“The single biggest advantage a value investor has is not IQ. It’s patience and waiting. Waiting for the right pitch and waiting for many years for the right pitch” – Mohnish Pabrai

Successful investors over the years have achieved that success on the back of their unique and often eccentric investment styles. The common thread amongst each of the styles is the ability to make money and keep risk low. Each style suits their respective personality and is tuned to their decision-making process.

So while one may make a concentrated bet like Graham or Ackman, others may choose to diversify amongst 1000+ stocks like Lynch. One legend may have an aggressive long position and the other may have an aggressive short position and they will both make money. The message from each successful investor to their followers and the masses, in general, has been to develop your own investment style and philosophy and one suited to your personality for it to be effective.

Then why do we study their philosophy? Hundreds of books and thousands of articles have been written by successful investors and traders and those that study them all describe the styles and philosophies, successes and failures in detail. Heck, why are you even reading this?

We study their philosophy in order to find and incorporate the best fit for us and our personalities. We take aspects from their strategies that work for us and fill in the gaps on our own. We strive to recreate the elements that led to their success while avoiding the missteps that led to their failures. Most importantly, we study them in order to do better for ourselves. One learns best from the best and these have demonstrated their greatness.

However, most of us do not possess genius-level IQs or sophisticated mathematical and programming skills. How are we supposed to come up with unique strategies? Well turns out you don’t have to. One can achieve success simply by copying everything from successful investors and applying their life experiences while implementing those strategies.

Our investing legend has managed to do just that. Inspired by another legend, Warren Buffett, our investing legend once bid $650,000 for a charity lunch with his idol. He runs a few hedge funds where he follows Buffett’s value investing principles but differentiates them for himself by sizing and concentrating his bets. It would not be surprising to find upwards of 50-80% of his portfolio in a single stock, a recipe for heart attack for most investors. All of this is a slap on the face of prudent risk management but our investor demonstrates that he practices prudent risk management despite it looking otherwise. Introducing our final legend for this season of the series, who made the Gujarati word for “Endeavour that creates wealth” popular with his book “The Dhandho Investor”; Mohnish Pabrai.

The Dhandho Investor Philosophy:

Pabrai has outlined his entire investment philosophy in his sublime text “The Dhandho Investor”. As you will see, his entire philosophy is a copy of Buffett’s investment style. His addition is the concentration of bets something that Buffett cannot afford to do due to his size. Throughout the book, his philosophy is explained using the examples of “Patels’, a community of Indian immigrants who migrated to the USA in the 70s after fleeing Uganda due to the threat of genocide by Idi Amin.

Before we outline the philosophy, a small history lesson is a must to give context to the philosophy and its examples as used by Pabrai. Patels are a community of Indians originating from the Gujarat region in the Western part of India. Patel was originally a title given to the local village head which in subsequent generations stuck on when last names became a norm.

They are a successful business community both in India and across the world where they are based including countries in Africa. They were a dominant business community in Uganda as well which often caused friction between the local black community and the Indian business community.

Idi Amin rose to power and declared his intentions of giving back Uganda to ethnic Ugandans. Unfortunately for the Indian minority, he chose to do so by expulsing them. Predominant amongst those who were expulsed were Patels, who subsequently migrated to America leaving behind their wealth and possessions to start anew.

Today Patels dominate the motel industry in the USA and it is this tenacity and skill to start a business from scratch that Pabrai mirrors his investment philosophy with and uses their struggles and successes to explain that philosophy.

The philosophy can be outlined in the following points:

- Existing businesses over new ones: Pabrai is clear about buying existing businesses. Start-ups are far riskier and often based on untested ideas which might blow up. He believes in buying existing, tried, and tested businesses as they often offer similar opportunities for growth but with a lower risk of blowing up. The recent implosions in start-ups across the world as interest rates rise and funding dries up prove a testament to his first point. The Patels did exactly that, choosing to buy motels in the USA which were proven successes.

