Title: Unlocking True Value: Master Fair Value Calculation Using DCF Method

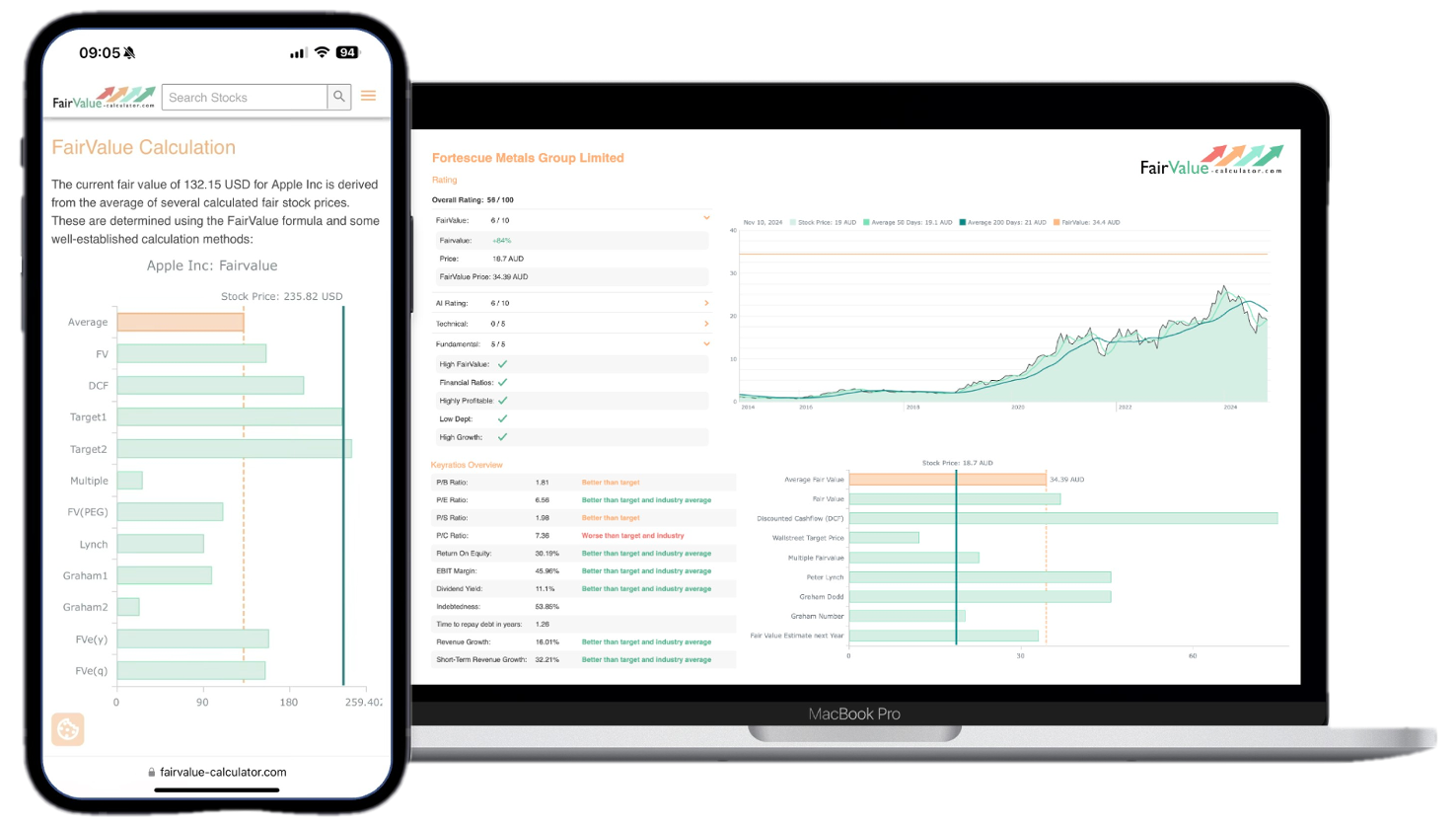

In the world of investment and corporate finance, unlocking the true value of a company or asset is akin to discovering hidden treasure. Yet, accurately determining this value is often a challenging task that requires skill and precision. One tool...

Decoding Differences: Fair Value Vs Market & Book Values Explained

Navigating the world of finance often feels like deciphering a complex code, with terms like fair value, market value, and book value thrown around as if they are part of a secret language. While on the surface these concepts may...

The Psychology Behind Overvalued and Undervalued Stocks

While mathematical models and financial metrics provide the foundation for determining a stock’s fair value, the actual market price often tells a different story. The gap between calculated fair value and market price reveals one of investing’s most fascinating aspects:...

Fair Value vs. Market Value: What’s the Difference?

In finance and accounting, the concepts of fair value and market value play pivotal roles in asset valuation, financial reporting, and investment decisions. While these terms are sometimes used interchangeably in casual conversation, they represent distinct approaches to determining the...

Trendspotting: Finding Value Investments

In the dynamic world of investing, staying ahead of market trends is crucial for identifying value investment opportunitiesBy leveraging fair value analysis, investors can evaluate undervalued stocks or assets and make informed decisions. In this blog post, we will explore...