Stock valuation is a critical aspect of investment analysis that enables investors to assess the intrinsic value of a company’s shares. By employing various methods, investors can make more informed decisions regarding buying, selling, or holding stocks. We will delve into the three primary methods of stock valuation, shedding light on their mechanics and providing insights into their application.

Dividend Discount Model (DDM)

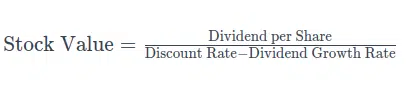

The Dividend Discount Model is a widely used method that focuses on estimating the present value of a stock based on its expected future dividends. This method assumes that a stock’s value is derived from the present value of all future cash flows in the form of dividends. The formula for DDM is as follows:

Investors utilizing DDM must carefully assess the company’s dividend history, growth prospects, and the appropriateness of the discount rate. DDM is particularly relevant for income-focused investors seeking stable returns through dividends.

Discounted Cash Flow (DCF) Analysis

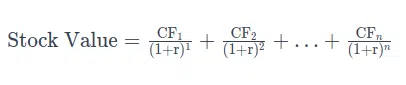

Discounted Cash Flow analysis is a comprehensive method that evaluates a company’s stock by estimating the present value of its future cash flows. Unlike DDM, DCF takes into account all forms of cash flows, including dividends, share buybacks, and debt repayments. The DCF formula is as follows:

Here, CF represents cash flows in each period, (r) is the discount rate, and (n) is the number of periods. DCF requires a meticulous analysis of a company’s financial statements, growth projections, and the determination of an appropriate discount rate. This method is valuable for investors seeking a holistic view of a company’s financial health.

Price-to-Earnings (P/E) Ratio

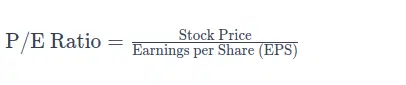

The Price-to-Earnings ratio is a relative valuation method that compares a company’s stock price to its earnings per share (EPS). This ratio is a quick and straightforward way to assess how the market values a company’s earnings. The formula for the P/E ratio is:

Investors often use the P/E ratio to compare a company’s valuation with industry peers or historical averages. A high P/E ratio may indicate the market’s expectation of strong future growth, while a low P/E ratio may suggest undervaluation or potential concerns. However, it’s essential to consider other factors alongside the P/E ratio for a comprehensive analysis.

In conclusion, the three methods of stock valuation—Dividend Discount Model, Discounted Cash Flow analysis, and Price-to-Earnings ratio—offer investors distinct perspectives for evaluating investment opportunities. Each method comes with its own set of assumptions, requirements, and considerations. Successful investors often combine these valuation methods and consider other qualitative factors to make well-informed decisions in the dynamic world of stock markets. By understanding and applying these valuation techniques, investors can enhance their ability to identify stocks that align with their investment goals and risk tolerance.

What is the Dividend Growth Model for stock valuation?

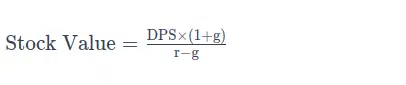

While the Dividend Discount Model (DDM) mentioned earlier focuses on estimating the present value of future dividends, the Dividend Growth Model (DGM) takes a step further by incorporating the expected growth rate of dividends. This method is particularly useful when evaluating stocks of companies with a consistent history of dividend growth. The formula for the Dividend Growth Model is as follows:

Here, DPS represents the dividend per share, r is the required rate of return, and g is the expected constant growth rate of dividends. The DGM assumes a perpetual growth rate in dividends, making it suitable for companies with a stable dividend payment history.

Understanding the components of the Dividend Growth Model:

- Dividend Per Share (DPS): This is the annual dividend payment made to shareholders divided by the total number of outstanding shares. It represents the cash flow returned to investors in the form of dividends.

- Required Rate of Return (r): Also known as the discount rate, r reflects the minimum rate of return an investor expects to compensate for the risk associated with the investment. It is influenced by factors such as prevailing interest rates, the company’s risk profile, and market conditions.

- Dividend Growth Rate (g): The growth rate of dividends is a crucial factor in the DGM. It represents the expected percentage increase in dividends over time. Companies with a track record of consistent dividend growth are often favored by investors seeking income and potential capital appreciation.

Application of the Dividend Growth Model:

- Stable Dividend Growth Companies: The DGM is most applicable to companies with a history of stable and predictable dividend growth. Investors looking for reliable income streams often find this model valuable for assessing the potential long-term value of such stocks.

- Comparative Analysis: The DGM allows investors to compare the intrinsic value of a stock with its market price. If the calculated intrinsic value is higher than the current market price, it may indicate that the stock is undervalued, presenting an opportunity for investors.

- Sensitivity Analysis: Investors can perform sensitivity analyses by adjusting the growth rate (g) and discount rate (r) to understand how changes in these factors impact the stock’s valuation. This helps in assessing the model’s sensitivity to different scenarios.

