Graham Dodd Fair Value Calculator

The Graham Dodd Method in Fundamental Stock Analysis.

Top 10 Stocks: Graham Strategy

This list is updated daily by our Stock Screener Tool, covering more than 60,000 stocks worldwide. Discover this and many other Top-Lists inside the Fairvalue Calculator Premium Tool – try it now for free!

Get Even More Value!

- Try Premium for Free

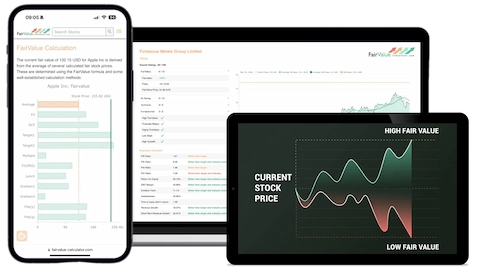

- Instantly discover the Fair Value for over 45,000 stocks – fully automated, zero effort.

- The Pro Tool for serious investors: Automated stock analysis using 10+ valuation models.

- A powerful algorithm combines AI and over ten valuation models to calculate an average Fair Value – based on DCF, Buffett, Graham, PEG ratio, Peter Lynch, multiples, P/B, P/S and more!

How to Use the Graham Dodd Fair Value Calculator

Calculate earnings per share (EPS) and sales growth with this calculator and get an estimate of the true value of the stock (fair value). Earnings per share and sales growth can be found via a Google search, in the annual report on the company’s website under “Investors Relations” or on relevant stock portals.

In our Premium Tools, a large number of different evaluation models are used and the required data is loaded automatically. Find the Graham Dodd Fair Value to more than 45.000 stocks worldwide.

Paste earnings per share (EPS) and expected growth into this Graham-Dodd Fair Value Calculator to estimate the intrinsic value of the stock using the classic Graham-Dodd valuation formula. Required data can be found via Google search, in the company’s annual reports under “Investor Relations,” or on popular financial portals.

- Enter the EPS (Earnings Per Share):

Input the company’s current or projected earnings per share. EPS reflects the net profit per outstanding share. - Enter the Expected Growth Rate (%):

Input the expected annual growth rate, based on revenue or earnings growth projections for the company. - Let the Calculator Work:

The tool applies the Graham-Dodd formula, using EPS and expected growth to calculate the estimated fair value. - View Your Result:

The result shows the Graham-Dodd Fair Value – helping you identify whether the stock is undervalued, fairly priced, or overvalued. - For Automated Valuations:

Use our Premium Tool to automatically calculate the Graham-Dodd Fair Value for over 45,000 global stocks – without manual data input.

Where to find EPS and Growth Data:

- Investor Relations reports on the company’s website

- Yahoo Finance

- Broker data platforms

- Or automatically via the Premium Tool

The Graham-Dodd Method of Stock Valuation

The Graham-Dodd method, also known as the Graham-Dodd valuation model, is a method for calculating the intrinsic value of a stock based on the principles of value investing. The method was developed by Benjamin Graham and David Dodd, two of the pioneers of value investing, and it’s based on the idea that a stock’s intrinsic value can be estimated by examining its financial statements and other fundamental data.

The Graham-Dodd method involves calculating the intrinsic value of a stock based on the company’s earnings power, its financial strength, and its growth potential. The method starts by estimating the company’s “normal” earnings power, which is based on its average earnings over a period of several years. This normal earnings figure is then adjusted for the company’s financial strength and growth prospects to arrive at an estimate of its intrinsic value.

The Graham-Dodd method is considered a classic approach to value investing and is widely recognized as an effective way to calculate the intrinsic value of a stock. However, like all valuation methods, it has its limitations and should not be used in isolation. It’s important to consider a variety of factors, including market conditions and industry trends when using the Graham-Dodd method to estimate the intrinsic value of a stock.

💬 Comment by Dr. Peter Klein, Founder of Fairvalue Calculator:

I’ve always been fascinated by the idea of finding a stock’s true value — not based on gut feeling or hype, but grounded in hard numbers. No one has influenced my thinking on this more than Benjamin Graham.

Graham wasn’t just a brilliant investor — he was the father of value investing and one of the first to build a systematic, rules-based approach to stock valuation. Together with David Dodd, he published the legendary book Security Analysis in 1934, which laid the foundation for modern fundamental investing. Warren Buffett later called it “the most important book of my life.”

What many people forget: Buffett was actually Graham’s student at Columbia University. So while Buffett may be the face of value investing today, its intellectual roots lie with Graham and Dodd. Their core idea still holds true: a company’s real worth often differs significantly from its stock price — and careful analysis of earnings, balance sheets, growth, and margin of safety can help uncover that difference.

Some call this approach “Old School Value” — and I agree, it's old-school, but timeless. Even though I now prefer more modern, tech-driven models supported by AI and real-time data, the fundamental principle hasn’t changed: the stock price is noise, value is the signal.

Without Graham and Dodd, the Fairvalue Calculator wouldn’t exist. Their legacy inspired me to turn theory into practice — to bring valuation out of textbooks and into an accessible tool for real-world investors. You could say I digitalized the tradition — with deep respect for the original minds behind it.

