Johnson & Johnson’s Intrinsic Value: A Comprehensive Valuation Analysis

Johnson & Johnson stands as one of the most enduring and diversified healthcare companies in the world, with a business portfolio spanning pharmaceuticals, medical devices, and consumer health products that has generated consistent returns for shareholders across multiple generations. Understanding...

How to Use an Intrinsic Stock Value Calculator for Smarter Investing

Intrinsic stock value calculators provide investors with powerful tools for determining what a company is genuinely worth based on its fundamental business characteristics rather than relying solely on market sentiment or price momentum. These calculators employ rigorous valuation methodologies that...

Understanding KBB Fair Market Value

Kelley Blue Book (KBB) fair market value represents the estimated price at which a specific vehicle should sell in the current marketplace under normal conditions. This valuation metric has become the automotive industry’s most trusted benchmark for determining what buyers...

Using Excel’s XNPV and XIRR Functions to Handle Irregular Cash Flows in Valuation

When valuing investments, projects, or assets, we often encounter cash flows that don’t arrive at regular intervals. Traditional NPV and IRR functions in Excel assume periodic cash flows (annual, quarterly, monthly), but real-world scenarios are rarely that neat. Enter XNPV...

Maximize Profit: How to Backtest with Fair Value for Investment Returns

Imagine a world where every investment decision you make could be tested and proven before committing your hard-earned money. Sounds like a dream, right? Yet, for many savvy investors, this dream becomes a reality through the art of backtesting. The...

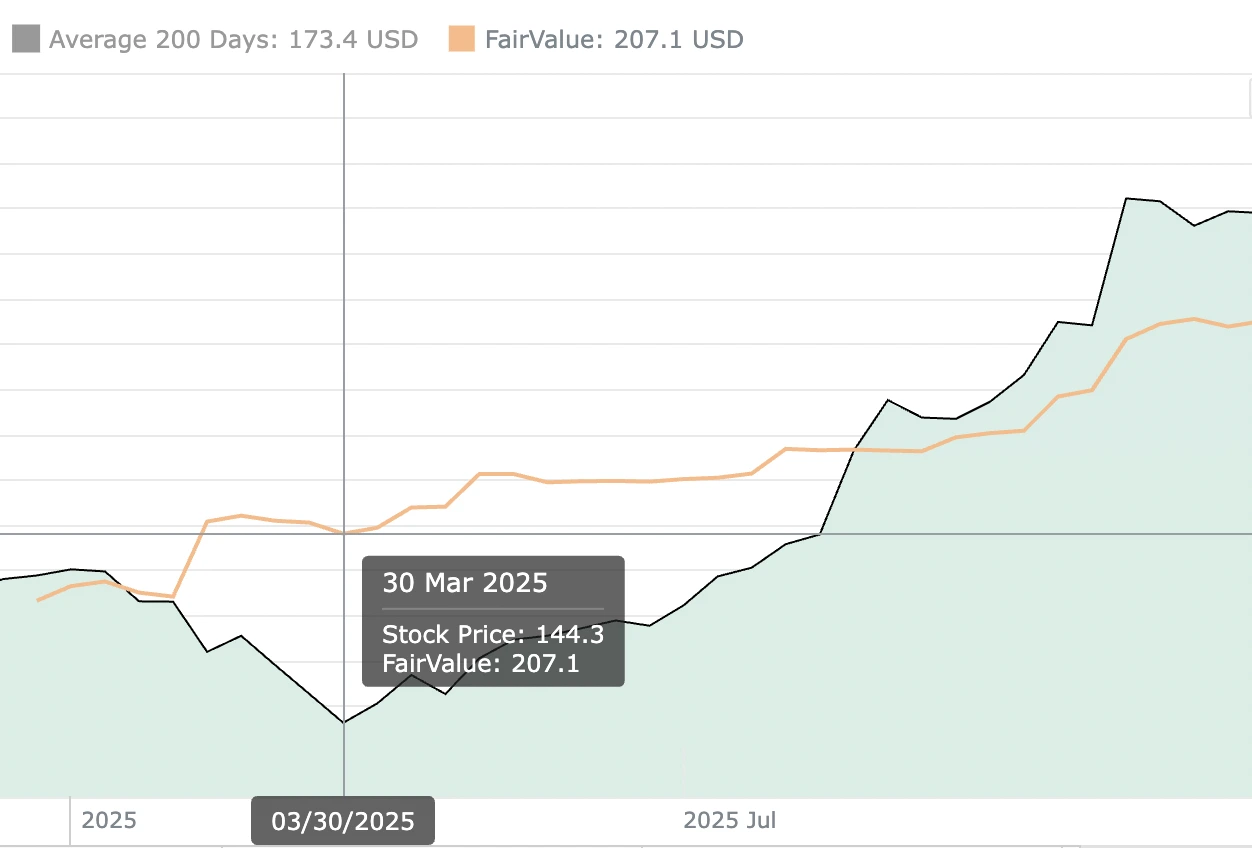

Unearthing Wealth: How Has Fair Value Estimates Compared to Market Prices Historically

In the ever-evolving world of finance, one question that often surfaces is: how does one pinpoint true value amidst market fluctuations? History has shown us that fair value estimates can be a powerful compass guiding investors through the turbulent waters...

Demystifying Fair Value: Applications in Financial Reporting, Impairments & Hierarchies

In the complex world of finance, deciphering the true worth of an asset can often feel like navigating a maze. This is where the concept of "fair value" emerges as a beacon of clarity, offering a glimpse into the actual...

Demystifying ‘Fair Value’ in Accounting: IFRS or GAAP

In the labyrinth of financial statements and accounting standards, "fair value" often emerges as a beacon of both clarity and confusion. While this concept is pivotal for accurate financial reporting, it frequently leaves professionals juggling between definitions under IFRS and...

Unpacking the Truth: What are the Limitations of Fair Value Estimates

In the complex world of finance and accounting, the concept of fair value estimates often shines like a beacon of transparency and accuracy. However, beneath its polished surface lies a web of challenges that financial professionals navigate daily. Understanding what...

Building a Comprehensive Stock Fair Value Calculator in Excel

A Professional GuideDetermining the fair value of stocks is a fundamental aspect of investment analysis that separates successful investors from speculators. While sophisticated financial software exists, Excel remains one of the most accessible and customizable tools for creating robust stock...

Manage Cookie Consent

To provide the best experiences, we use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. Not consenting or withdrawing consent, may adversely affect certain features and functions.

Functional Always active

The technical storage or access is strictly necessary for the legitimate purpose of enabling the use of a specific service explicitly requested by the subscriber or user, or for the sole purpose of carrying out the transmission of a communication over an electronic communications network.

Preferences

The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user.

Statistics

The technical storage or access that is used exclusively for statistical purposes.

The technical storage or access that is used exclusively for anonymous statistical purposes. Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you.

Marketing

The technical storage or access is required to create user profiles to send advertising, or to track the user on a website or across several websites for similar marketing purposes.