Investors are always on the lookout for the fair value of undervalued companies to invest in, and the key to finding such companies lies in understanding the concept of fair value. In this blog post, we will explain what fair value is, how to calculate it, which financial figures are needed, where to get official financial data, which formulas are used, and what the investment strategy behind fair value is. With our Premium Tools, all data is loaded automatically, the formulas are used especially for you and you can make informed investment decisions without having to work hard for them.

What is Fair Value?

Fair value is the estimated value of an asset or liability, based on the current market conditions. It is the price at which an asset can be sold or liability can be settled in an open market transaction. In other words, fair value is the price that a willing buyer would pay and a willing seller would accept in an arm’s length transaction.

It is an important concept in the financial world, as it is used in financial reporting, auditing, and investment analysis. Financial statements such as balance sheets and income statements often provide the fair value of certain assets and liabilities.

How to Calculate Fair Value?

Calculating this key figure involves estimating the future cash flows that an asset or a company is expected to generate and discounting them back to their present value. This involves forecasting the expected earnings of a company and discounting them using a discount rate that reflects the risk involved in investing in the company.

To calculate fair value, you need to obtain certain financial figures for the company, including revenue, earnings, cash flow, debt, and assets. These figures can be obtained from financial statements such as the income statement, balance sheet, and cash flow statement. These statements can be found in the annual reports of public companies.

Where to Get Official Financial Data?

Official financial data can be obtained from various sources, including the company’s annual reports, SEC filings, financial websites, and financial data providers. The financial data provided by these sources can be used to calculate the fair value of a company.

Which Formulas are Used to Calculate Fair Value?

There are several formulas used to calculate the key figure we are talking about, including the discounted cash flow (DCF) method, the price-to-earnings (P/E) ratio, and the price-to-book (P/B) ratio.

The DCF method is the most commonly used formula for calculating fair value. It involves estimating the future cash flows of a company and discounting them back to their present value using a discount rate that reflects the risk involved in investing in the company.

The P/E ratio compares the price of a company’s stock to its earnings per share. A low P/E ratio indicates that a company’s stock is undervalued, while a high P/E ratio indicates that a company’s stock is overvalued.

The P/B ratio compares the price of a company’s stock to its book value per share. A low P/B ratio indicates that a company’s stock is undervalued, while a high P/B ratio indicates that a company’s stock is overvalued.

What is the Investment Strategy Behind it?

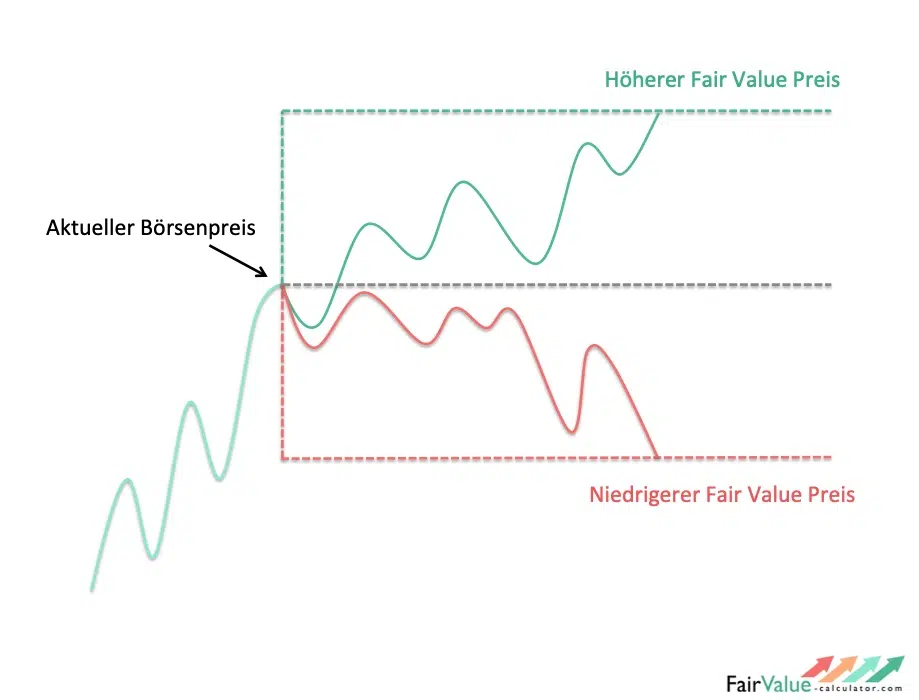

The investment strategy behind fair value involves buying stocks that are undervalued and selling stocks that are overvalued. This strategy involves looking for companies that have a lower market price than their fair value. This is because stocks that are undervalued have a higher potential for capital gains, as their price will eventually catch up with their fair value.

Investors who use the fair value strategy typically look for stocks that have a P/E ratio and P/B ratio below the industry average. They also look for stocks that have a high dividend yield, as this indicates that the company is generating enough cash flow to pay dividends to shareholders.

To sum up, calculating fair value can be a complex process that requires a significant amount of financial knowledge and time. However, with the right tools, investors can quickly and easily calculate the fair value of thousands of companies. That’s where our premium tools come in – our software automatically loads official financial data and calculates fair value for a wide range of companies. With our tools, you can save time and effort and focus on making informed investment decisions based on reliable data. Stop guessing and start investing with confidence.

- Click to share on Facebook (Opens in new window) Facebook

- Click to share on X (Opens in new window) X

- Click to email a link to a friend (Opens in new window) Email

- Click to share on LinkedIn (Opens in new window) LinkedIn

- Click to share on Reddit (Opens in new window) Reddit

- Click to share on Pinterest (Opens in new window) Pinterest

- Click to share on Telegram (Opens in new window) Telegram

- Click to share on WhatsApp (Opens in new window) WhatsApp

- Click to share on Mastodon (Opens in new window) Mastodon

- Click to share on Threads (Opens in new window) Threads