Some ideas never go out of style. Sometimes, the best way forward is to take a wise step back.

👉 Learn more about Fairvalue Calculator, our vision, and me.

Graham Dodd Fair Value to Determine Intrinsic Value.

The Graham Dodd Formula rates growth stocks by using the magic formula of two stock market legends! Benjamin Graham was the tutor of Warren Buffet and was the inventor of fundamental securities analysis. He created the basis for the value approach, which invests in stocks that are worth more than they currently cost.

For this purpose, Graham and Dodd presented a valuation method as early as 1962, which uses a formula to determine the approximate true value of a stock. Follow in the footsteps of stock market legends in this simple Graham Dodd calculator and try out the valuation approach from the 1962 book Security Analysis by Benjamin Graham and David L. Dodd.

Graham Dodd Valuation Formula:

Graham worked hard to develop a formula that would simplify stock valuation. He also presents his valuation formulas in Benjamin Graham’s classic book “The Intelligent Investor”. Graham calls fair value “intrinsic value”. Original Benjamin Graham Dodd Formula to calculate the intrinsic value of a stock:

Intrinsic Value = Earnings per Share * (8,5 + 2 Growth)

Earnings per share and growth can be read from the annual report of every stock corporation. In addition, there are stock exchange portals that clearly display this information. Earnings per share are the company’s profit divided by the number of shares issued.

For earnings per share, one can often find “estimates” online, that is, forecast earnings per share. These estimates can of course also flow into the input of this calculator. For growth, one should estimate profit growth and sales growth over the next 10 years. An average value from the past year is suitable for estimating the correct growth.

In this calculator, we use the further developed method in which the calculator uses three different formulas depending on how high the entered growth is:

- If growth is less than 5%: earnings per share * (8.5 + 2 growth)

- If growth of 5 to 10%: Earnings per share * 15

- If growth is greater than 15%: Earnings per share * growth

Depending on the input, one of the three formulas is selected in the background of the calculation, and the fair value is calculated.

Limitations and Critics:

Benjamin Graham placed the formula rather inconspicuously in his book “The Intelligent Investor” and also indicated that this formula is only an indication of the possible intrinsic value (fair value) of a stock. In addition, Graham neglects many other important factors that are important to the success of a company.

For this reason, we launched the Fair Value Calculator, which uses further developments and other online tools to determine the intrinsic value of stocks more precisely. In addition to the advanced manual calculators, which use 7 key figures instead of just 2 fundamental key figures, all evaluation models are clearly summarized in the premium area of the Fairvalue calculator.

With the premium tools of the Fair Value Calculator, you no longer have to search for the fundamental key figures yourself. The Premium Tools automatically load the fundamental key figures from the annual report into the formulas and clearly display the already calculated fair values in the database. You can then summarize these in a watchlist in your personal dashboard.

A stock screener and portfolio manager help you build a meaningful portfolio and tools to determine the intrinsic value of an entire industry and even the entire market are also available. All at a fair price.

Start your free trial now and enjoy more than 20 key financial ratios and valuation models to more than 35000 stocks worldwide.

FAQ: Graham-Dodd Fair Value

A classic, quick way to estimate intrinsic value from earnings, growth and a bond yield anchor—best used with modern checks and a margin of safety.

What is the Graham-Dodd fair value formula? ▾

V = EPS × (8.5 + 2g) × (4.4 / Y), where EPS is normalized earnings per share, g is expected growth (%), and Y is a reference bond yield.

We present it as a screening estimate—not a substitute for a full DCF.

Which inputs do I need for a clean estimate? ▾

- EPS: last twelve months, normalized (exclude one-offs).

- g: realistic 3–5 year growth assumption.

- Y: current benchmark yield (e.g., 10-year gov’t in reporting currency).

- Optional quality checks: margins, return on capital, leverage.

How should I choose the growth rate g? ▾

Which bond yield should I use for Y? ▾

Where does the method work well—and where not? ▾

- Works: steady earners with visible mid-cycle margins.

- Use caution: highly cyclical, negative EPS, heavy accounting noise or hyper-growth—prefer a DCF.

Common pitfalls to avoid with Graham-Dodd ▾

- Using peak EPS or unadjusted one-offs.

- Overly optimistic g for too many years.

- Mismatched currency/yield bases for Y.

- Ignoring balance sheet and quality metrics.

How do I set a Margin of Safety (MoS) here? ▾

Which cross-checks should I run before acting? ▾

How do market rates and sector cycles affect results? ▾

What if EPS is negative or erratic? ▾

What’s a practical workflow with this page? ▾

- Context: Review market and sector backdrop.

- Estimate: Compute Graham-Dodd fair value on this page.

- Cross-check: Run a DCF and EV multiples via the EV tool.

- Decide: Only act if MoS meets your risk standard; size in the Portfolio Manager.

Is this investment advice? ▾

Get Your Unlimited Access NOW!

100% Satisfaction - 0% Risk - Cancel Anytime.