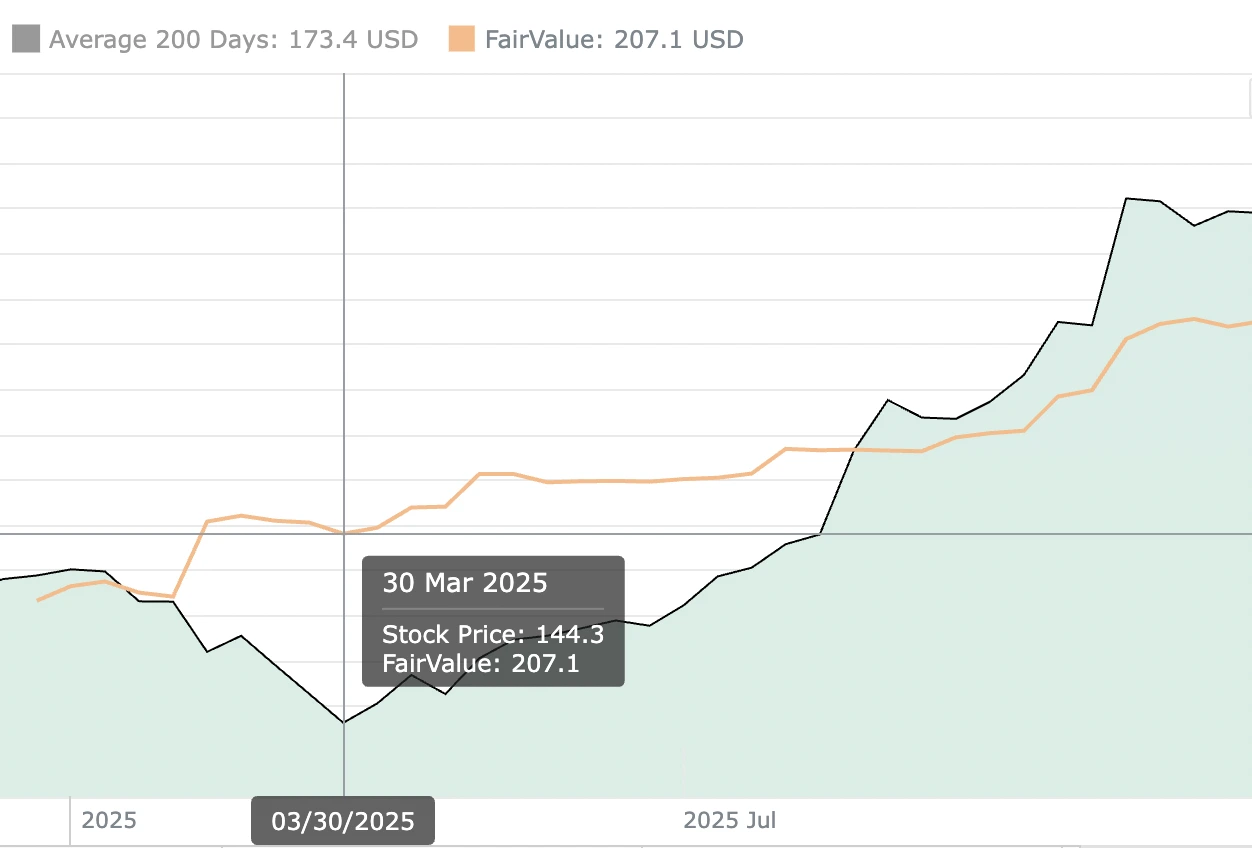

Johnson & Johnson’s Intrinsic Value: A Comprehensive Valuation Analysis

Johnson & Johnson stands as one of the most enduring and diversified healthcare companies in the world, with a business portfolio spanning pharmaceuticals, medical devices, and consumer health products that has generated consistent returns for shareholders across multiple generations. Understanding...

How to Use an Intrinsic Stock Value Calculator for Smarter Investing

Intrinsic stock value calculators provide investors with powerful tools for determining what a company is genuinely worth based on its fundamental business characteristics rather than relying solely on market sentiment or price momentum. These calculators employ rigorous valuation methodologies that...

Using Excel’s XNPV and XIRR Functions to Handle Irregular Cash Flows in Valuation

When valuing investments, projects, or assets, we often encounter cash flows that don’t arrive at regular intervals. Traditional NPV and IRR functions in Excel assume periodic cash flows (annual, quarterly, monthly), but real-world scenarios are rarely that neat. Enter XNPV...