- Simple businesses with a slow rate of change in the industry: This is a direct pick up of Buffett’s strategy. Invest in a simple business that any fool can run rather than a business that requires a high level of skills to operate like banking or IT. Also, businesses that may experience a high rate of change are a solid no. IT businesses are much different today Vis a Vis a decade ago. Both of these stand true for the motel business. It is a simple business model and has remained practically unchanged over the decades.

- Troubled businesses in Troubled industries: This is an opportunistic investment philosophy practiced by Buffett and as seen in part 2 of this series. The idea is to buy businesses that are temporarily distressed in industries that are temporarily distressed. Investors must not, under any conditions, go investing in industries and companies in permanent decline. For an astute investor, investing in automobiles during the 70s oil crisis was a good investment as the industry would recover once the oil prices normalized. However, investing in typewriters when computers are taking the world by storm is a sure shot of losing position. The Patels chose to invest in motels in the 70s as the industry was in distress due to the reduced number of travelers due to the oil crisis. The industry would obviously recover as soon as the oil crisis settled.

- Businesses with a competitive advantage (moat): This sounds obvious on paper but is often difficult to distinguish in reality. What might appear as a moat may very well disappear the next day. Google with its search engine moat now faces a formidable challenge in AI-based text search engines. The Patels constructed their moats using ingenious decisions and sheer hard work. The main cost of a motel after property costs is staff expenses. The family members of Patel would engage in hotel services like housekeeping and room services thus saving on salary costs. They would also live in the motel, thereby saving on rent as well. This translated into a business with low costs and which could then offer these benefits to the customers resulting in a relatively lower rent for the rooms.

- Few Bets, Big Bets, and Infrequent Bets: This is where his philosophy differs from others and takes on a personal hue. If the business is solid, the industry is solid and the downside is limited, make a big bet. A stock that quadruples but forms only 5% of your portfolio will generate a mere 10% return for your portfolio but a stock that forms 50% of your portfolio and quadruples will double your portfolio. The Patels bet heavily on the motel business by buying other bankrupt motels from banks and taking a loan to fund that acquisition. The downside was a loss of some money and the motel but the upside was an entire motel should the business succeed, of which they had solid experience.

- Dhandho Arbitrage: Arbitrage in this scenario refers to the ability of businesses to earn above-normal profits for a limited time before competitors or substitutes enter and destroy these higher returns. Pabrai is a strong advocate of this arbitrage which he called ‘Dhandho Arbitrage”. He believed that due to the nature of capitalism, the arbitrage may very well be gone in a short period of time, but the presence of it makes a company a good investment. For e.g. GEICO set up call centers to sell auto insurance policies directly to its customers instead of going through the traditional distributor route allowing it to cut commissions and improve margins.

- The Margin of Safety: This is a direct uptake of Benjamin Graham’s philosophy. The idea is to buy a company at a strong discount to its intrinsic value and expected future cash flows resulting in a superior return over time and at the same time, limited loss if the bet goes wrong.

- Copycats rule: Innovation and the first mover advantage are often overrated. It is the copycat that often succeeds. Innovation is fraught with mistakes and errors and a lot of money, time, and effort goes into it. Copycats just have to take care of the flaws and the return on investment is far superior. From Microsoft’s OS to PhonePe’s transaction volumes in India, the copycat has managed to achieve success similar to the original and in some cases far more but at much lower risk. Pabrai in fact calls himself Buffett’s copy and attributes all his success to the investment strategies of Berkshire Hathaway.

The success and failures of Dhandho Investing:

Unlike our predecessors, Pabrai’s path to success has been lined with multiple small successes that compound into a large successful portfolio. From 2000 to 2018, his flagship hedge fund generated a massive absolute return of 1204% vs. 159% for the S&P 500 index. $100,000 invested with him in 1999 would be worth $1.8 million in 2018.

Pabrai is not interested in small discounts to value his investments. A company that is 10-20% undervalued will be ignored by him in a minute. Pabrai angles for making a fivefold return on investment in a few years. If the opportunity is not blindingly obvious, he will pass on it in a heartbeat.

