Dividend Discount Model Calculator

Calculate the Estimated Intrinsic Value of Your Dividend Stock!

💵 Dividend Discount Model (DDM) Calculator

Estimate intrinsic value per share based on annual dividend, discount rate, and dividend growth rate. Accepts “,” or “.” as decimals.

Top 10 Stocks: Dividend Strategy

This list is updated daily by our Stock Screener Tool, covering more than 60,000 stocks worldwide. Discover this and many other Top-Lists inside the Fairvalue Calculator Premium Tool – try it now for free!

Dividend Discount Model: How to Value Dividend Stocks

The Dividend Discount Model (DDM) Calculator tool is designed to estimate the intrinsic value of a stock based on its expected future dividends. This simple yet effective calculator helps investors make informed decisions by assessing a stock’s value about its dividend payments and growth potential.

The Dividend Discount Model (DDM) Calculator is a powerful tool for estimating the intrinsic value of a dividend-paying stock. It is based on the principle that the value of a stock is the present value of all its expected future dividend payments. This article explains how the DDM Calculator works, the financial concepts behind it, and its practical applications in stock valuation. The Dividend Discount Model (DDM) is a classic valuation method that estimates the fair value of dividend-paying stocks.

It calculates how much a stock is worth today based on projected future dividend payments – discounted back to present value.

This model is especially effective for stable companies with predictable dividend growth, such as utility firms or consumer goods giants. Use this calculator to determine whether your dividend stocks are trading at a fair price.

What Does The DDM Calculator Do?

The Dividend Discount Model (DDM) calculates the intrinsic value of a stock by using the following formula:

Dividend Discount Model (DDM) Formula

Fair Value = Expected Dividend Next Year ÷ ( Discount Rate – Growth Rate )

Fair Value = D₁ / ( r – g )

Where D₁ = Expected Dividend Next Year | r = Discount Rate | g = Growth Rate

Example Calculation:

D₁ = $2.00 r = 9% (0.09) g = 4% (0.04)

Fair Value = 2.00 / ( 0.09 – 0.04 ) = 2.00 / 0.05 = $40.00

- P: Intrinsic value of the stock

- D: Annual dividend per share

- r: Discount rate (required rate of return, expressed as a decimal)

- g: Dividend growth rate (expressed as a decimal)

How The Dividend Discount Formula Works:

Fair Value of the Stock = Expected Dividend for the Next Year divided by ( Discount Rate minus Dividend Growth Rate ) OR: Fair Value = Expected Dividend ÷ ( Discount Rate – Dividend Growth Rate )

Inputs Required:

- Annual Dividend per Share (D): The total yearly dividend paid by the company per share.

- Discount Rate (r): The investor’s required rate of return, often based on the risk of the stock.

- Dividend Growth Rate (g): The annual percentage growth expected in dividends.

Calculation Process:

- The calculator subtracts the growth rate (ggg) from the discount rate (rrr) to find the net required return.

- It divides the annual dividend (DDD) by this value to estimate the stock’s intrinsic value.

Output:

- The result is the intrinsic value of the stock, which represents its fair value based on the expected dividend stream

What is the Discount Rate (r) ?

To determine the discount rate in the Dividend Discount Model, start with your desired return as an investor – typically between 6% and 12%, depending on risk. Stable companies justify a lower rate (around 6–7%), while riskier or fast-growing stocks require higher rates (up to 12%).

Discount Rate Formula (Using CAPM)

Discount Rate = Risk-Free Rate + Beta × ( Expected Market Return – Risk-Free Rate )

r = Rf + β × ( Rm – Rf )

Where Rf = Risk-Free Rate | β = Beta of the Company | Rm = Expected Market Return

Example Calculation:

Risk-Free Rate (Rf) = 3% Beta (β) = 1.2 Expected Market Return (Rm) = 8%

r = 3% + 1.2 × (8% – 3%) = 3% + 1.2 × 5% = 3% + 6% = 9%

Alternatively, you can calculate the cost of equity using the CAPM formula: Discount Rate = risk-free rate + (beta × market premium).

The risk-free rate is the return of a completely safe investment like government bonds.

The company’s beta measures how volatile the stock is compared to the market.

The expected market return is the average return of the entire market, usually 7–9% annually.

To calculate the discount rate using the CAPM formula, you’ll need three key inputs: the risk-free rate, the company’s beta, and the expected market return.

The risk-free rate represents the return of a completely safe investment, typically measured by long-term government bonds like the 10-year U.S. Treasury yield. You can find this rate on financial websites such as TradingEconomics or MarketWatch by searching for “10-Year Treasury Yield.”

The company’s beta measures how volatile a stock is compared to the overall market. A beta of 1 means the stock moves in line with the market, while a beta above 1 indicates higher volatility. You can easily find a company’s beta on Yahoo Finance: search for the company, go to the Statistics section, and look for “Beta (5Y Monthly).” Brokers and financial data platforms like Morningstar also provide this value.

The expected market return reflects the average annual return of the entire stock market, often assumed to be between 7% and 9% based on long-term historical data. Unlike the other two inputs, the expected market return is a general assumption rather than a company-specific figure.

