Unlocking Fair Market Value: A Guide to Smart Investing Success

Navigating the financial markets can feel like deciphering a complex foreign language, but there's one concept that acts as a universal translator: fair market value. Imagine unlocking a treasure chest filled with potential investment opportunities, each evaluated accurately—now that's the...

The Psychology Behind Overvalued and Undervalued Stocks

While mathematical models and financial metrics provide the foundation for determining a stock’s fair value, the actual market price often tells a different story. The gap between calculated fair value and market price reveals one of investing’s most fascinating aspects:...

Fair Value vs DCF Valuation: Which One Is More Reliable?

When it comes to determining what a stock is truly worth, investors face a fundamental choice between different valuation methodologies. The debate between DCF vs fair value approaches has divided financial professionals for decades, with passionate advocates on both sides...

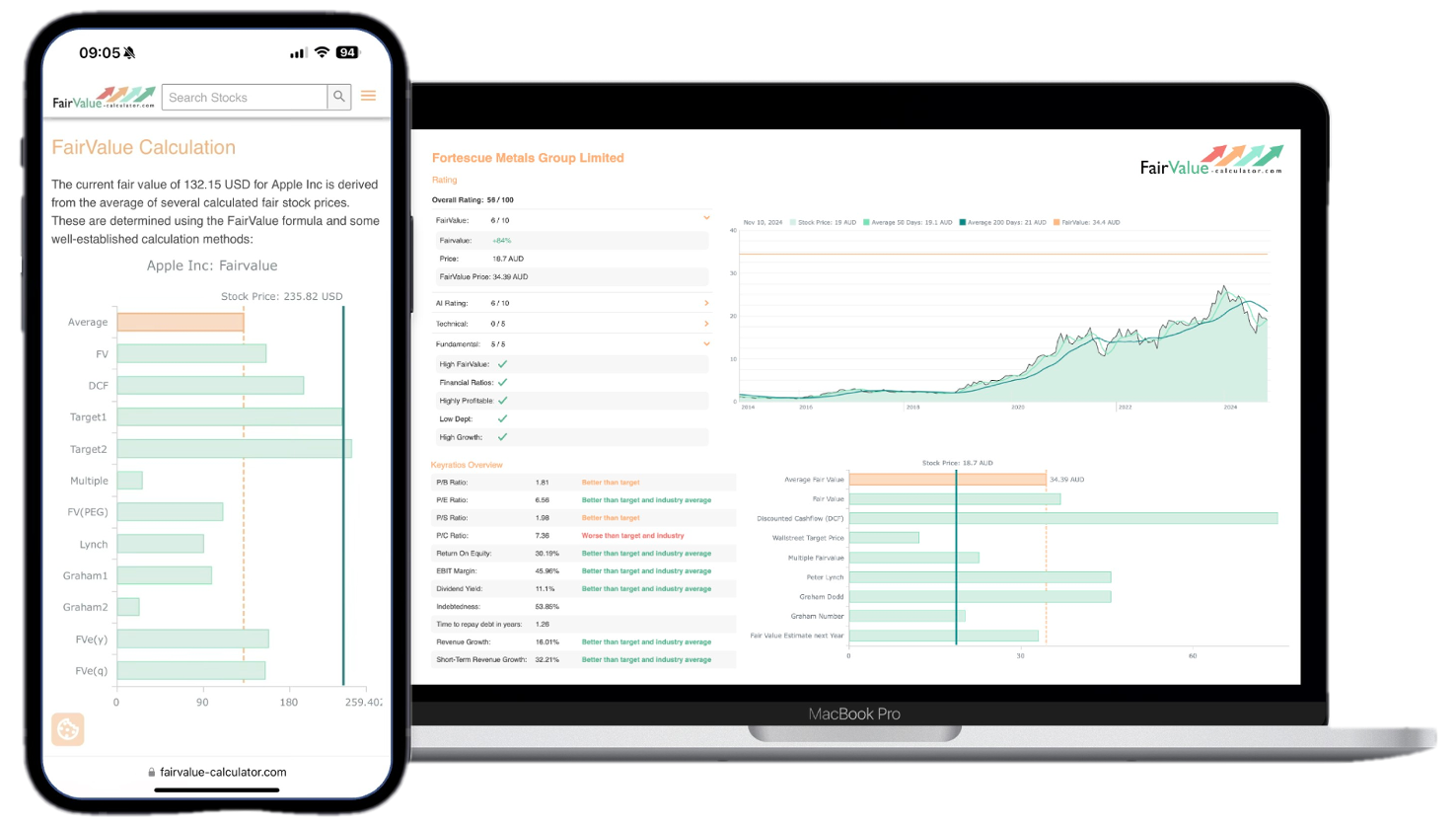

How to Use Free Fair Value Calculators to Outperform the Market

In today’s complex investment landscape, having access to professional-grade analysis tools can mean the difference between mediocre returns and market-beating performance. While institutional investors spend millions on sophisticated valuation software, individual investors can now access powerful free stock valuation calculator...

How Fair Value Investing Compares to Growth Investing in 2025

The investment landscape has dramatically evolved over the past few years, with shifting interest rates, technological disruption, and changing market dynamics forcing investors to reconsider their strategies. As we navigate through 2025, the debate between fair value investing vs growth...

How to Analyze a Stock Using Fair Value in 2025

The investment landscape has undergone dramatic shifts since 2020, fundamentally changing how we approach stock valuation. With persistent inflation, evolving interest rate environments, and technology disrupting traditional business models, determining stock fair value 2025 requires a more sophisticated approach than...

What is Warren Buffett’s 90/10 rule?

A Simple Investment Strategy for Long-Term WealthWhen it comes to investment advice, few voices carry as much weight as Warren Buffett, the legendary investor known as the “Oracle of Omaha.” Among his many pearls of wisdom, one recommendation stands out...

Sector-Specific Applications of Fair Value: Technology vs. Utilities

Fair value estimation, while governed by universal principles, requires significant adjustments when applied across different sectors. Perhaps no comparison illustrates this better than examining how fair value methodologies differ between high-growth technology companies and stable utility businesses. These sectors represent...

A Comprehensive Guide to Calculating Stock Intrinsic Value in 2025

Advanced Methods and Modern Applications In the recent unprecedented market volatility and technological transformation, calculating a stock’s intrinsic value has become more crucial—and more complex—than ever. This comprehensive guide explores both traditional valuation methods and cutting-edge approaches, incorporating real-world examples...

Behavioral Finance and Its Impact on Asset Valuation

The traditional financial paradigm assumes market participants act rationally, processing information efficiently to arrive at accurate asset valuations. However, the field of behavioral finance challenges this assumption by examining how psychological biases and cognitive limitations influence financial decision-making. This article...

Manage Cookie Consent

To provide the best experiences, we use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. Not consenting or withdrawing consent, may adversely affect certain features and functions.

Functional Always active

The technical storage or access is strictly necessary for the legitimate purpose of enabling the use of a specific service explicitly requested by the subscriber or user, or for the sole purpose of carrying out the transmission of a communication over an electronic communications network.

Preferences

The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user.

Statistics

The technical storage or access that is used exclusively for statistical purposes.

The technical storage or access that is used exclusively for anonymous statistical purposes. Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you.

Marketing

The technical storage or access is required to create user profiles to send advertising, or to track the user on a website or across several websites for similar marketing purposes.