Intrinsic Value Calculator

Calculate the Intrinsic Value of Stocks online!

Use this intrinsic stock value calculator to calculate the intrinsic value of stocks. Insert earnings per share and revenue growth to receive an estimate of the intrinsic value of the stock. Earnings per share and sales (revenue) growth can be easily found with a Google search, in the annual report on the company’s website under “Investors Relations” or on relevant financial websites.

Additionally, we offer many free online calculators for stock valuation and fundamental analysis on this website.

In our Premium Tool, all necessary data for valuation is imported automatically, and intrinsic values to more than 45,000 Stocks.

Intrinsic Value Online Calculator

We have covered a significant portion of value and value investing with a focus on the value of a stock, the value of a company, value per share, valuation methods, and even some information on the father of value investing, Mr. Benjamin Graham over the other online calculators on this website. If you haven’t gone through them, then what are you waiting for? In this article, we go in-depth to calculate the intrinsic value of a stock using various multiples as well as shed some light on the DCF (Discounted Cash Flow) method of valuation.

In our article on undervalued stocks, we covered some multiples along with examples to highlight undervalued stocks and in this one, we will use those same examples to calculate the intrinsic value of those stocks. You will find the formula with an example below.

What is Intrinsic Value?

Intrinsic, derived from the Latin word intrinsics meaning “on the inside” is now used today to represent inherent qualities in an object or individual. E.g. motivation. Some individuals are motivated to perform an activity either to earn a reward or to avoid punishment. This is an externally sourced motivation. Some on the other hand perform the same activity for their personal goals and satisfaction. They are driven by internal desires that are present in them basis of their dreams, nurturing, and life goals. Their motivation is internal or intrinsic.

Intrinsic value can be calculated using various methods such as discounted cash flow analysis, dividend discount model, price-to-earnings ratio, and others. The goal is to determine the underlying value of the stock, apart from its market price. If the said number of a stock is higher than its market price, it is often considered undervalued and could be a good investment opportunity. Conversely, if the intrinsic value is lower than the market price, the stock may be considered overvalued.

Intrinsic Value via the Humble Penny

In terms of value, intrinsic value refers to the value that is inherent in the stock or company that we are looking to invest in. This can be applied to any asset in life and not just stocks or companies. E.g. we all collect rare coins and money bills. E.g. the United States penny before 1982 contained 95% copper.

The rising prices of copper have made that penny worth a lot more than a penny. While the external value of a penny is just that, one cent, its intrinsic value is double i.e. two cents due to the weight of the copper in that penny. Thus those holding the coin are holding an undervalued coin if they are to exchange it for one cent of value.

How to Apply Intrinsic Value to Stocks?

The intrinsic value of stock holds similarly to that of stock. Financial value calculation is complex but is often straightforward once you get the hang of it. Stock price reflects the value at which one can acquire that stock. However, its intrinsic value will be different calculated based on physical assets (Land, machinery, etc.) to intangible assets (formula, patents, licenses) and the same can be worth several times more than the stock price.

There are some popular multiples well-known in the market that are normally used to determine whether a company’s stock or company is trading at a discount to its intrinsic value or premium. Those same multiples can be used in various calculators to determine the intrinsic value of the company’s stock or company as well. Let us look at some of the intrinsic value formulas now.

Price to Earnings Ratio

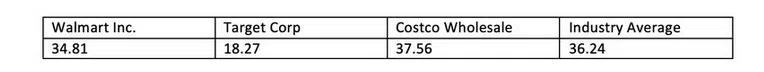

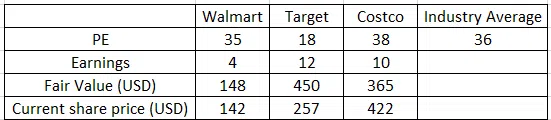

The ratio, often known as the PE ratio of a company when compared with its peers tells us whether the company is undervalued or not. The same can be used to calculate intrinsic value by taking a fair estimate of future earnings and current stock price. Consider the following companies:

Now considering that Target’s earnings per share remains the same and its growth rate remains positive, one can simply multiply industry average PE with Target’s earnings to get the intrinsic value of the company’s shares. Alternatively, one can also plot the numbers into an Excel model for quicker output.

As you can see, the fair value of Target as per the P/E ratio is 450, that is when its PE ratio reaches the industry average. If earnings were to grow as well this intrinsic value would go much higher.