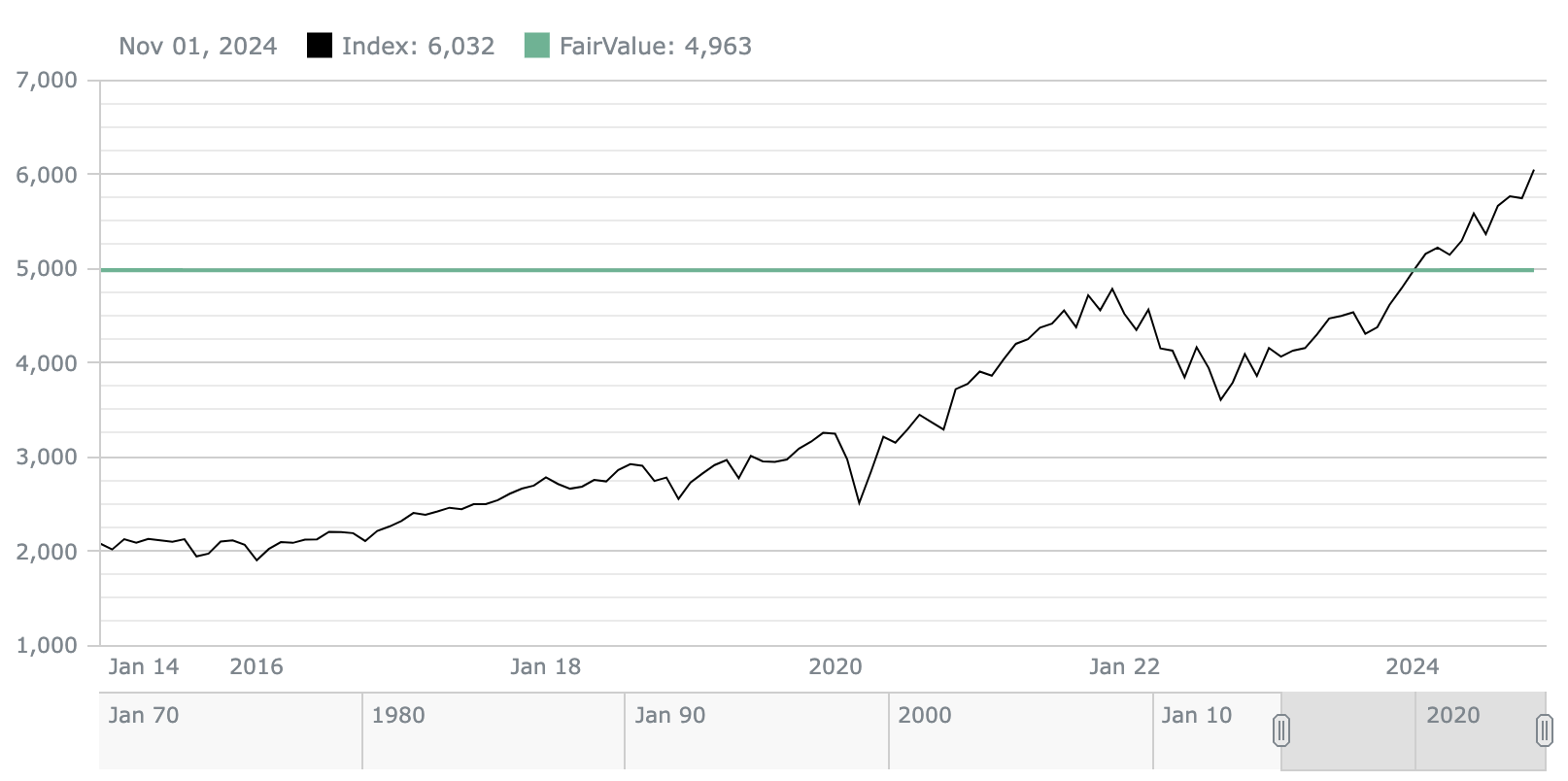

Fair Value Investing: The Ultimate Strategy for 2025 Success

In a world where market highs and lows can feel like a rollercoaster, fair value investing emerges as the calm, calculated strategy for 2025 success—offering stability and smarter financial decisions when it seems the entire financial landscape is in flux.

Intrinsic Value vs Market Price: What Should Investors Trust More?

When it comes to making smart investment decisions, one of the most fundamental questions every investor faces is whether to trust what the market says a stock is worth or to rely on their own analysis of what it should...

Intrinsic Value vs. Discounted Cash Flow Analysis

Valuation is a cornerstone of investment decision-making, helping investors assess whether an asset is overvalued, undervalued, or fairly priced. Among the various valuation methodologies, intrinsic value and discounted cash flow (DCF) analysis stand out for their focus on the underlying...

What is the intrinsic value of an asset?

In the intricate realm of investing and financial analysis, the concept of intrinsic value emerges as a cornerstone of informed decision-making. It serves as a distinguishing factor between strategic, long-term investors and speculative traders who rely on short-term market fluctuations....

The Importance of Fair Value in Portfolio Management

Fair value is a critical concept in modern portfolio management that plays a vital role in asset valuation, risk assessment, and investment decision-making. Understanding and accurately calculating fair values allows portfolio managers to make more informed choices about asset allocation,...

What is the Difference Between Intrinsic and Extrinsic Value?

Value is a complex and multifaceted concept that has been the subject of intense philosophical and economic debate for centuries. At the heart of this debate is the fundamental distinction between intrinsic value and extrinsic value. Understanding this distinction is...

Warren Buffett’s Intrinsic Value Calculator

The calculator can’t be shown due browser incompatibilityA Guide to Estimating the True Value of a StockWarren Buffett, the legendary investor and CEO of Berkshire Hathaway, is renowned for his ability to identify undervalued stocks that have the potential for...

Manage Cookie Consent

To provide the best experiences, we use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. Not consenting or withdrawing consent, may adversely affect certain features and functions.

Functional Always active

The technical storage or access is strictly necessary for the legitimate purpose of enabling the use of a specific service explicitly requested by the subscriber or user, or for the sole purpose of carrying out the transmission of a communication over an electronic communications network.

Preferences

The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user.

Statistics

The technical storage or access that is used exclusively for statistical purposes.

The technical storage or access that is used exclusively for anonymous statistical purposes. Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you.

Marketing

The technical storage or access is required to create user profiles to send advertising, or to track the user on a website or across several websites for similar marketing purposes.