The “Magnificent Seven” stocks also “Magnificent 7 Stocks” are a group of seven high-growth technology companies that are considered to be leaders in their respective industries. The term was originally coined by CNBC personality Jim Cramer in 2013 and included the following stocks:

- Alphabet (GOOG)

- Amazon (AMZN)

- Apple (AAPL)

- Facebook (now Meta) (META)

- Microsoft (MSFT)

- Nvidia (NVDA)

- Tesla (TSLA)

Fair Value Magnificent 7 Stocks

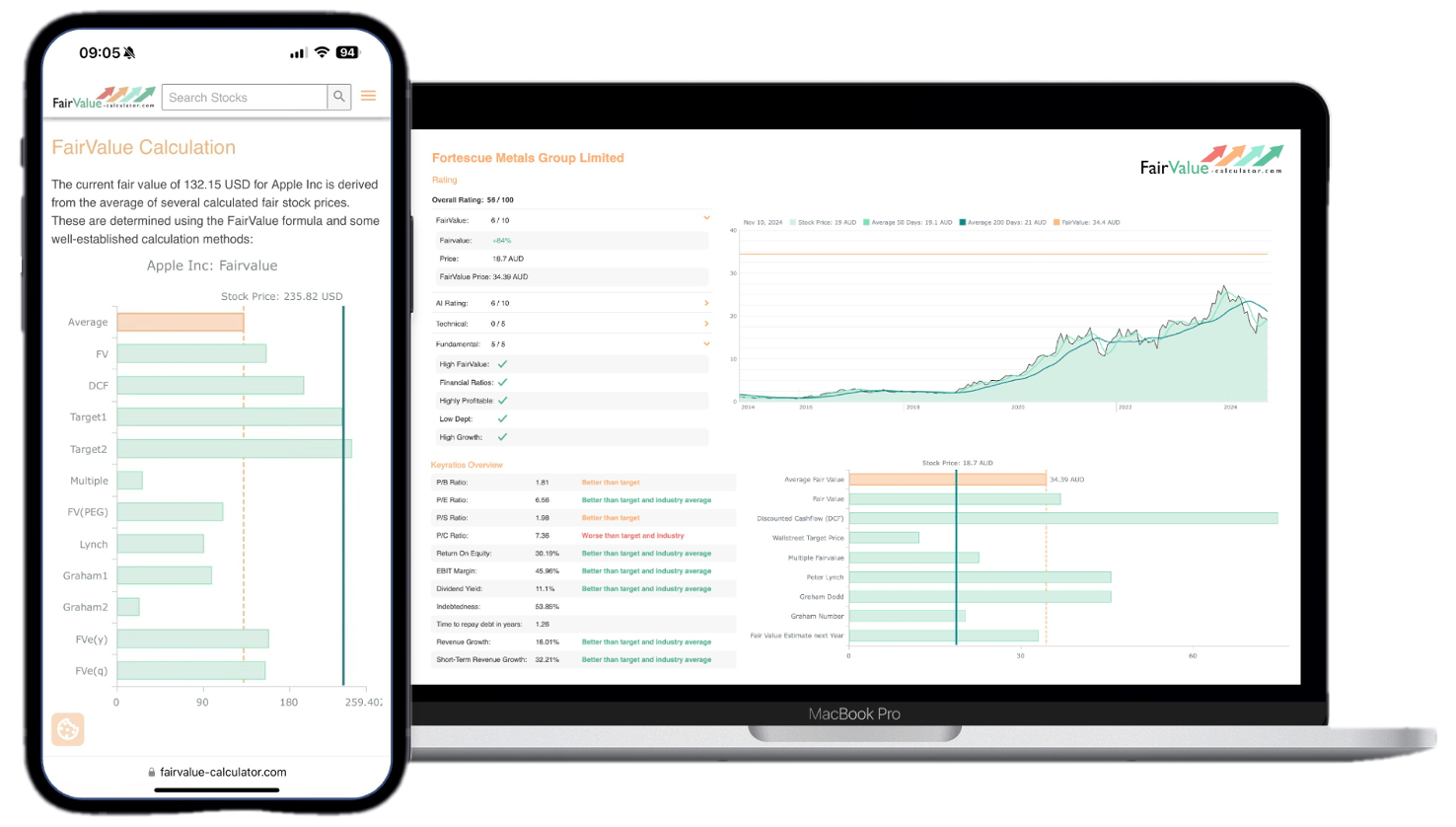

The “Magnificent Seven” stocks, a term popularized by CNBC personality Jim Cramer in 2013, comprise a select group of high-growth technology companies that are widely recognized as industry leaders. This list presents a comprehensive analysis of the fair value of these stocks, providing valuable insights for investors seeking to make informed decisions. The evaluation encompasses relevant financial metrics, market trends, and growth potential, offering a thorough understanding of the investment prospects of these renowned companies.