Price to Earnings Ratio Calculator

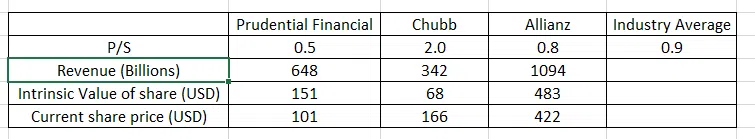

Price to Sales Ratio

This ratio, often known as the PS ratio of a company when compared with its peers highlights whether the value of a company basis its revenues is fair or not. Similar to PE we can calculate intrinsic value for investment by a fair estimate of growth rate, revenue cash flow/ cash flows, and expanding multiples.

We have taken into consideration, insurance companies whose revenues often translate directly into earnings. Prudential Financial remains highly undervalued while Chubbs remains overvalued. The Intrinsic value of a company like Prudential Financial when it reaches an average P/S ratio is high and that combined with revenue growth pushes it quite higher.

Price to Sales Ratio Calculator

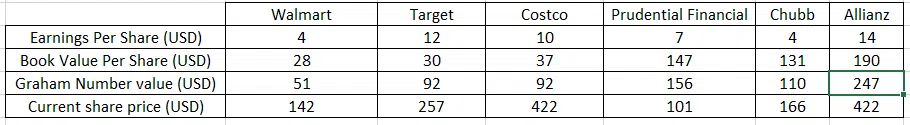

Graham Number

The ratios mentioned above are some of the common ones used to compare with industry averages for accurate intrinsic value formula applications and are commonly used in intrinsic value calculators. A less-known but very effective formula to determine the value of a company was founded by Benjamin Graham, also known as the father of value investing. The graham number is unique in that it is sector-agnostic.

It gives the absolute value of the stock’s price in the market irrespective of its sector. It relies on book value and earnings per share to give fair value of shares in the stock market. Net, Graham number calculator is a perfect way to get intrinsic value in a couple of clicks. Benjamin Graham gave the formula as the root of (22.5*earnings per share*book value per share). Using this let us compare the companies of the above examples and determine their intrinsic value using the Benjamin Graham number.

As one can see, the graham number is highly conservative giving severely low intrinsic values. This is one of the reasons it is no longer popular. Graham formula can be used fairly for a company’s hard assets but cannot be used for those with soft assets like software companies.

Graham Number Calculator

A Brief Word on Discounted Cashflow (DCF Model)

Discounted Cash Flow or DCF is a valuation model dependent on an estimate of /estimated future cash flows. The cash flows are adjusted for inflation by converting them to present value using a discount rate which is equal to inflation or prevailing interest rates. EPS is the usual starting point from which one moves to free cash flow. A growth rate is to be determined known as terminal growth rate which helps determine final future value.

DCF is not prominently used due to the inherent issues with assumptions and its sensitivity to those assumptions. A lot of assumptions are made on future cash flows DCF, discounted rate, growth rate, stock market returns, and terminal growth. There is a lot of scope for mistakes and the value received is often understated or over-exaggerated. Thus DCF tends to be the starting point of valuation for investment banks following which they use industry multiples as above for calculating the fair price of stocks.

How can we Help?

Wouldn’t you like your own intrinsic value calculator or fair market value calculator? Do you want to work on an intrinsic value of stock Excel/ intrinsic value formula Excel toiling away in calculating the intrinsic value of a stock using the tedious intrinsic value of share formula?

Or do you want to take it easy and have our inbuilt intrinsic value of stock calculator do the job for you in a single click? Our premium membership here at fairvalue-calculator website will allow you to avoid this model and simply estimate/ get estimated fair values for your stock market investment success. Stock markets contain risk, but also immense rewards for investors, and those investors that stay patiently can do well.

Conclusion

At fairvalue-calculator website, use our advice/analysis and make your investing journey easier. Like the legendary Warren Buffett, we have learned from Mr. Benjamin Graham and have given our own twist to his advice to give you as an investor better than expected yield/returns. Your search for your own Benjamin Graham ends here with us so come join us online and use our automated intrinsic value calculator and other calculators/calculators where our exhaustive data and tools along with analytical posts will help you manage your money better. After all, your money should work hard for you and not the other way around. Be your own Buffett and allow us to be your graham on this investment journey called life.

Find 45.000 Stocks with Intrinsic Value!

100% Satisfaction - 0% Risk - Cancel Anytime.