Equity Return Formula: Master ROE Calculation With Expert Tips

Understanding the intricacies of financial metrics can often feel like navigating a maze without a map. Yet, one of the cornerstones of financial analysis that savvy investors rely on is the Return on Equity (ROE). Whether you're a seasoned investor...

The Psychology Behind Overvalued and Undervalued Stocks

While mathematical models and financial metrics provide the foundation for determining a stock’s fair value, the actual market price often tells a different story. The gap between calculated fair value and market price reveals one of investing’s most fascinating aspects:...

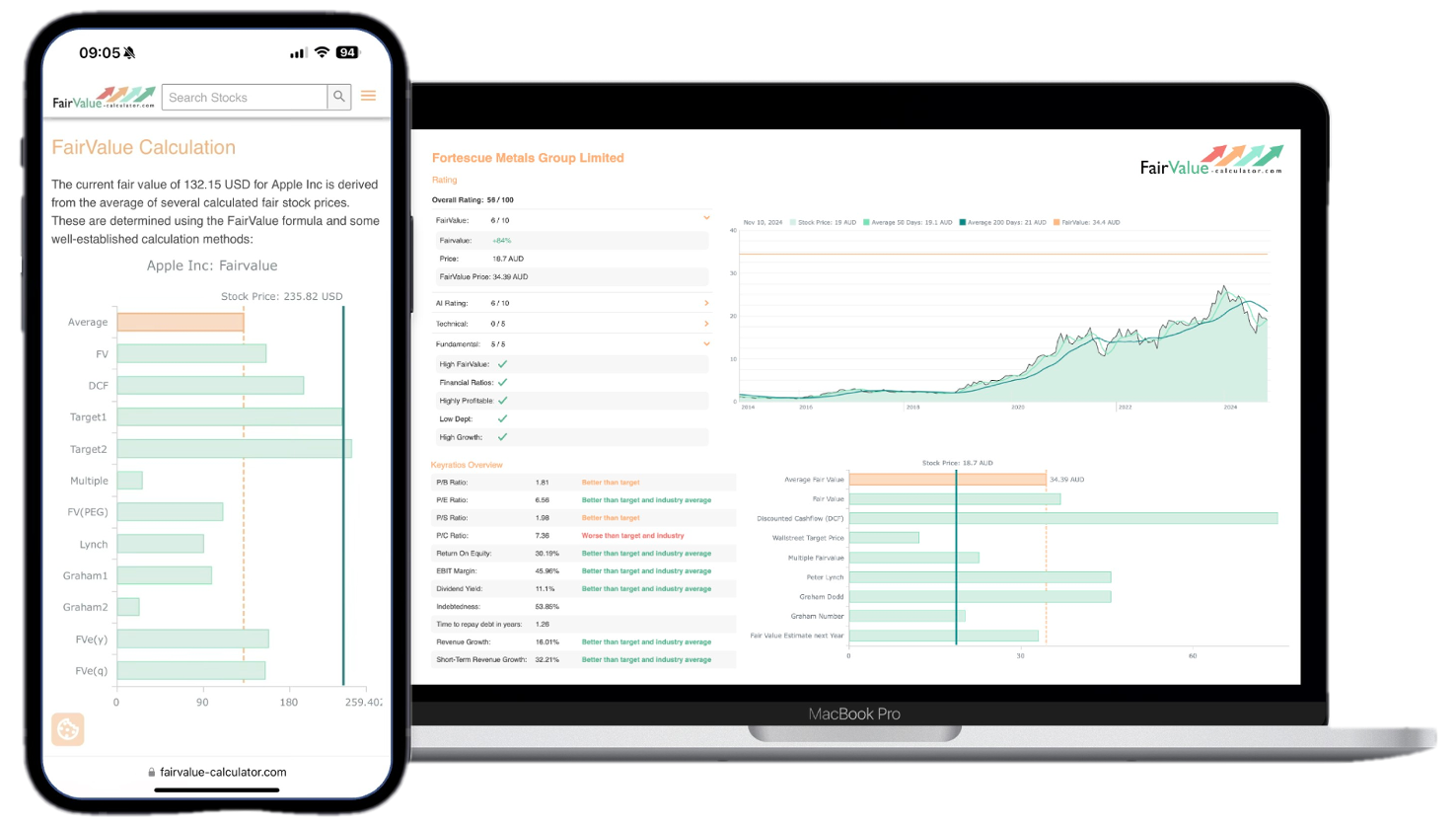

Fair Value vs DCF Valuation: Which One Is More Reliable?

When it comes to determining what a stock is truly worth, investors face a fundamental choice between different valuation methodologies. The debate between DCF vs fair value approaches has divided financial professionals for decades, with passionate advocates on both sides...

How Fair Value Investing Compares to Growth Investing in 2025

The investment landscape has dramatically evolved over the past few years, with shifting interest rates, technological disruption, and changing market dynamics forcing investors to reconsider their strategies. As we navigate through 2025, the debate between fair value investing vs growth...

Intrinsic Value vs Market Price: What Should Investors Trust More?

When it comes to making smart investment decisions, one of the most fundamental questions every investor faces is whether to trust what the market says a stock is worth or to rely on their own analysis of what it should...

How to Analyze a Stock Using Fair Value in 2025

The investment landscape has undergone dramatic shifts since 2020, fundamentally changing how we approach stock valuation. With persistent inflation, evolving interest rate environments, and technology disrupting traditional business models, determining stock fair value 2025 requires a more sophisticated approach than...

What is Warren Buffett’s 90/10 rule?

A Simple Investment Strategy for Long-Term WealthWhen it comes to investment advice, few voices carry as much weight as Warren Buffett, the legendary investor known as the “Oracle of Omaha.” Among his many pearls of wisdom, one recommendation stands out...

A Comprehensive Guide to Calculating Stock Intrinsic Value in 2025

Advanced Methods and Modern Applications In the recent unprecedented market volatility and technological transformation, calculating a stock’s intrinsic value has become more crucial—and more complex—than ever. This comprehensive guide explores both traditional valuation methods and cutting-edge approaches, incorporating real-world examples...

Behavioral Finance and Its Impact on Asset Valuation

The traditional financial paradigm assumes market participants act rationally, processing information efficiently to arrive at accurate asset valuations. However, the field of behavioral finance challenges this assumption by examining how psychological biases and cognitive limitations influence financial decision-making. This article...

Advanced Valuation Techniques for Experienced Investors

Experienced investors are constantly seeking sophisticated methods to accurately estimate the fair value of assets. Advanced valuation techniques, such as Monte Carlo simulations and real options analysis, offer powerful tools to navigate the complexities of modern markets. This article delves...

Manage Cookie Consent

To provide the best experiences, we use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. Not consenting or withdrawing consent, may adversely affect certain features and functions.

Functional Always active

The technical storage or access is strictly necessary for the legitimate purpose of enabling the use of a specific service explicitly requested by the subscriber or user, or for the sole purpose of carrying out the transmission of a communication over an electronic communications network.

Preferences

The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user.

Statistics

The technical storage or access that is used exclusively for statistical purposes.

The technical storage or access that is used exclusively for anonymous statistical purposes. Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you.

Marketing

The technical storage or access is required to create user profiles to send advertising, or to track the user on a website or across several websites for similar marketing purposes.