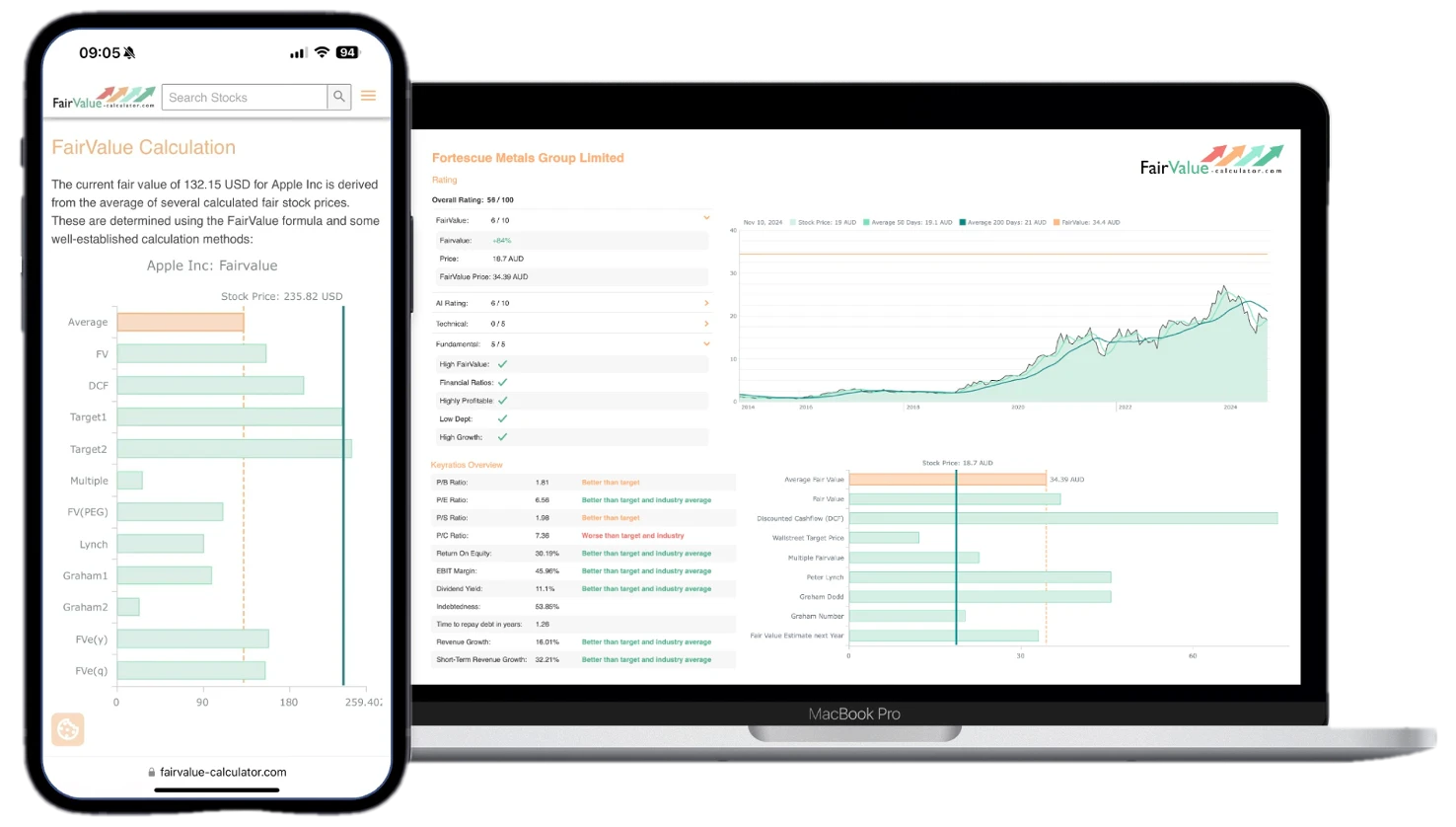

How to Use Free Fair Value Calculators to Outperform the Market

In today’s complex investment landscape, having access to professional-grade analysis tools can mean the difference between mediocre returns and market-beating performance. While institutional investors spend millions on sophisticated valuation software, individual investors can now access powerful free stock valuation calculator...

How Fair Value Investing Compares to Growth Investing in 2025

The investment landscape has dramatically evolved over the past few years, with shifting interest rates, technological disruption, and changing market dynamics forcing investors to reconsider their strategies. As we navigate through 2025, the debate between fair value investing vs growth...

How to Analyze a Stock Using Fair Value in 2025

The investment landscape has undergone dramatic shifts since 2020, fundamentally changing how we approach stock valuation. With persistent inflation, evolving interest rate environments, and technology disrupting traditional business models, determining stock fair value 2025 requires a more sophisticated approach than...

What is Warren Buffett’s 90/10 rule?

A Simple Investment Strategy for Long-Term Wealth When it comes to investment advice, few voices carry as much weight as Warren Buffett, the legendary investor known as the “Oracle of Omaha.” Among his many pearls of wisdom, one recommendation stands...

Sector-Specific Applications of Fair Value: Technology vs. Utilities

Fair value estimation, while governed by universal principles, requires significant adjustments when applied across different sectors. Perhaps no comparison illustrates this better than examining how fair value methodologies differ between high-growth technology companies and stable utility businesses. These sectors represent...

A Comprehensive Guide to Calculating Stock Intrinsic Value in 2025

Advanced Methods and Modern Applications In the recent unprecedented market volatility and technological transformation, calculating a stock’s intrinsic value has become more crucial—and more complex—than ever. This comprehensive guide explores both traditional valuation methods and cutting-edge approaches, incorporating real-world examples...

Behavioral Finance and Its Impact on Asset Valuation

The traditional financial paradigm assumes market participants act rationally, processing information efficiently to arrive at accurate asset valuations. However, the field of behavioral finance challenges this assumption by examining how psychological biases and cognitive limitations influence financial decision-making. This article...

The Role of Fair Value in Real Estate Investments

In the complex world of real estate investing, understanding fair value is crucial for making informed decisions. Fair value assessment provides a foundation for evaluating properties, identifying opportunities, and managing investment risks. This article explores how fair value calculations can...

How to Build Your Perfect Stock Portfolio

Proven Strategies for Success! Investing in the stock market can be one of the most rewarding ways to grow your wealth, but it requires a solid plan and proven strategies to achieve lasting success. We at Fairvalue-Calculator.com are committed to...

Warren Buffett’s Investment Philosophy and Practice

Warren Buffett, often hailed as the “Oracle of Omaha,” is widely regarded as one of the most successful investors in history. His approach to investing has not only made him one of the wealthiest individuals in the world but has...