Monaco Fair Value Calculator

Estimate the fair value of a stock using the Monaco method

🏝️ Monaco Fair Value Calculator

Intrinsic value from EPS, growth and discount; compares against current price.

Note: Works best for stable EPS and moderate growth; ensure discount > growth.

Get Even More Value!

- Try Premium for Free

- Instantly discover the Peter Lynch Fair Value for over 45,000 stocks – fully automated, zero effort.

- The Pro Tool for serious investors: Automated stock analysis using 10+ valuation models, including the Peter Lynch Fair Value.

- A powerful algorithm combines AI and over ten valuation models to calculate an average Fair Value – based on DCF, Buffett, Graham, PEG ratio, Peter Lynch, multiples, P/B, P/S and more!

Monaco Fair Value Calculator

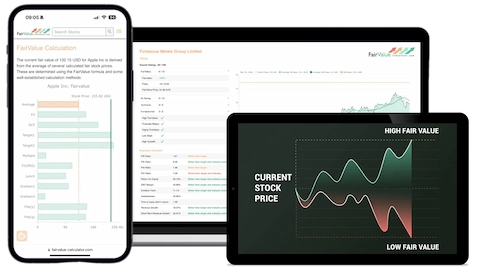

Inputting the current stock price, earnings per share (EPS), growth rate, and discount rate is just the beginning of gaining a greater understanding of the potential value of a stock. Using the Monaco method, which is a tried and true approach in financial analysis, investors can calculate the intrinsic value of a stock to make more informed investment decisions.

Our Fair Value Calculator takes these key financial metrics and provides an estimate of the stock’s fair value. This tool is incredibly useful for any investor as it allows them to quickly and easily evaluate the potential value of a stock before deciding to invest.

By utilizing this calculator and understanding the intrinsic value of a stock, investors are better equipped to make informed and strategic decisions when it comes to investing in the stock market. Whether you are a seasoned professional or just starting, our Fair Value Calculator is an invaluable resource to help you make the most of your investments.

FAQ: Monaco Fair Value Calculator

A composite, regime-aware fair value that blends cash-flow models, dividend methods, classic heuristics and quality/EV checks into one actionable range.

What is the Monaco Fair Value? ▾

Which valuation methods are blended? ▾

- Discounted Cash Flow (DCF)

- Dividend Discount Model (DDM) for stable payers

- Classic heuristics: Graham-Dodd, Graham Number, Peter Lynch PEG, Buffett-style

- EV-based cross-checks on Stock Valuation

How are model weights decided? ▾

Which inputs drive Monaco the most? ▾

- Growth and margin path (use mid-cycle for cyclicals).

- Reinvestment (CapEx, working capital) and cash conversion.

- Discount rate/WACC from the Discount Rate Calculator.

- Terminal value assumptions and share count/dilution.

How does the quality/risk overlay affect fair value? ▾

How do I keep capital structure and EV consistent? ▾

How does Monaco handle cyclicals or negative EPS cases? ▾

How should I read the Monaco range and confidence? ▾

Do market rates and sector cycles change the result? ▾

Common mistakes to avoid with Monaco Fair Value ▾

- Mixing TTM and forward inputs inconsistently across models.

- Ignoring EV reconciliation and share-count changes.

- Over-weighting heuristics for cyclicals or negative EPS.

What’s a practical workflow with this page? ▾

- Screen candidates in the Stock Screener.

- Blend values here with Monaco; tune weights if needed.

- Model details in the DCF Calculator and compute clean EV.

- Review multiples in Stock Valuation and size positions in the Portfolio Manager.