Pabrai also takes inspiration from Buffett’s opportunism and made large bets on the recovery of General Motors and Chrysler post the financial crisis of 2008, a bet that paid off handsomely. He also focuses on companies in emerging markets like India as the companies are often not covered by street analysts making the probability of discovering a value gem very high.

His successful streak is marred by an occasional failure but the same has been offset by significant outperformance in other investments. Pabrai’s favorite quote is “Heads I win, tails I don’t lose much” and it is this obsession with protecting the downside that has allowed his portfolio to grow to the size that it is.

One of his most notable failures has been his investment in Horsehead Holdings Corp which was a zinc and related material mining company in the USA. True to his style, Pabrai made a sizeable bet in the company which was trading below its net worth. However, the company was soon plagued with cost overruns and issues at the plant which was exacerbated by the prices of zinc reaching an all-time low during that period. The company soon filed for bankruptcy and the fund lost around 15-19% in that year. Again this goes to show that the loss was limited to 15-19% despite making a sizeable bet whereas the upside when it comes is often multifold of the initial investment.

Philosophy Caveat:

Pabrai’s philosophy is essentially quite simple but difficult to implement if one does not have a knack for business. For a few talented, gifted people, business and its modalities are instinctively understood. For the rest of us, it requires hard work.

Fortunately, there is a model to it that Pabrai himself advocates. Again, this has been derived from Buffett. While going through the list of companies, Buffett and subsequently Pabrai spend no more than a minute during the initial filtration process. They wish to find a reason to say no to the investment and if they find it they move on to the next one. The game begins when you don’t find a reason to say no.

Pabrai also advocates staying away from complicated financial statements and balance sheets that don’t make sense. Financial statements should be easy to read and companies that keep it simple often tend to be good investments too.

Finally, Pabrai’s style of investing is highly concentrated with large bets on a single stock that remain unchanged for years. As small investors, we too have the ability to make such bets but it would be often detrimental to do so considering our expertise in the matter. As a workaround, one can separate a small portion of the portfolio for such large bets (Say around 10-20%) and place it all in the couple of stocks you wish to make a bet on. Remember the crux is to bet large but to do so infrequently. Opportunities to multiply your money are rare and do not come often so don’t assume every stock that meets your criteria will double.

Application in the real world with fair value investing:

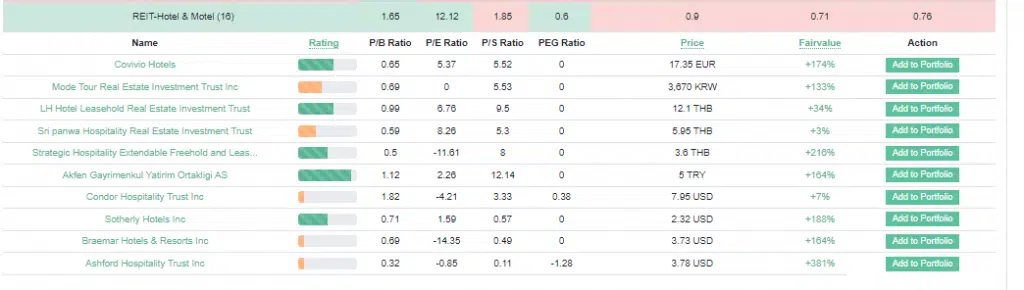

At Fairvalue calculator, we have data on 30,000+ stocks listed across the world with automatic financial analysis. As our premium user, all you have to do is search for the listed company and you will find all the information you need. Alternatively, you can visit our sector analysis stock screener and check out the hot sector currently driving the economy. Let us look at the same business sector that the Patels excelled in: Hotels and motels

The sector as a whole appears undervalued considering its highlight in green. Let us look at the first name itself Covivio Hotels.