The “Magnificent Seven” stocks are a group of seven high-growth technology companies that are considered to be leaders in their respective industries. The term was originally coined by a CNBC personality, and its fair value is evaluated based on relevant financial metrics, market trends, and growth potential. This valuation provides valuable insights for investors seeking to make informed decisions and offers a thorough understanding of the investment prospects of these renowned companies.

1. Alphabet (GOOG) – Fairly Valued!

Alphabet Inc. is an American multinational technology conglomerate holding company headquartered in Mountain View, California. It was created through a restructuring of Google on October 2, 2015, and became the parent company of Google and several former Google subsidiaries. Alphabet is the world’s third-largest technology company by revenue and one of the world’s most valuable companies. Based on more than 28 evaluated financial metrics, Alphabet appears to be currently fairly valued.

Explore our most popular stock fair value calculators to find opportunities where the market price is lower than the true value.

- Peter Lynch Fair Value – Combines growth with valuation using the PEG ratio. A favorite among growth investors.

- Buffett Intrinsic Value Calculator – Based on Warren Buffett’s long-term DCF approach to determine business value.

- Buffett Fair Value Model – Simplified version of his logic with margin of safety baked in.

- Graham & Dodd Fair Value – Uses conservative earnings-based valuation from classic value investing theory.

- Intrinsic vs. Extrinsic Value – Learn the core difference between what a company’s really worth and what others pay.

- Intrinsic Value Calculator – A general tool to estimate the true value of a stock, based on earnings potential.

- Fama-French Model – For advanced users: Quantifies expected return using size, value and market risk.

- Discount Rate Calculator – Helps estimate the proper rate to use in any DCF-based valuation model.

2. Amazon (AMZN) – Overvalued!

Amazon.com, Inc. is an American multinational technology company focusing on e-commerce, cloud computing, online advertising, digital streaming, and artificial intelligence. It has been often referred to as “one of the most influential economic and cultural forces in the world”, and is often regarded as one of the world’s most valuable brands.

💡 Discover Powerful Investing Tools

Stop guessing – start investing with confidence. Our Fair Value Stock Calculators help you uncover hidden value in stocks using time-tested methods like Discounted Cash Flow (DCF), Benjamin Graham’s valuation principles, Peter Lynch’s PEG ratio, and our own AI-powered Super Fair Value formula. Designed for clarity, speed, and precision, these tools turn complex valuation models into simple, actionable insights – even for beginners.