It’s important to note that the Dividend Growth Model, like other valuation methods, has its limitations. It assumes a constant growth rate, which may not hold true indefinitely. Additionally, market conditions and company-specific factors can influence the accuracy of the model’s predictions. Therefore, investors should use the DGM as one tool among many in their valuation toolkit and consider a holistic approach to stock analysis.

What are the limitations of the Dividend Growth Model

While the Dividend Growth Model (DGM) provides a systematic approach to valuing stocks based on expected dividend growth, it is crucial for investors to be aware of its limitations. Understanding these constraints can help investors make informed decisions and consider alternative valuation methods when necessary.

- Assumption of Constant Growth: One of the primary limitations of the DGM is its assumption of a constant growth rate (g) in perpetuity. In reality, very few companies can sustain a consistent growth rate over an extended period. Changes in the economic environment, industry dynamics, or company-specific challenges can disrupt the expected growth trajectory.

- Applicability to Non-Dividend Paying Companies: The DGM is designed for companies that pay dividends. For firms that do not distribute dividends, or have erratic dividend payment histories, the model may not be suitable. In such cases, alternative valuation methods like discounted cash flow (DCF) analysis may be more appropriate.

- Sensitivity to Input Parameters: The accuracy of the DGM is highly dependent on the accuracy of the input parameters, particularly the dividend growth rate (g) and the required rate of return (r). Small changes in these values can lead to significant variations in the calculated intrinsic value. Investors should exercise caution and conduct sensitivity analyses to understand how changes in these inputs impact the results.

- Neglect of Share Buybacks: The DGM focuses exclusively on dividends and does not consider share buybacks, which can also contribute to enhancing shareholder value. In modern financial markets, companies often repurchase their own shares as a means of returning value to shareholders. Ignoring this aspect can result in an incomplete valuation.

- Market Volatility and External Shocks: External factors such as economic downturns, geopolitical events, or industry disruptions can introduce volatility that may not be adequately captured by the DGM. As a model based on historical data and assumptions, the DGM may struggle to account for sudden and unforeseen changes in the market or a company’s circumstances.

- Appropriate for Mature Companies: The DGM is most suitable for mature, stable companies with a consistent dividend payment history. It may be less effective for assessing the value of growth-oriented or start-up companies that may not prioritize dividend payments in their early stages.

While the Dividend Growth Model is a valuable tool for certain types of investors and companies, it is not a one-size-fits-all solution. Investors should consider the specific characteristics of the company under evaluation and the prevailing market conditions. Combining the DGM with other valuation methods and qualitative analyses can provide a more comprehensive understanding of a stock’s intrinsic value and its investment potential.

What are the advantages of the Dividend Growth Model

While the Dividend Growth Model (DGM) has its limitations, it offers several advantages that make it a valuable tool for certain investors and situations. Understanding these advantages can help investors leverage the DGM effectively in their stock valuation processes.

- Simplicity and Ease of Use: The DGM is relatively straightforward and easy to use compared to more complex valuation models like Discounted Cash Flow (DCF) analysis. Its simplicity makes it accessible to a wide range of investors, including those with limited financial modeling expertise.

- Focus on Income Investors: For investors seeking a reliable income stream, the DGM is particularly useful. By emphasizing a company’s dividend payments and growth, the model aligns well with the goals of income-focused investors who prioritize regular and increasing dividend income.

- Long-Term Investment Perspective: The DGM is inherently geared towards assessing the long-term value of a stock. Investors with a buy-and-hold strategy, especially those looking for stable and growing income over an extended period, find the DGM’s emphasis on perpetual dividend growth beneficial.

- Useful for Dividend Aristocrats: Companies with a track record of consistently increasing dividends often referred to as “Dividend Aristocrats,” can be effectively evaluated using the DGM. This model aligns with the characteristics of these companies, making it a suitable tool for investors interested in such stocks.

- Valuation Benchmark: The DGM can serve as a benchmark for comparing a stock’s intrinsic value with its market price. If the calculated intrinsic value is higher than the current market price, it may signal that the stock is potentially undervalued, providing an opportunity for investors.

- Clear Link to Company Performance: The DGM’s focus on dividends directly ties the valuation of a stock to a company’s financial performance and ability to generate cash flows. This connection can provide investors with insights into the financial health and sustainability of a company’s operations.

- Historical Data Utilization: The DGM relies on historical dividend data, making it suitable for companies with a consistent dividend payment history. Investors can use this historical data as a basis for projecting future dividend growth, assuming that past performance is indicative of future trends.

DGM offers simplicity, a long-term perspective, and a clear link to a company’s financial performance, making it a valuable tool for certain types of investors. While its application may be limited to companies with stable dividend histories, income-focused investors and those seeking a straightforward valuation approach can benefit from incorporating the DGM into their investment analysis toolkit. As with any valuation model, it is essential for investors to consider the specific characteristics of the company and market conditions when using the DGM.