The enigma of Warren Buffett’s immense wealth continues to fascinate financial enthusiasts and aspiring investors alike. While many attribute his success to a blend of uncanny intuition and strategic acumen, the reality is steeped in well-honed principles and calculated decisions. Known as the “Oracle of Omaha,” Buffett’s journey to becoming one of the world’s richest individuals is not a tale of overnight success but rather one of disciplined strategy and relentless pursuit of value. As we delve into the core question—why is Warren Buffett rich?—we uncover the intricate tapestry woven from his unique investment approaches, risk management techniques, and enduring philosophies.

Buffett’s path to wealth is a masterclass in understanding and leveraging value investing. From his early days, he demonstrated a remarkable propensity for identifying undervalued stocks and patiently nurturing his investments to fruition. His unwavering commitment to a few core principles, such as buying businesses he understands and evaluating them through intrinsic value, has been pivotal. This blog post will not only explore the mechanics behind Buffett’s financial triumphs but also offer insights into how you can apply these strategies. By examining Buffett’s methodologies and philosophies, and with resources like those available on fairvalue-calculator.com, your investing acumen could be poised for transformative growth.

Why is Warren Buffett so rich?

Warren Buffett’s extraordinary wealth stems from a lifetime of practicing and perfecting value investing. From the start, he focused on purchasing shares of solid businesses at prices below their intrinsic worth and then holding them for the long term. This buy-and-hold philosophy allowed compounding, the “eighth wonder of the world,” as Buffett calls it, to work its magic. By reinvesting dividends and capital gains year after year, he turned relatively modest initial investments into a fortune that surpasses most fortunes in history.

Buffett’s ability to identify undervalued companies relies on disciplined financial analysis and a deep understanding of business fundamentals. He assesses a company’s earnings power, cash flows, and competitive advantages, then compares those metrics to its market price. When a significant margin of safety exists, he commits capital. Over decades, the combination of disciplined selection, patient holding periods, and reinvestment of profits compounded into the multibillion-dollar empire behind Berkshire Hathaway. This singular focus on intrinsic value and compounding explains why is Warren Buffett rich, more than any single stock pick or speculative bet.

What is Warren Buffett’s investment strategy?