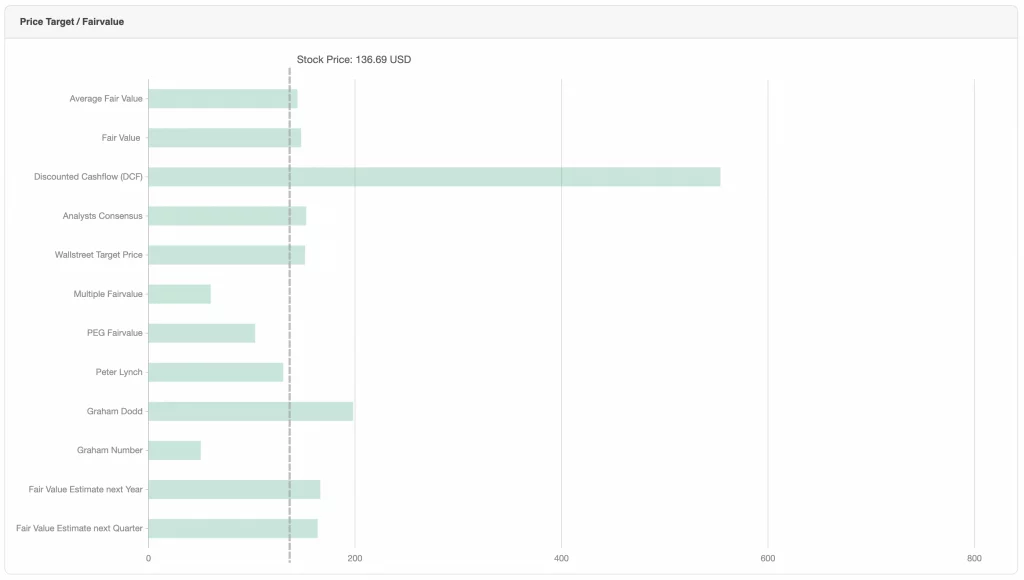

Learn More About the Tools →3. Apple (AAPL) – Overvalued!

Apple Inc. is an American multinational technology company headquartered in Cupertino, California. As of March 2023, Apple is the world’s largest company by market capitalization, and with US$394.3 billion the largest technology company by 2022 revenue. As of June 2022, Apple is the fourth-largest personal computer vendor by unit sales; the largest manufacturing company by revenue; and the second-largest mobile phone manufacturer in the world.

4. Facebook (META) – Overvalued!

Meta Platforms, Inc., doing business as Meta, and formerly named Facebook, Inc., and TheFacebook, Inc., is an American multinational technology conglomerate based in Menlo Park, California. The company owns and operates Facebook, Instagram, Threads, and WhatsApp, among other products and services. Meta is one of the world’s most valuable companies and among the ten largest publicly traded corporations in the United States.

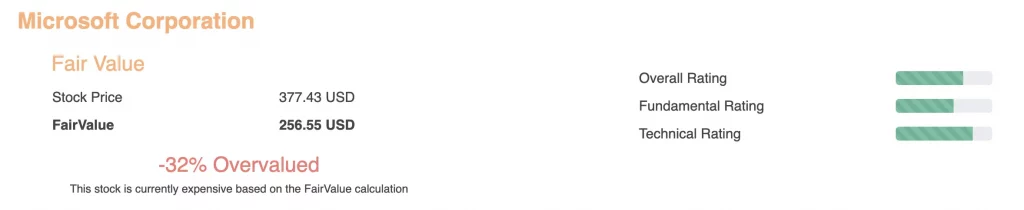

5. Microsoft (MSFT) – Overvalued!

Microsoft Corporation is an American multinational technology corporation headquartered in Redmond, Washington. Microsoft’s best-known software products are the Windows line of operating systems, the Microsoft 365 suite of productivity applications, and the Edge web browser. Its flagship hardware products are the Xbox video game consoles and the Microsoft Surface lineup of touchscreen personal computers. Microsoft ranked No. 14 in the 2022 Fortune 500 rankings of the largest United States corporations by total revenue; it was the world’s largest software maker by revenue as of 2022.

