Try it free · No credit card

Fair Value in Seconds

Fairvalue Calculator analyzes over 45,000 stocks using more than 15 proven valuation models and shows you in seconds what a stock is really worth. If the market price is below this value, it may indicate long-term opportunities.

„Price is what you pay. Value is what you get.“ - Warren Buffett

Top Down Market -> Sector -> Stock -> Portfolio Analysis

Market, Sector and Stock Analysis with Screener and Portfolio Manager

These tools reveal when the market is attractively valued, which sectors offer the best opportunities, and which stocks fit a balanced portfolio.

Higher Returns

Easy to Use

Worldwide Data

Experience the Fair Value Factor!

Your Strategy + The Fair Value Factor

Combine Your Strategy with the Fair Value Factor to Boost Your Returns.

Find the best stocks to your strategy.

Preassembled stock lists fitting to your investment criteria, always keeping the fair value in mind:

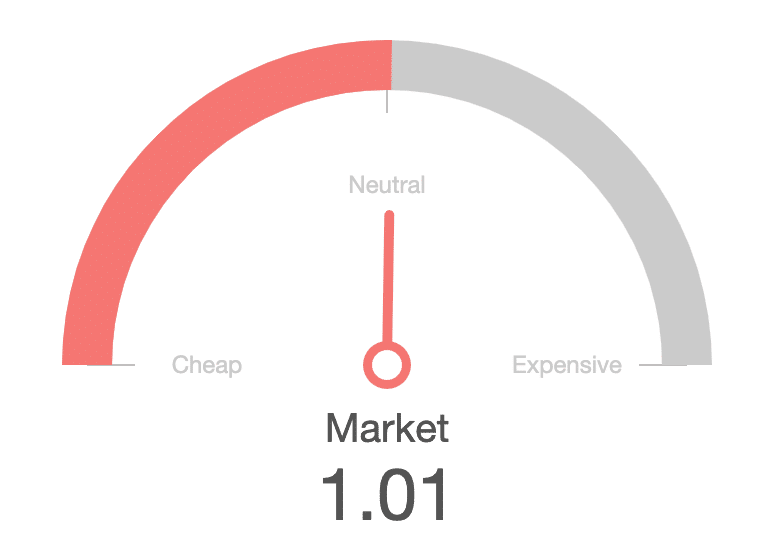

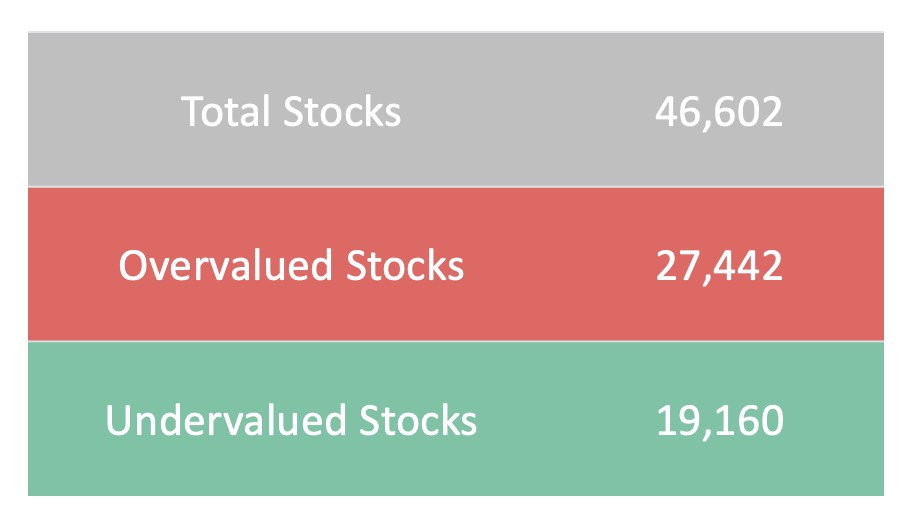

Market Valuation

Analyze the Overall Stockmarket

The Market Analysis Tool helps you to define wheter its a good time to buy big into stocks or to keep some cash.