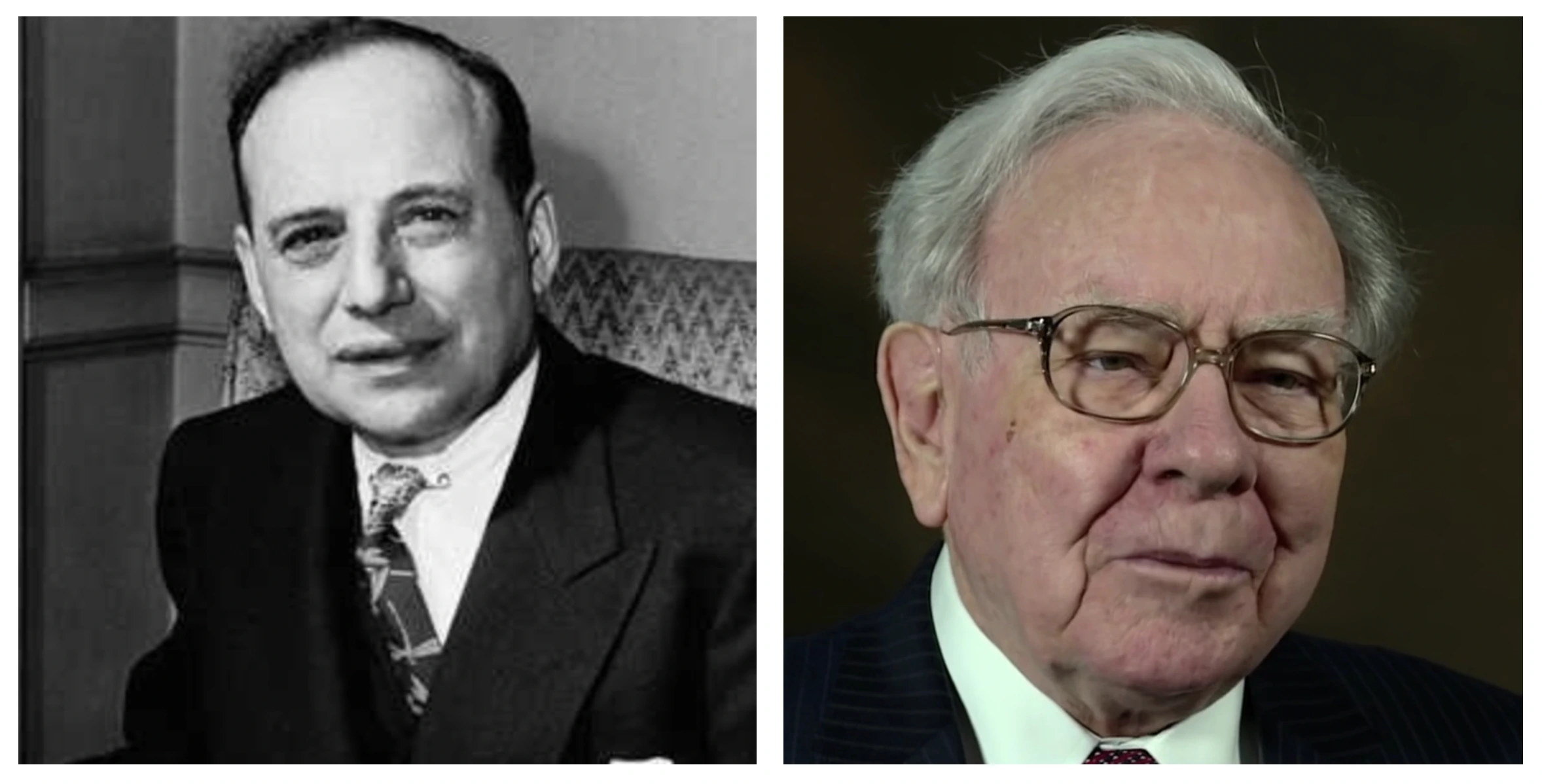

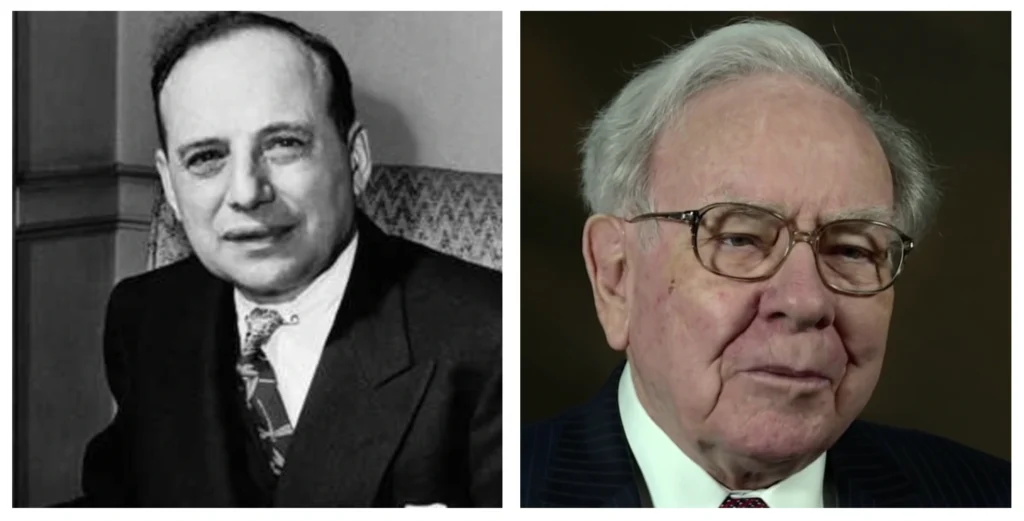

At the core of Buffett’s investment strategy lies the principle of value investing, originally formulated by Benjamin Graham. Buffett takes that foundation and adds his own stringent filters: he invests only in businesses he truly understands, those with durable competitive moats, strong management teams, and predictable cash flows. He then seeks to purchase these companies at prices that offer a comfortable margin of safety.

Beyond stock selection, Buffett’s strategy emphasizes patience and discipline. He resists market noise and short-term trends, preferring to hold high-quality businesses indefinitely. For those who want to emulate his methods, tools such as the Fair Value Calculator can help quantify intrinsic value and determine whether a stock is attractively priced. Meanwhile, the Investment Insights section on fairvalue-calculator.com provides in-depth analyses and case studies that mirror Buffett’s approach to assessing company health and long-term prospects.

How did Warren Buffett start his wealth-building journey?

Warren Buffett began building his wealth in his teens by delivering newspapers and selling used golf balls door to door. He made his first stock purchase at age 11 and filed his first tax return at 13. During college, he studied under Benjamin Graham at Columbia, internalizing the principles of value investing. After graduation, he worked at Graham’s firm, sharpening his analytical skills and leadership abilities.

In 1956, Buffett launched Buffett Partnership Ltd., pooling capital from family and friends. He applied strict value-investing tenets and paid himself a modest management fee. By 1962, his partnerships had amassed over $7 million and were outperforming the S&P 500 by wide margins. In 1965, he merged the partnerships into Berkshire Hathaway, transforming a failing textile mill into a diversified conglomerate. Throughout those formative years, Buffett reinvested his earnings and partnership profits back into the business, accelerating his wealth accumulation. Early adopters of Buffett’s approach can use the Premium Tools on fairvalue-calculator.com to analyze private and public investments with similar rigor.

Explore our most popular stock fair value calculators to find opportunities where the market price is lower than the true value.

- Peter Lynch Fair Value – Combines growth with valuation using the PEG ratio. A favorite among growth investors.

- Buffett Intrinsic Value Calculator – Based on Warren Buffett’s long-term DCF approach to determine business value.

- Buffett Fair Value Model – Simplified version of his logic with margin of safety baked in.