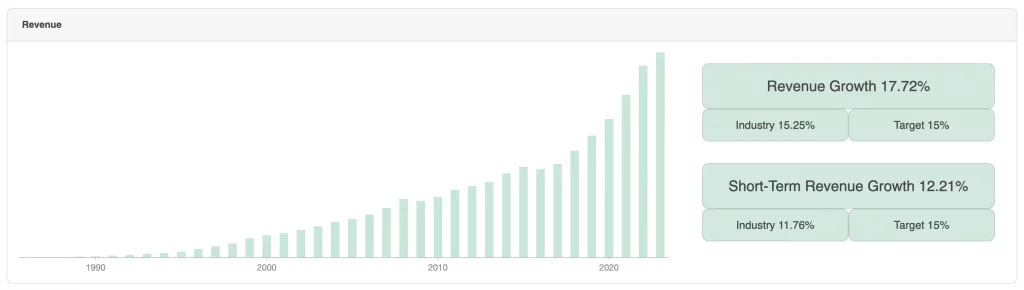

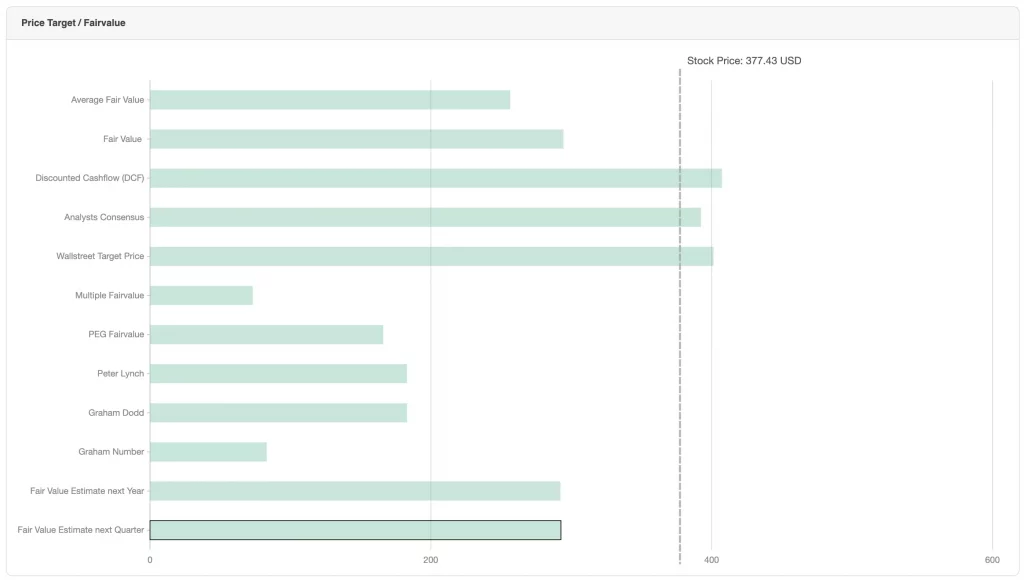

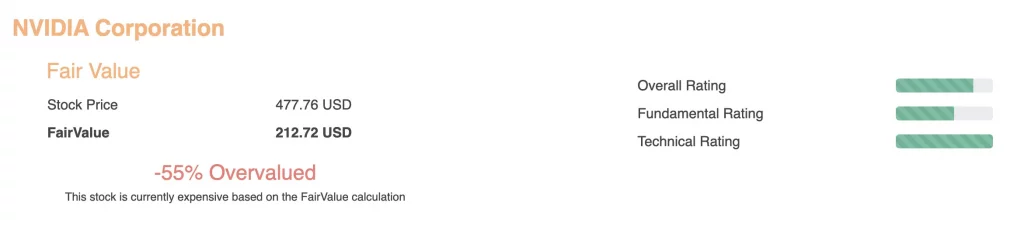

6. Nvidia (NVDA) – Overvalued!

NVIDIA Corporation operates as a visual computing company worldwide. It operates in two segments, Graphics and Compute & Networking. The Graphics segment offers GeForce GPUs for gaming and PCs, the GeForce NOW game streaming service and related infrastructure, and solutions for gaming platforms; Quadro/NVIDIA RTX GPUs for enterprise design; GRID software for cloud-based visual and virtual computing; and automotive platforms for infotainment systems.