Market Valuation

Recommended Cash

Database Statistics

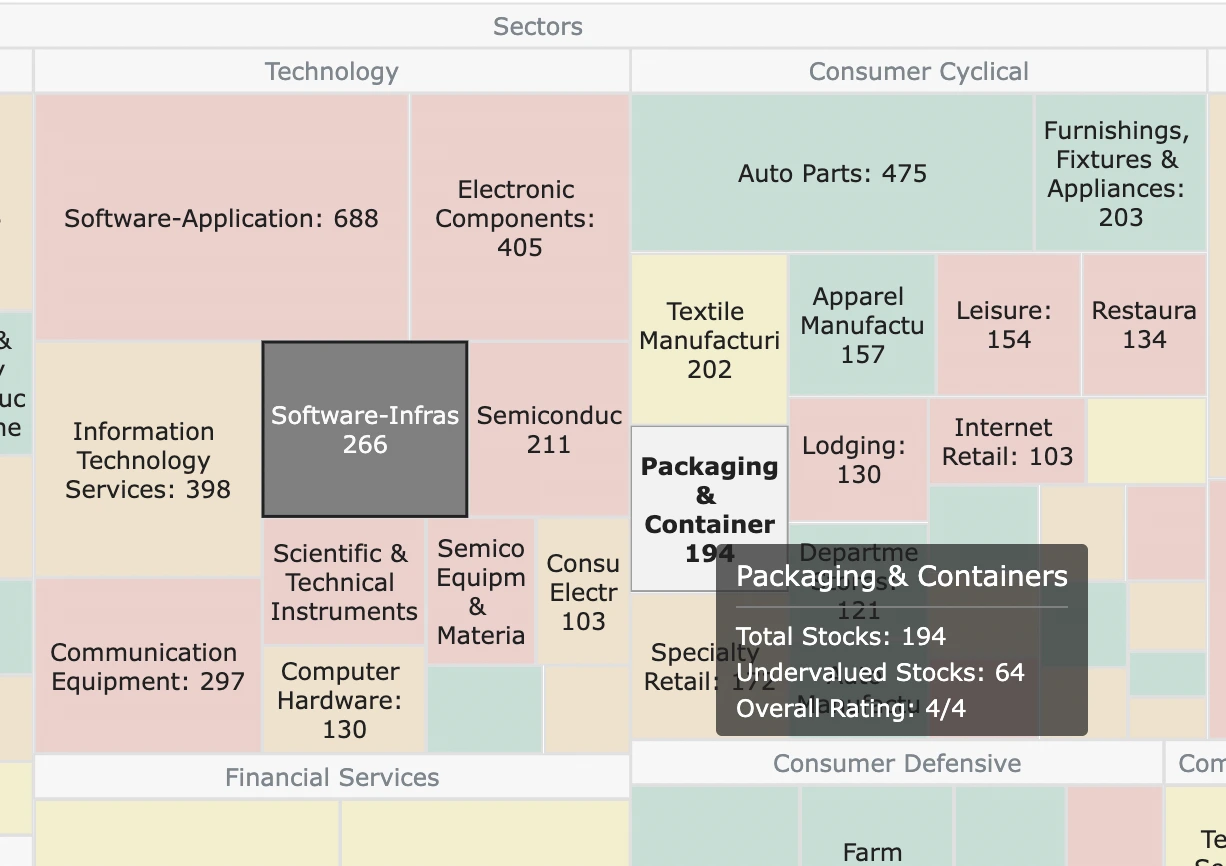

Sector Analysis

See the Best Sectors at a Glance.

Find the best sectors to invest in. Simple color coded table - the more green, the better.

Fair Value. Key Data. And Relative Performance.

With the Sector Analysis Tool we introduce a new way to find great sectors to invest in. The combination of key data like P/E or PEG and relative sector performance to the market performance shows undervalued sectors that are performing strong.

Stock Analysis

Financial Analysis Made Easy.

You don't have to be an expert to understand the financial fundamentals and ratios of a stock.

Alphabet Inc.

For each stock there is a stock sub-page where you can find out more about the stock. General ratings on the company's finances and the development of the stock price help to get a first impression of the company. Look for a higher Fair Value than stock price!

Stock Price: 98$ < Fair Value: 153$

Key Data & Multiple Comparison

Discover a New Way of Analysis

Discover, interpret and compare stock data the easy way. Just compare the stock's financial data to its peers and to the average targets, that are generally considered as good for the future stock performance. Each box is color coded, as always, the more green, the better. This data is used to estimate the Fair Value with 15 different valuation models and to create the fundamental rating. Additionally earnings- and revenue growth is integrated in our algorithm.

Fair Value · Fair Price

Unlock 15+ Valuation Models and AI-Powered Stock Analysis

6 Monate

14 Tage Free

- 5 Free Stock Analyses

- All FairValue Valuation Models

- Stock Search

- Portfolio

- Technical Chart Analysis

- Instant Access. Zero Risk.

Expert

12 Monate

30 Tage Free

- Annual Billing

- 50,000+ Stocks Worldwide

- Stock Screener

- Artificial Intelligence Ratings

- Market & Sector Analysis

- Full Version

Beginner

1 Monat

7 Tage free

- Monthly Billing

- 50,000+ Stocks Worldwide

- Stock Screener

- Artificial Intelligence Ratings

- Market & Sector Analysis

- Full Version

Safe Checkout.

Secure Checkout

with PayPal, Amazon Pay or Credit Card.

Cancel at any Time.

Cancel your Subscription whenever

you want via Account, PayPal or E-mail.

Instant Access.

You will receive your Premium Tool

Access Data immediately.

Dr. Peter Klein, BA

#1 Google-Ranked Fair Value Calculator. Internationally listed and used thousands of times.

"We have come such a long way already. Originally, I wanted to develop this tool only for myself — to better understand the markets and to discover companies that often remain unnoticed. From the very beginning, I poured a lot of heart and passion into this project. But the unexpectedly strong feedback motivated me to make the Fairvalue Calculator accessible to everyone who values solid, data-driven analysis. Since then, I have been working with great dedication to continuously improve the tool. In the end, it’s all about creating real value — not just for myself, but for everyone who shares this passion."

This tool can do more than conventional services and is even cheaper.

Tommy H.

via google.comI am a web designer, you guys are very inspiring. I wish to see more work from you, maybe more freebies. Using fairvalue products made my investing a lot easier!

Marc A.

via twitter.comI use these tools to weigh up whether a stock tip is really a trustworthy tip.

Carla M.

via MailYou have created a really great tool. Keep it up! I'm curious what comes next!

Sara S.

via google.comEven as a beginner, I understand the instructions of the software.

Lili S.

via twitter.comEven Hongkong, South Africa and Instabul Stock Exchange are covered in the stock database.

Marsa A.

Feedback via EmailStock Screener

Stock Screener with unique filters.

Find your favorite Fair Value Stock with amazing financial filter options to every data point we deliver:

How to get Unlimited Tool Access?

How to Cancel my Subscription?

Is There a Free Trial?

Feel free to submit your question here, and we will be happy to assist you!

Get Your Unlimited Access NOW!

100% Satisfaction . 0% Risk. No credit card required.