Using these three metrics, you can calculate a company-specific discount rate to apply in valuation models like the Dividend Discount Model or Discounted Cashflow.

CAPM (Capital Asset Pricing Model) is a widely used method to set the discount rate more objectively, reflecting both market conditions and the individual company’s risk. As a simple rule: The more uncertain the dividends, the higher your discount rate should be.

Practical Applications of the DDM Calculator:

The Dividend Discount Model is especially useful for:

Valuing Dividend-Paying Stocks:

- This tool is best suited for companies with stable and predictable dividend growth.

- This tool is best suited for companies with stable and predictable dividend growth.

Investment Decision-Making:

- By comparing the calculated intrinsic value to the stock’s current market price, investors can decide whether the stock is undervalued (buy) or overvalued (avoid/sell).

- By comparing the calculated intrinsic value to the stock’s current market price, investors can decide whether the stock is undervalued (buy) or overvalued (avoid/sell).

Portfolio Management:

- It helps long-term investors prioritize investments in dividend-paying stocks that align with their required rate of return.

- It helps long-term investors prioritize investments in dividend-paying stocks that align with their required rate of return.

Assessing Risk and Growth:

- The model provides insights into how the growth rate and required return influence a stock’s valuation.

💬 Comment by Dr. Peter Klein, Founder of Fairvalue Calculator:

I like the Dividend Discount Model for businesses that pay reliable, well-covered dividends — utilities, consumer staples, some insurers. The Gordon Growth version is beautifully simple, but it’s also very sensitive to tiny changes in growth or discount rate.

Early in my dividend journey I chased an 8% yielder. Six months later the company cut the payout in half after a debt-heavy acquisition. Painful lesson: a high yield without coverage and discipline is just a value trap with good marketing.

Practical tips that work for me:

- Anchor dividend growth to reality: use a base case 1–3%, a cautious case 0–1%, and only a bullish 3–4% for exceptional dividend growers.

- Set your discount rate to your opportunity cost (I sanity-check with a 9–12% range).

- Check cash coverage: payout ratio ≤60% (≤80% for utilities/telecoms). Prefer FCF/AFFO over accounting earnings.

- Look at total shareholder yield (dividend + net buybacks). Serial share issuers often disappoint.

- Skip pure Gordon Growth for irregular payers — use multi-stage DDM or a different model.

That’s why I never rely on one formula. In our Premium Tool the DDM is one vote among 15+ methods, automatically weighted. The blend is calmer, more robust — and it saves time.

Conclusion:

Strengths:

- Simple and Intuitive: The model is easy to understand and relies on basic inputs such as dividends and growth rates.

- Long-Term Perspective: It is ideal for long-term investors focusing on income-generating stocks.

Limitations:

- Assumes Constant Growth: The model assumes a steady growth rate, which may not always reflect a company’s financial reality.

- Not Suitable for Non-Dividend Stocks: It cannot be used for companies that do not pay dividends.

- Sensitive to Inputs: Small changes in the discount or growth rates can lead to significant variations in the valuation.

The Dividend Discount Model Calculator is a practical and systematic tool for evaluating dividend-paying stocks. With this model:

- Investors can identify undervalued stocks and assess their potential profitability.

- It provides a framework for determining the fair value of a stock based on dividends, growth rates, and required returns.

By using this tool, you can make informed investment decisions, focus on stable dividend-paying stocks, and build a robust portfolio. Whether you’re new to investing or a seasoned professional, mastering the DDM is a vital step in refining your valuation techniques and achieving long-term financial goals.

