How to Analyze a Stock Using Fair Value in 2025

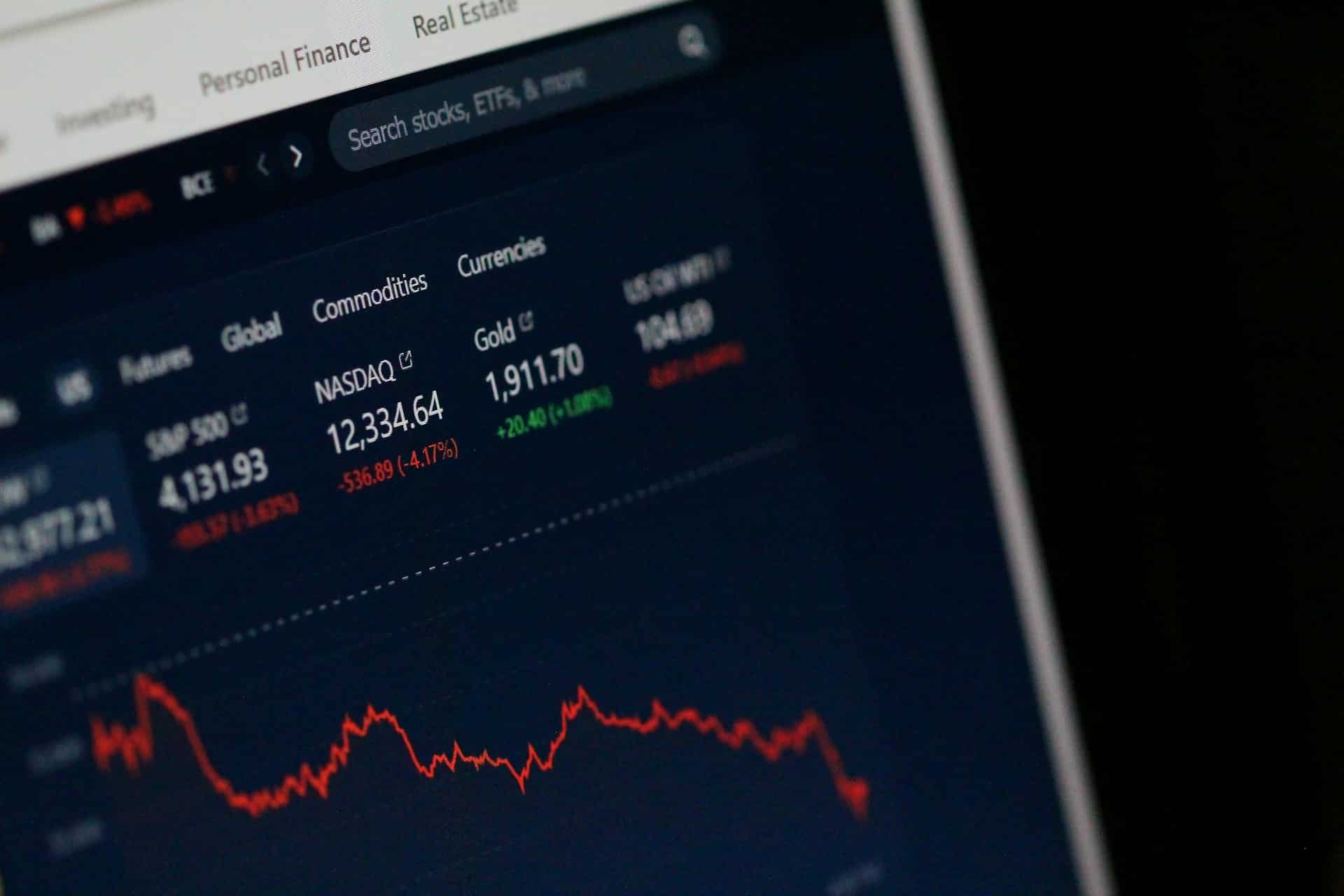

The investment landscape has undergone dramatic shifts since 2020, fundamentally changing how we approach stock valuation. With persistent inflation, evolving interest rate environments, and technology disrupting traditional business models, determining stock fair value 2025 requires a more sophisticated approach than...

What is Warren Buffett’s 90/10 rule?

A Simple Investment Strategy for Long-Term WealthWhen it comes to investment advice, few voices carry as much weight as Warren Buffett, the legendary investor known as the “Oracle of Omaha.” Among his many pearls of wisdom, one recommendation stands out...

Sector-Specific Applications of Fair Value: Technology vs. Utilities

Fair value estimation, while governed by universal principles, requires significant adjustments when applied across different sectors. Perhaps no comparison illustrates this better than examining how fair value methodologies differ between high-growth technology companies and stable utility businesses. These sectors represent...

A Comprehensive Guide to Calculating Stock Intrinsic Value in 2025

Advanced Methods and Modern Applications In the recent unprecedented market volatility and technological transformation, calculating a stock’s intrinsic value has become more crucial—and more complex—than ever. This comprehensive guide explores both traditional valuation methods and cutting-edge approaches, incorporating real-world examples...

The Role of Fair Value in Real Estate Investments

In the complex world of real estate investing, understanding fair value is crucial for making informed decisions. Fair value assessment provides a foundation for evaluating properties, identifying opportunities, and managing investment risks. This article explores how fair value calculations can...

Advanced Valuation Techniques for Experienced Investors

Experienced investors are constantly seeking sophisticated methods to accurately estimate the fair value of assets. Advanced valuation techniques, such as Monte Carlo simulations and real options analysis, offer powerful tools to navigate the complexities of modern markets. This article delves...

How Economic Indicators Influence Fair Value

The relationship between economic indicators and fair value calculations is fundamental to financial analysis and investment decision-making. This article explores how key macroeconomic metrics impact the determination of an asset’s fair value, providing insights into the complex interplay between economic...

Fair Value and Cryptocurrency: Evaluating Digital Assets

In the rapidly evolving digital finance landscape, cryptocurrencies have emerged as a transformative force that challenges traditional notions of value and valuation. Bitcoin, Ethereum, and other digital assets have disrupted conventional financial paradigms, presenting unprecedented opportunities and complex challenges for...

How to Build Your Perfect Stock Portfolio

Proven Strategies for Success!Investing in the stock market can be one of the most rewarding ways to grow your wealth, but it requires a solid plan and proven strategies to achieve lasting success. We at Fairvalue-Calculator.com are committed to empowering...

Understanding Fair Value – What It Means for Investors

In the complex world of finance and investment, understanding the concept of fair value is crucial for making informed decisions. Fair value is a fundamental principle that helps investors, analysts, and financial professionals assess the true worth of assets, securities,...

Manage Cookie Consent

To provide the best experiences, we use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. Not consenting or withdrawing consent, may adversely affect certain features and functions.

Functional Always active

The technical storage or access is strictly necessary for the legitimate purpose of enabling the use of a specific service explicitly requested by the subscriber or user, or for the sole purpose of carrying out the transmission of a communication over an electronic communications network.

Preferences

The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user.

Statistics

The technical storage or access that is used exclusively for statistical purposes.

The technical storage or access that is used exclusively for anonymous statistical purposes. Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you.

Marketing

The technical storage or access is required to create user profiles to send advertising, or to track the user on a website or across several websites for similar marketing purposes.