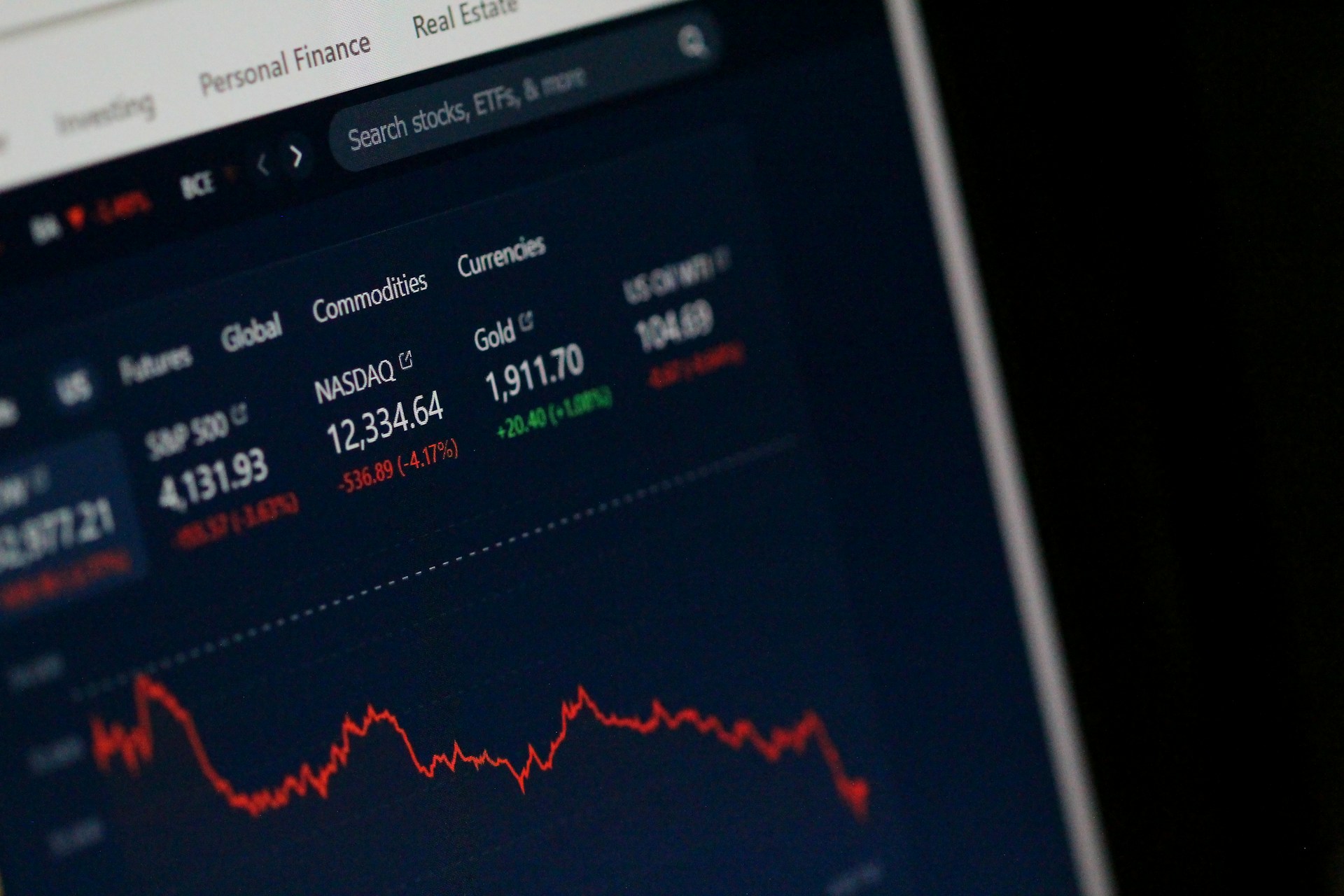

How to Use Free Fair Value Calculators to Outperform the Market

In today’s complex investment landscape, having access to professional-grade analysis tools can mean the difference between mediocre returns and market-beating performance. While institutional investors spend millions on sophisticated valuation software, individual investors can now access powerful free stock valuation calculator...

How Fair Value Investing Compares to Growth Investing in 2025

The investment landscape has dramatically evolved over the past few years, with shifting interest rates, technological disruption, and changing market dynamics forcing investors to reconsider their strategies. As we navigate through 2025, the debate between fair value investing vs growth...

Behavioral Finance and Its Impact on Asset Valuation

The traditional financial paradigm assumes market participants act rationally, processing information efficiently to arrive at accurate asset valuations. However, the field of behavioral finance challenges this assumption by examining how psychological biases and cognitive limitations influence financial decision-making. This article...

The Role of Fair Value in Real Estate Investments

In the complex world of real estate investing, understanding fair value is crucial for making informed decisions. Fair value assessment provides a foundation for evaluating properties, identifying opportunities, and managing investment risks. This article explores how fair value calculations can...

How Economic Indicators Influence Fair Value

The relationship between economic indicators and fair value calculations is fundamental to financial analysis and investment decision-making. This article explores how key macroeconomic metrics impact the determination of an asset’s fair value, providing insights into the complex interplay between economic...

Fair Value and Cryptocurrency: Evaluating Digital Assets

In the rapidly evolving digital finance landscape, cryptocurrencies have emerged as a transformative force that challenges traditional notions of value and valuation. Bitcoin, Ethereum, and other digital assets have disrupted conventional financial paradigms, presenting unprecedented opportunities and complex challenges for...

Fair Value and ESG

How to Integrate Sustainability into Your Investment Decisions In recent years, the investment landscape has undergone a significant transformation. No longer are financial metrics the sole determinants of a company’s worth or an investment’s potential. A new paradigm has emerged,...

Understanding Fair Value – What It Means for Investors

In the complex world of finance and investment, understanding the concept of fair value is crucial for making informed decisions. Fair value is a fundamental principle that helps investors, analysts, and financial professionals assess the true worth of assets, securities,...

How to Utilize a Fair Value Calculator to Determine the True Worth of Stocks

Investing in stocks can be a rewarding endeavor, but it also carries inherent risks. One of the biggest challenges for investors is determining the true worth or fair value of a stock before making an investment decision. Overpaying for a...

Value of Stock

A Key Metric for Smart Investing In the dynamic world of finance and investing, one concept stands out as a fundamental principle for valuing stocks: intrinsic value. This metric goes beyond the surface-level fluctuations of stock prices and dives deep...