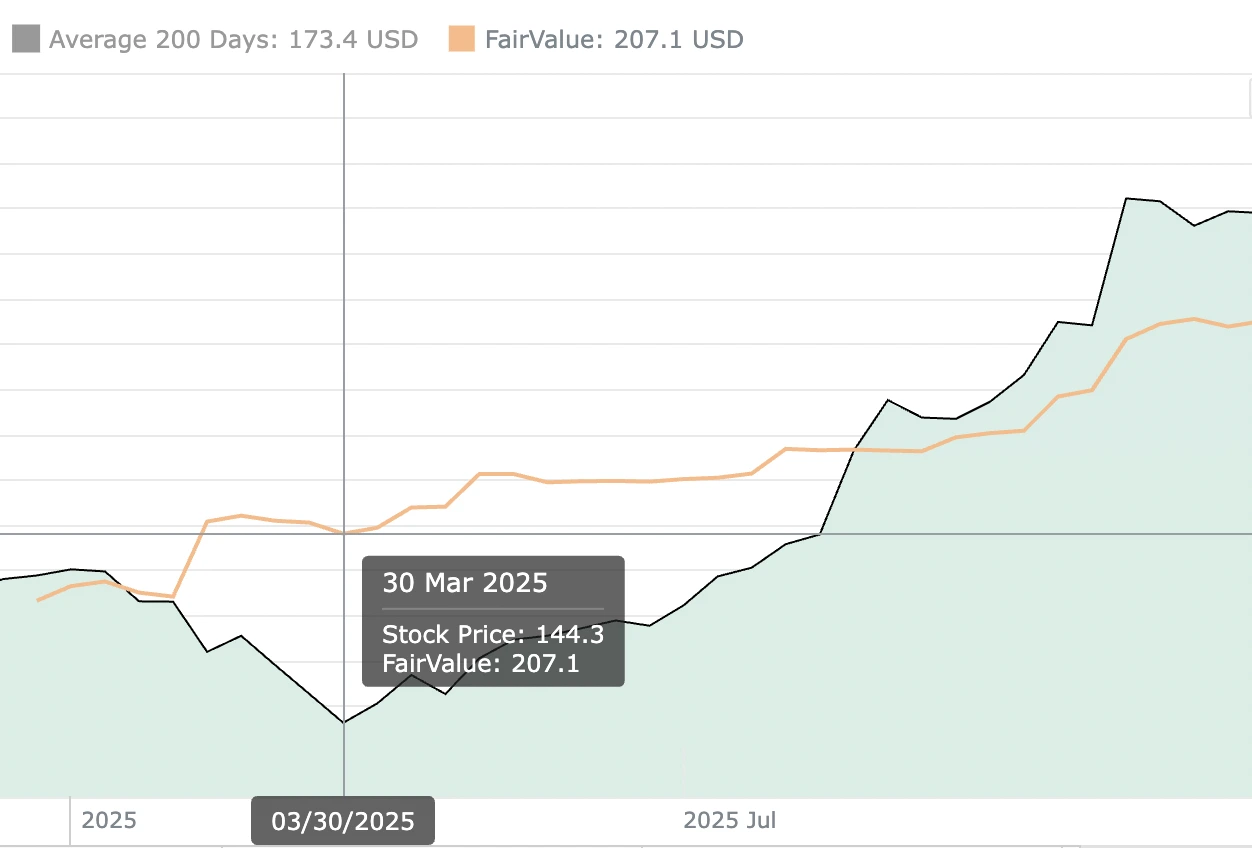

7. Tesla (TSLA) – Overvalued!

Tesla, Inc. is an American multinational automotive and clean energy company headquartered in Austin, Texas, which designs and manufactures electric vehicles (cars and trucks), stationary battery energy storage devices from home to grid-scale, solar panels and solar shingles, and related products and services. Its subsidiary Tesla Energy develops and is a major installer of photovoltaic systems in the United States and is one of the largest global suppliers of battery energy storage systems with 6.5 gigawatt-hours (GWh) installed in 2022. Tesla is one of the world’s most valuable companies and, as of 2023, is the world’s most valuable automaker.

Conclusion

While the Magnificent Seven stocks have undoubtedly been impressive performers over the past decade, their valuations have reached levels that raise concerns about potential overvaluation. Here are some factors contributing to the perception of overvaluation:

- Valuation Metrics: The Magnificent Seven stocks consistently trade at high multiples of earnings, sales, and other fundamental metrics. For instance, as of October 2023, their average P/E ratio stood at around 40, significantly higher than the overall market P/E ratio of around 15. These elevated valuations suggest that investors are pricing in substantial future growth expectations.

- Interest Rate Sensitivity: Technology stocks, including the Magnificent Seven, are generally considered to be more sensitive to interest rate fluctuations. As interest rates rise, the present value of future cash flows declines, making valuation multiples less attractive. Rising interest rates could put downward pressure on the valuations of these high-growth stocks.

- Economic Risks: The global economy faces various headwinds, including inflation, supply chain disruptions, and geopolitical tensions. These factors could impact the growth prospects of technology companies, potentially leading to valuation corrections.

- Competition and Innovation: The technology industry is highly competitive, with new entrants and innovative products constantly emerging. While the Magnificent Seven have established themselves as leaders, they face the risk of losing market share or being disrupted by new technologies.

- Sector Rotation: Investor sentiment can shift towards different sectors based on economic conditions and perceived opportunities. If investors favor other sectors, such as value stocks or cyclical industries, technology stocks could experience valuation declines.

It’s important to note that overvaluation is not always a predictor of future performance. High-growth companies can continue to outperform even when valuations are high if their growth expectations materialize. However, the elevated valuations of the Magnificent Seven stocks suggest that investors should carefully assess the risks before investing and be prepared for potential corrections.