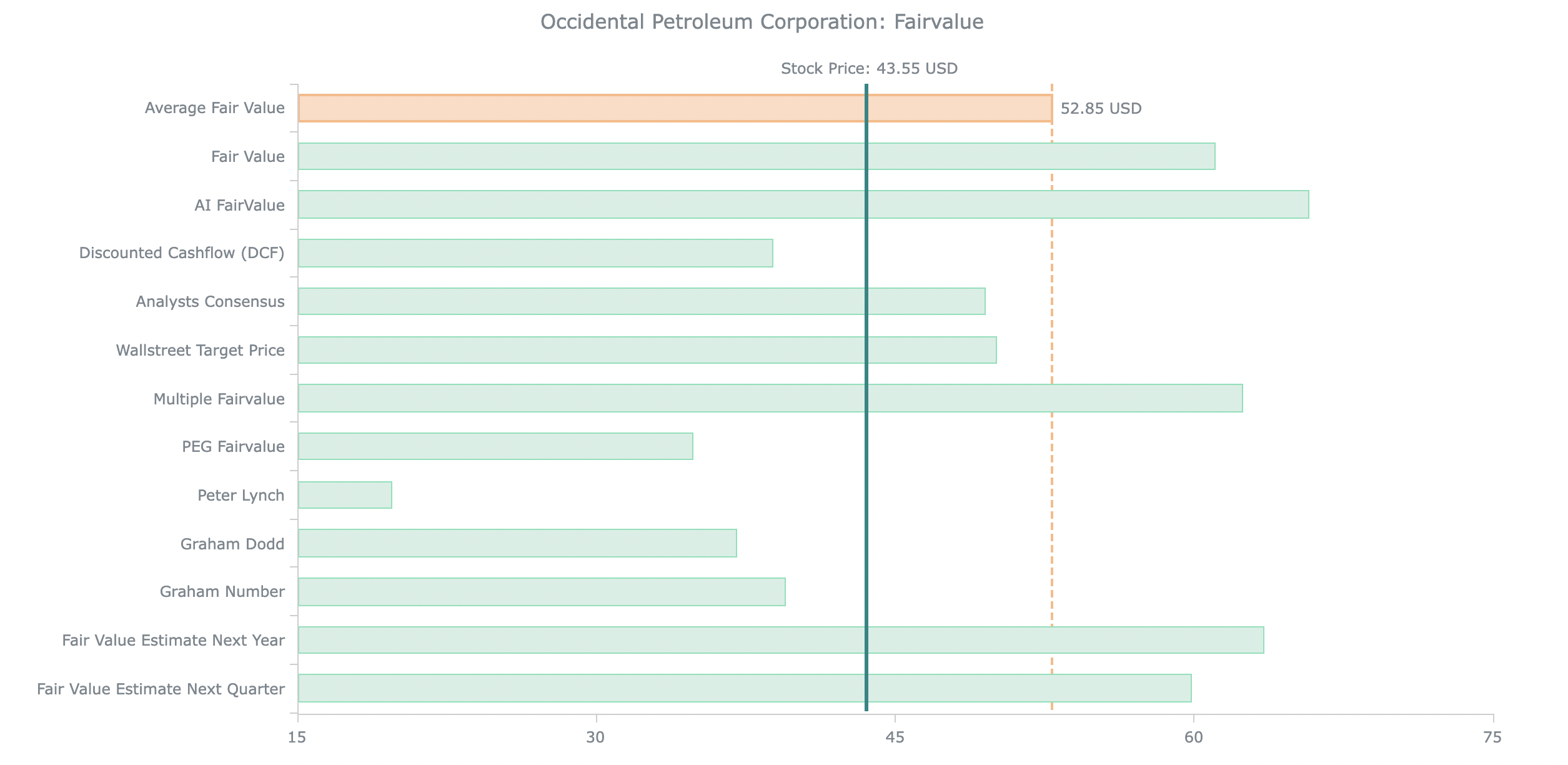

Relying solely on the Dividend Discount Model can be risky, as it assumes stable dividends and consistent growth – which many companies simply don’t deliver. To make smarter investment decisions, it’s better to combine multiple valuation methods. Different models, like Discounted Cashflow, PEG Ratio, Peter Lynch, and Graham, each highlight different aspects of a company’s value. By combining these methods, you minimize errors and get a more balanced, realistic estimate of a stock’s fair value. Our Premium Tool does exactly that – it automatically applies over 10 valuation models and calculates an average fair value. You save time, avoid manual data input, and get a professional-level analysis within seconds. Whether you’re evaluating dividend stocks or high-growth companies, our tool adapts to your strategy. Upgrade now and let the Premium Tool help you make better investment decisions with real data and proven methods:

FAQ: Dividend Discount Model (DDM) Calculator

Value dividend payers by discounting future dividends at a sensible required return with single- or multi-stage growth setups.

What is the Dividend Discount Model (DDM)? ▾

Which inputs does this calculator use? ▾

- Latest dividend per share (or a baseline D₀).

- Expected dividend growth (one or multiple stages).

- Required return (r) or discount rate.

- Horizon and terminal growth if using multi-stage.

How does the Gordon Growth (single-stage) DDM work? ▾

P₀ = D₁ / (r − g), where D₁ = D₀ × (1 + g). Use only when dividends grow at a stable rate and ensure g < r.

How do I set up multi-stage growth (two-stage or H-model)? ▾

- Two-stage: high growth for N years, then a stable g forever.

- H-model: growth declines linearly from ghigh to gstable over the transition period.

- Pick reasonable horizons (often 5–10 years) and a conservative terminal g.

How should I choose a dividend growth rate g? ▾

What’s a sensible required return r for DDM? ▾

What if dividends are irregular or buyback-heavy? ▾

How do I judge if the payout is sustainable? ▾

- Payout ratio vs. normalized earnings and cash flow.

- Leverage and interest coverage.

- CapEx needs and cash conversion.

Any rules of thumb to avoid obvious errors? ▾

- Ensure g < r in every terminal setup.

- Keep currency for r, g and dividends consistent.

- Don’t mix TTM with forward inputs inconsistently.

How should I cross-check a DDM result? ▾

What’s a practical workflow with this page? ▾

- Context: Check Market and Sector levels.

- Income check: Use the Dividend Yield Calculator.

- Value: Run the DDM here; cross-check with DCF.

- Review: Combine in Stock Valuation and manage sizing in the Portfolio Manager.

Is this investment advice? ▾

Unleash Your Stock Data Instantly.

100% Satisfaction - 0% Risk - Cancel Anytime.