Apple AI Revolution: Innovation Boost or Valuation Trap for Investors

When Apple unveiled its newest venture, "Answers," it wasn't just another tech announcement. Echoing throughout the halls of innovation, this move signifies Apple's foray into a privacy-centric AI assistant designed to redefine how personal devices operate. Unlike conventional AI, "Answers"...

Exploring Tesla Stock: Overrated Bubble or Potential Gem by 2025

In the electrifying world of finance, few topics have sparked as much debate as Tesla stock. Picture this: a current stock price sitting confidently at $302, yet an estimated fair value looming at $171. That’s a staggering 45% overvaluation. It’s...

Novo Nordisk Stumbles Amidst Eli Lilly’s Triumphant Rise: What’s Next

In the high-stakes world of pharmaceutical giants, fortunes can shift dramatically and with little warning. Just ask Novo Nordisk, which recently faced a significant stumble in its long-standing reign over the diabetes and obesity treatment market. The company is grappling...

Analyzing Gamestop: Stock Valuation Insights for Long-Term Investors in 2025

In an era where meme stocks seem to dance at the whims of social media chatter, the financial landscape is anything but predictable. Yet amidst this roller-coaster ride, long-term investors need more than just a viral tweet to make informed...

Unpacking Berkshire Hathaway Price to Book P/B Ratio: Buffett’s Valuation Insight

For seasoned investors, Warren Buffett’s name alone is synonymous with strategic wisdom and remarkable financial insight. When it comes to decoding the valuation metrics of Berkshire Hathaway, particularly the price-to-book (P/B) ratio, understanding the nuances behind these numbers becomes paramount....

Equity Return Formula: Master ROE Calculation With Expert Tips

Understanding the intricacies of financial metrics can often feel like navigating a maze without a map. Yet, one of the cornerstones of financial analysis that savvy investors rely on is the Return on Equity (ROE). Whether you're a seasoned investor...

Unlocking Fair Market Value: A Guide to Smart Investing Success

Navigating the financial markets can feel like deciphering a complex foreign language, but there's one concept that acts as a universal translator: fair market value. Imagine unlocking a treasure chest filled with potential investment opportunities, each evaluated accurately—now that's the...

The Psychology Behind Overvalued and Undervalued Stocks

While mathematical models and financial metrics provide the foundation for determining a stock’s fair value, the actual market price often tells a different story. The gap between calculated fair value and market price reveals one of investing’s most fascinating aspects:...

Fair Value vs DCF Valuation: Which One Is More Reliable?

When it comes to determining what a stock is truly worth, investors face a fundamental choice between different valuation methodologies. The debate between DCF vs fair value approaches has divided financial professionals for decades, with passionate advocates on both sides...

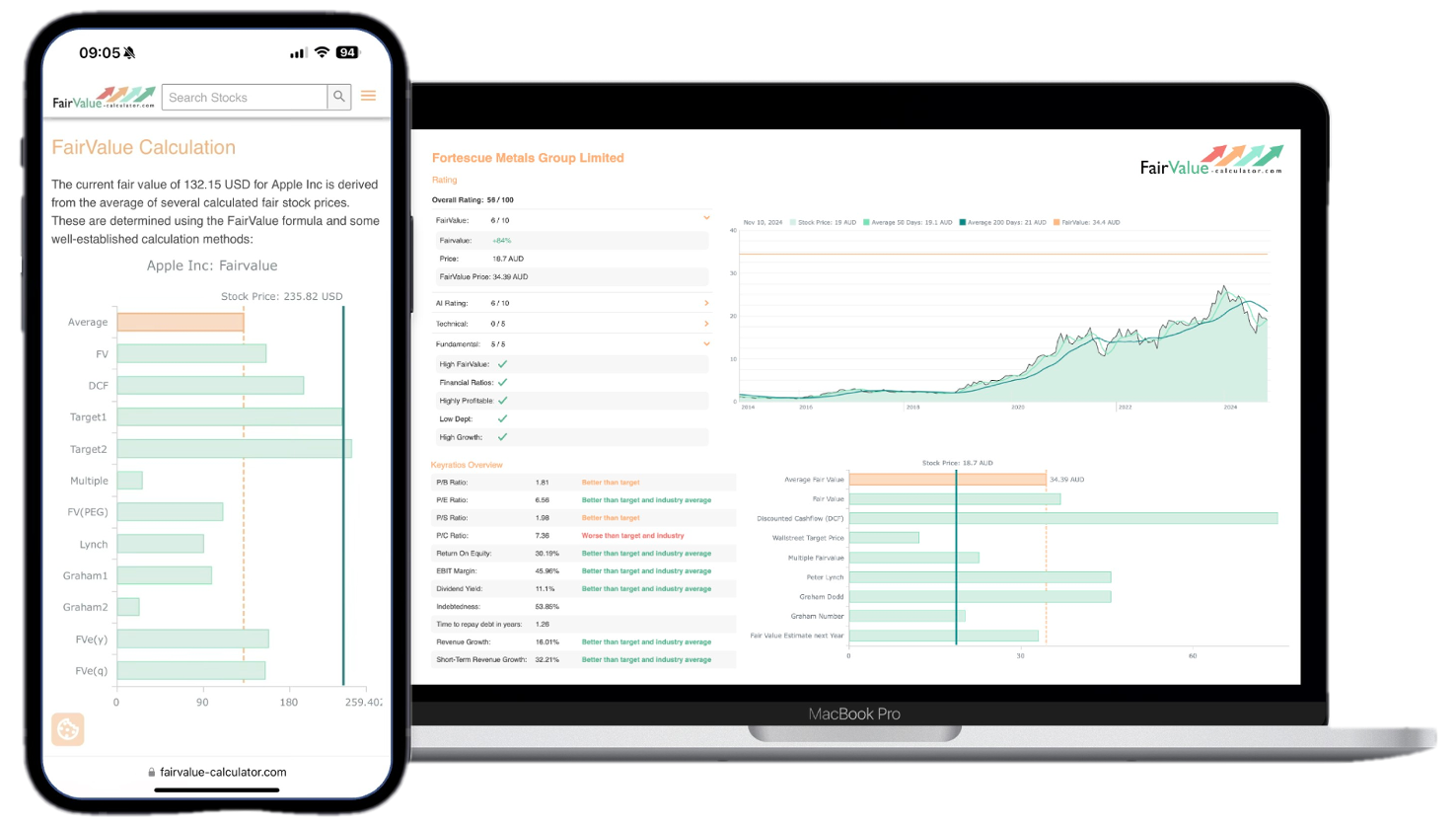

How to Use Free Fair Value Calculators to Outperform the Market

In today’s complex investment landscape, having access to professional-grade analysis tools can mean the difference between mediocre returns and market-beating performance. While institutional investors spend millions on sophisticated valuation software, individual investors can now access powerful free stock valuation calculator...

Manage Cookie Consent

To provide the best experiences, we use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. Not consenting or withdrawing consent, may adversely affect certain features and functions.

Functional Always active

The technical storage or access is strictly necessary for the legitimate purpose of enabling the use of a specific service explicitly requested by the subscriber or user, or for the sole purpose of carrying out the transmission of a communication over an electronic communications network.

Preferences

The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user.

Statistics

The technical storage or access that is used exclusively for statistical purposes.

The technical storage or access that is used exclusively for anonymous statistical purposes. Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you.

Marketing

The technical storage or access is required to create user profiles to send advertising, or to track the user on a website or across several websites for similar marketing purposes.