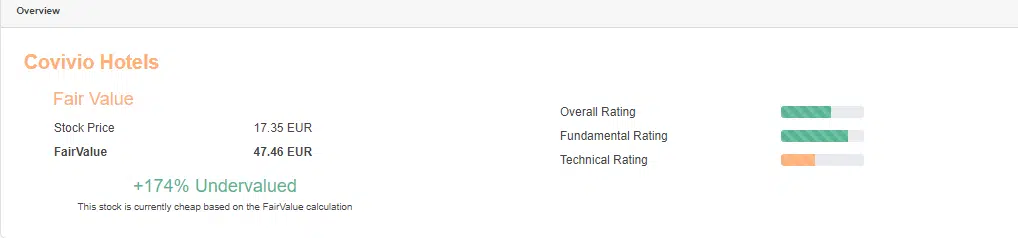

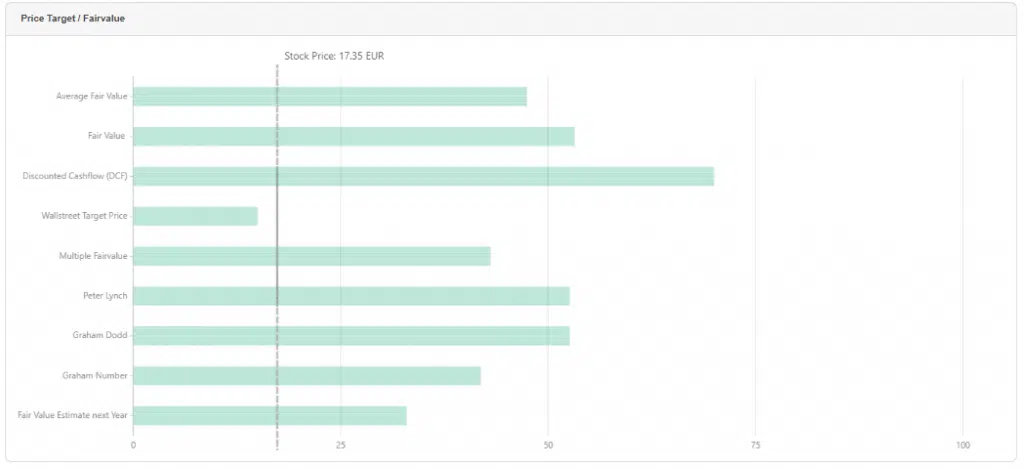

The stock appears to be 174% undervalued, proving to be a good opportunity to get multifold returns.

Covivio is a European investment and development company with a focus on hotels. With the pandemic over and tourism on a significant rise, the company is sure to see good times in the coming years.

The stock is undervalued on almost all parameters. This warrants further digging into company financials, management discussions, and analyst calls to figure out what is causing this undervaluation and then acquiring shares and sitting patiently for the markets to realize its fair value. One can also channel their inner activism and raise any potential issues in the shareholder meeting to force the company to take steps to realize fair value.

We at Fairvalue Calculator have done most of the heavy lifting. All that remains is for you, dear investor to dig a bit deeper and then wait patiently until all is well or ask some strong questions to the management of the company in question.

Last Words:

Being an innovator is not a guarantee of success, especially in business. Numerous stories and examples in businesses have proven that being a copycat can ensure similar success with limited risk. For those of us who cannot create our own strategies, Pabrai is a role model for being the ideal copycat. The only caveat is that we leave our ego at the door.

Concentrated bets may not be everybody’s cup of tea but as Buffett states, diversification is for the ignorant. As small investors, however, we are better off diversifying until we gain the required experience and expertise to make concentrated bets. Concentration should also be backed by a margin of safety so that if the investment does not work out, the loss is not significant.

Finally, investing is a game of patience and opportunity. Like a tiger stalking its prey, one must wait for the right opportunity to make the bet. Make large bets but make them infrequently. Be absolutely sure of the opportunity and it should be blindingly obvious. Once you have it, make the bet and then wait for the next one. That is all there is to value investing.

This concludes the first season of value investing legends. We at fair value calculator are always by your side to assist you in your investment journey and shall be coming up with new material soon. Meanwhile, join our premium membership and get started on analyzing the various styles of legendary investors to see which one suits you the best. Until next time, Happy Investing.