: the discount rate is your opportunity cost and risk translator. Treat it with respect.

My workflow today is pragmatic: start from the risk-free rate (long-term government yield), add an equity risk premium, and then adjust for business-specific risk (cyclicality, leverage, size, governance, FX/country risk). Keep nominal vs. real consistent: if your cash flows are nominal, your rate must be nominal too.

Practical tips that keep me out of trouble:

- Anchors first: Risk-free (10y gov) + Equity Risk Premium (usually ~4–6%). That’s your market baseline.

- Quality spread: Subtract 0.5–1.5 pp for exceptional moats & balance sheets; add 1–3 pp for cyclicals, high leverage, small caps, or FX/country risk.

- Consistency check: Compare your rate to the firm’s historical ROIC and sector WACC. If your rate is below cash yields or above ROIC by miles, revisit assumptions.

- Inflation sanity: In high-inflation periods, don’t hard-code a low rate. Either model real cash flows with a real rate, or nominal with a nominal rate—never mix.

- Range, not point: Value with a band (e.g., 9%, 10.5%, 12%) and make decisions on the distribution, not a single number.

- Opportunity cost lens: If you can earn 8–9% with broad ETFs, your stock pick must clear that bar after risk adjustments.

On this site I rarely trust one input alone. In our Premium Tool the discount rate flows into 15+ valuation models and we evaluate outcomes across ranges—more robust, less fragile, and much closer to how real decisions are made.

Quick rule of thumb I use: Baseline 9–10% for high-quality large caps in stable markets; add 1–3 pp for leverage/cyclicality/small-cap/country risk; subtract up to 1 pp for fortress balance sheets and predictable cash flows.

Practical Applications of the Discount Rate

The discount rate has significant implications in fields like finance, investment analysis, and business valuation. Some of the key uses include:

-

Investment Decision-Making:

- Investors use the discount rate to determine if an investment will meet their required rate of return.

-

Net Present Value (NPV) Calculations:

- Businesses use the discount rate to calculate the present value of future cash flows, helping them assess the profitability of projects.

-

Valuation of Financial Instruments:

- The discount rate is critical in valuing bonds, stocks, and other financial instruments.

-

Risk Assessment:

- A higher discount rate typically reflects higher risk associated with future cash flows.

-

Personal Finance:

- Individuals can use the discount rate to compare investment opportunities or savings plans.

The discount rate represents the opportunity cost of capital or the minimum return required to justify an investment. By accurately calculating the discount rate, you can:

- Compare various investment opportunities.

- Account for the time value of money.

- Make informed decisions based on risk and return trade-offs.

The Discount Rate Calculator is a simple yet powerful tool for financial decision-making. By automating complex calculations, it helps users focus on understanding the implications of the results. Whether you’re analyzing investments, valuing a business, or planning for the future, knowing how to calculate and interpret the discount rate is essential for sound financial judgment. Embrace this tool to unlock deeper insights into your financial decisions, and let it guide you in navigating the complexities of the financial world!

Too Complex? Let Our Fair Value Calculator Do the Work!

Valuing a company precisely is more complex than it seems. Even small errors in estimating the cost of equity, cost of debt, or capital structure can lead to significantly wrong valuations. Many investors underestimate how difficult it is to correctly adjust for taxes or changing financing conditions. Gathering reliable data across multiple financial reports and platforms takes both time and expertise. That’s why relying on manual WACC calculations often leads to avoidable mistakes.

Our Fair Value Calculator solves this problem for you. It combines professional data sources with tested valuation models and delivers reliable, automated results instantly. Instead of spending hours researching – focus on making smarter investment decisions with our Premium Tools.

FAQ: Discount Rate Calculator

Estimate a sensible required return or WACC with clean inputs (risk-free, risk premium, beta, cost of debt and target capital structure) for use in your DCF.

What does the Discount Rate Calculator do? ▾

How is the cost of equity calculated? ▾

re = Rf + β × ERP (+ size premium + country risk). Use a currency-consistent risk-free, a reasonable equity risk premium and a sector-appropriate beta.

How should I handle beta (unlevering and relevering)? ▾

βU = βL ÷ [1 + (1 − T) × (D/E)]βL,target = βU × [1 + (1 − T) × (D/E)target]

How do I set the cost of debt correctly? ▾

rd,after = rd,pre × (1 − T)How is WACC built from the parts? ▾

WACC = we × re + wd × rd,after, where w are market-value weights. Align target weights with your valuation horizon and peer set.

How do I keep currency and inflation consistent? ▾

When should I use a pure equity discount rate instead of WACC? ▾

Any guidance for choosing Rf, ERP, tax rate and capital structure? ▾

- Rf: liquid gov’t yield in your cash-flow currency.

- ERP: long-run estimate consistent with your market/region.

- Tax: normalized forward effective rate (exclude one-offs).

- Weights: target market-value D/E aligned to peers and strategy.

How do I cross-check the discount rate before using it? ▾

How do market and sector conditions affect the rate? ▾

Common mistakes to avoid ▾

- Mixing book instead of market weights.

- Using pre-tax debt cost inside WACC (forgetting the tax shield).

- Mismatching currency or mixing real with nominal.

- Ignoring leases/pensions when they’re material to EV.

What’s a practical workflow around this page? ▾

- Context: Review market and sector levels.

- Rate: Build re and WACC here.

- Value: Plug into the DCF Calculator.

- EV: Keep structure consistent with the EV Calculator.

- Review: Compare outcomes on Stock Valuation.

Is this investment advice? ▾

Unleash Your Stock Data Instantly.

100% Satisfaction - 0% Risk - No Credit Card.