Unlocking Valuations: What is the Formula for Fair Value of a Stock

Imagine you're on a treasure hunt, but instead of a dusty map with an "X" marking the spot, you have a complex puzzle in your hands—each piece representing the nuances of the stock market. At the heart of this quest...

Title: Unlocking True Value: Master Fair Value Calculation Using DCF Method

In the world of investment and corporate finance, unlocking the true value of a company or asset is akin to discovering hidden treasure. Yet, accurately determining this value is often a challenging task that requires skill and precision. One tool...

Unlocking Accuracy: What Methods Are Used to Calculate Fair Value

In the intricate world of finance, understanding the true worth of an asset is akin to unlocking a secret code. "What methods are used to calculate fair value?" you may wonder. At the heart of this quest lies a blend...

Decoding Differences: Fair Value Vs Market & Book Values Explained

Navigating the world of finance often feels like deciphering a complex code, with terms like fair value, market value, and book value thrown around as if they are part of a secret language. While on the surface these concepts may...

Unlocking Insights: What is “Fair Value” and Why It Matters

In the complex world of finance and investing, clarity can often seem elusive. The term "fair value" is frequently thrown around in discussions, yet many find themselves puzzled by its true meaning and significance. Imagine having the ability to peer...

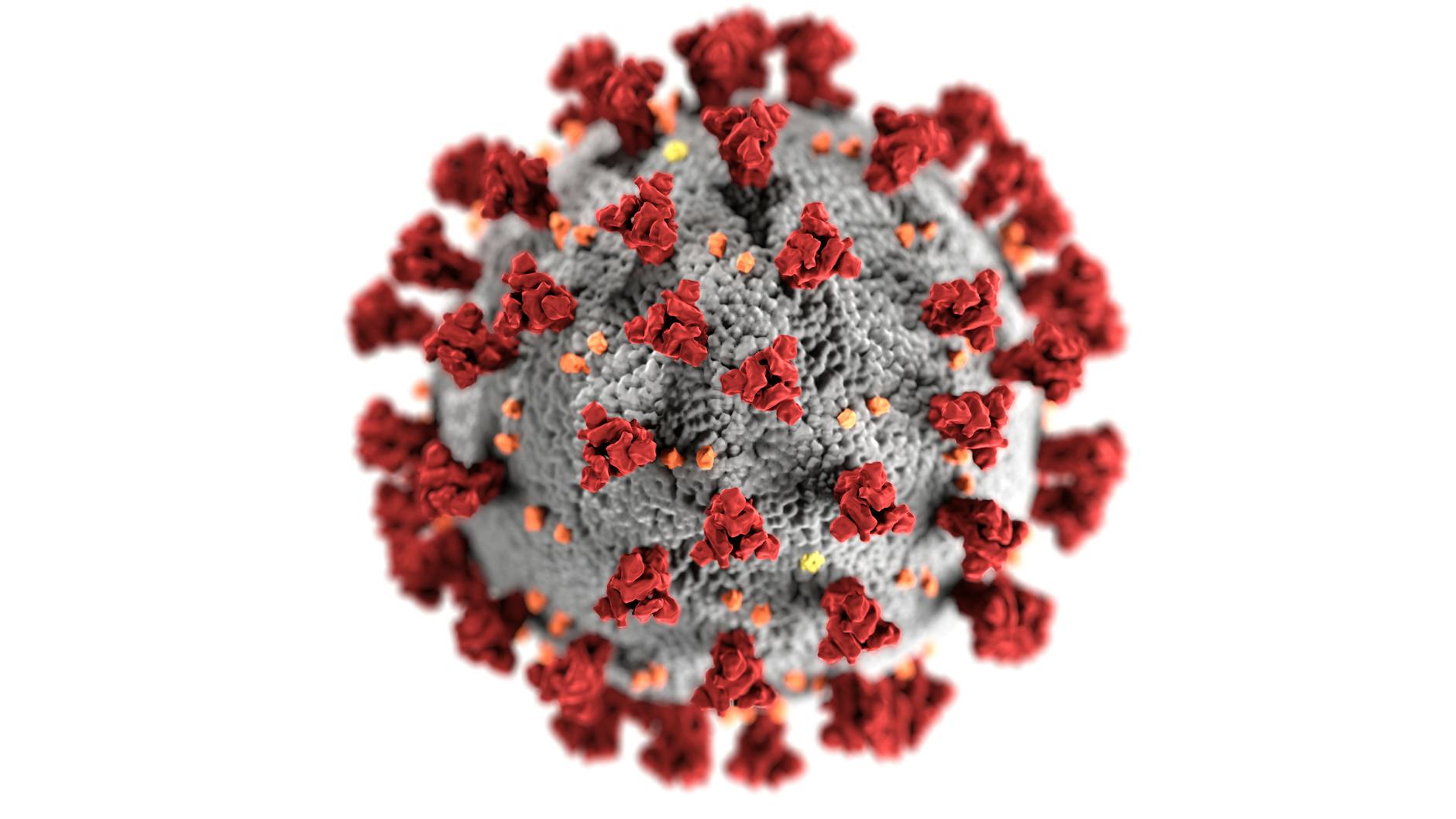

Understanding CrowdStrike Virus Risks: Investors’ Guidepost to Cybersecurity and Stocks

In an era where a single software glitch can cause sprawling disruptions, the recent CrowdStrike incident in July 2024 stands as a stark reminder of the fragile tapestry that our modern supply chains rely on. A seemingly innocuous code update...

Apple iPhone 17: Is It Pushing Apple Stock’s True Worth

As Apple unveils its latest marvel, the iPhone 17, investors and tech enthusiasts alike are keenly observing its impact on Apple’s stock valuation. The release of a new iPhone has always been a pivotal moment for Apple, symbolizing innovation while...

Broadcom Stock Analysis: Is It the Underestimated Rival to Nvidia

In the high-stakes world of AI investment, two titans often dominate conversations: Nvidia and Broadcom. While Nvidia's groundbreaking work in GPUs has made it a household name among tech investors, Broadcom is often overlooked as a formidable contender. But could...

Crack Confusing Spreadsheets

Navigating the treacherous waters of stock investment can feel like deciphering an ancient manuscript. With endless opinions, mind-boggling spreadsheets, and a cacophony of AI buzzwords, even seasoned investors can find themselves lost in a sea of information overload. Enter ismystockgood.com,...

The Untold Secrets of Value vs Growth Stocks Performance Unveiled

In the world of investing, few debates spark as much passion and intrigue as the battle between value and growth stocks. It's a struggle that has captivated the minds of investors for decades, with both sides claiming superiority at different...

Manage Cookie Consent

To provide the best experiences, we use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. Not consenting or withdrawing consent, may adversely affect certain features and functions.

Functional Always active

The technical storage or access is strictly necessary for the legitimate purpose of enabling the use of a specific service explicitly requested by the subscriber or user, or for the sole purpose of carrying out the transmission of a communication over an electronic communications network.

Preferences

The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user.

Statistics

The technical storage or access that is used exclusively for statistical purposes.

The technical storage or access that is used exclusively for anonymous statistical purposes. Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you.

Marketing

The technical storage or access is required to create user profiles to send advertising, or to track the user on a website or across several websites for similar marketing purposes.