- Graham & Dodd Fair Value – Uses conservative earnings-based valuation from classic value investing theory.

- Intrinsic vs. Extrinsic Value – Learn the core difference between what a company’s really worth and what others pay.

- Intrinsic Value Calculator – A general tool to estimate the true value of a stock, based on earnings potential.

- Fama-French Model – For advanced users: Quantifies expected return using size, value and market risk.

- Discount Rate Calculator – Helps estimate the proper rate to use in any DCF-based valuation model.

How does Warren Buffett manage risk in his investments?

Contrary to popular belief, Buffett defines risk not as volatility but as the probability of permanent capital loss. To mitigate this risk, he focuses on businesses with strong balance sheets, predictable earnings, and robust free cash flow. He examines management integrity, avoids overleveraged companies, and steers clear of speculative ventures. This risk-averse mindset has shielded Berkshire Hathaway from severe drawdowns during market crises.

Another key risk-management tool in Buffett’s arsenal is diversification—but only so far as to avoid “diworsification.” He often concentrates large positions in his highest-conviction ideas while maintaining adequate diversification across industries. Additionally, he holds significant cash on the balance sheet, providing liquidity to act decisively when opportunities arise. Investors looking to adopt a similar framework can consult resources like the Fair Value Calculator and Investment Insights on fairvalue-calculator.com to stress-test portfolios under adverse market scenarios.

How does Warren Buffett’s wealth continue to grow over time?

Buffett’s wealth growth is powered by three compounding engines: reinvested earnings within portfolio companies, dividends from invested equities, and earnings retained by Berkshire Hathaway. He systematically allocates capital—either by reinvesting in existing businesses or acquiring new ones—so that every dollar works to generate future returns. This self-reinforcing cycle of earnings driving more earnings explains the exponential growth curve of his net worth.

Market fluctuations may cause short-term volatility, but Buffett maintains a long-term horizon that smooths out market noise. Whenever stock prices drop, he views it as an opportunity to deploy idle cash. His annual letters to shareholders reflect a consistent refrain: focus on intrinsic value, remain patient, and let compounding do its work. Over decades, even a modest annual return can morph into enormous wealth when compounded, illustrating why is Warren Buffett rich and why his fortunes keep escalating.

💡 Discover Powerful Investing Tools

Stop guessing – start investing with confidence. Our Fair Value Stock Calculators help you uncover hidden value in stocks using time-tested methods like Discounted Cash Flow (DCF), Benjamin Graham’s valuation principles, Peter Lynch’s PEG ratio, and our own AI-powered Super Fair Value formula. Designed for clarity, speed, and precision, these tools turn complex valuation models into simple, actionable insights – even for beginners.

Learn More About the Tools →What are the core principles that guide Buffett’s investment decisions?

Buffett’s investment philosophy rests on a handful of immutable principles: purchase businesses at prices below intrinsic value, emphasize quality and management integrity, maintain a margin of safety, and adopt a long-term perspective. He avoids ambiguous businesses and sectors he doesn’t understand, earning him the reputation of sticking to his “circle of competence.” Buffett also values capital preservation above chasing outsized returns, ensuring that potential losses don’t overshadow potential gains.

These principles extend to capital allocation decisions at Berkshire Hathaway. Whether buying back shares, paying dividends, or acquiring entire companies, Buffett asks: “Is this the best use of our capital?” This disciplined approach—supported by rigorous analysis and moral conviction—has consistently guided his decisions. To study these principles in depth, investors can explore the Investment Insights and utilize the Fair Value Calculator to replicate Buffett’s intrinsic valuation methods.

How can I learn from Warren Buffett’s investment philosophy?

Learning from Buffett begins with immersing yourself in his writings: his annual shareholder letters, biographies like “The Snowball,” and transcripts of interviews. Next, adopt his value-investing framework: calculate intrinsic value, demand a margin of safety, and invest with a long-term horizon. Use modern tools, such as the Fair Value Calculator, to perform discounted cash flow analyses and gauge whether a stock is trading below its true worth.

Beyond tools, cultivate Buffett’s mindset. Embrace patience, remain emotionally disciplined, and resist market noise. Join forums or subscribe to expert newsletters that echo his principles. For those seeking advanced features, the Premium Tools section on fairvalue-calculator.com offers proprietary models and screening capabilities designed to mirror Buffett’s rigorous approach. By combining timeless principles with modern resources, you can chart a path that follows in the footsteps of the Oracle of Omaha.

Conclusion: Decoding the Enigma of Warren Buffett’s Riches

Warren Buffett’s extraordinary wealth is the culmination of disciplined value investing, patient capital allocation, and unwavering adherence to core principles. His focus on intrinsic value, margin of safety, and long-term compounding has set him apart from peers and market fads.

By studying his methods, leveraging tools like the Fair Value Calculator, Investment Insights, and Premium Tools on fairvalue-calculator.com, aspiring investors can adopt Buffett’s timeless strategies. Ultimately, the question of why is Warren Buffett rich is answered not by luck but by a lifetime of disciplined, principled investing.