Personal finance can be a daunting topic for many people

There are countless options and strategies out there, and it can be tough to figure out what is right for you. However, taking control of your personal finances is essential for securing your financial future. Here are some practical tips and advice on budgeting, investing, saving money, and reducing debt to help you improve your financial situation.

Budgeting

The first step to taking control of your personal finance is to create a budget. A budget is a plan that shows how you will spend your money over a period of time. It is important to track all of your expenses, including fixed costs like rent, utilities, and car payments, as well as variable costs like groceries and entertainment. Once you have a clear picture of your spending habits, you can make adjustments to ensure that you are living within your means.

Saving Money

Saving money is another important component of personal finance. There are many different ways to save money, from cutting back on unnecessary expenses to using coupons and shopping sales. One simple way to save money is to automate your savings. Set up a direct deposit from your paycheck into a savings account so that you are consistently saving money without even thinking about it.

Reducing Debt

Debt can be a major obstacle to achieving financial security and your personal financial situation. If you have high-interest debt, like credit card debt or personal loans, it is important to pay it off as quickly as possible. One strategy for reducing debt is the snowball method. With this method, you focus on paying off your smallest debt first and then use the money you were paying towards that debt to pay off the next smallest debt. This creates a snowball effect that helps you pay off your debts more quickly.

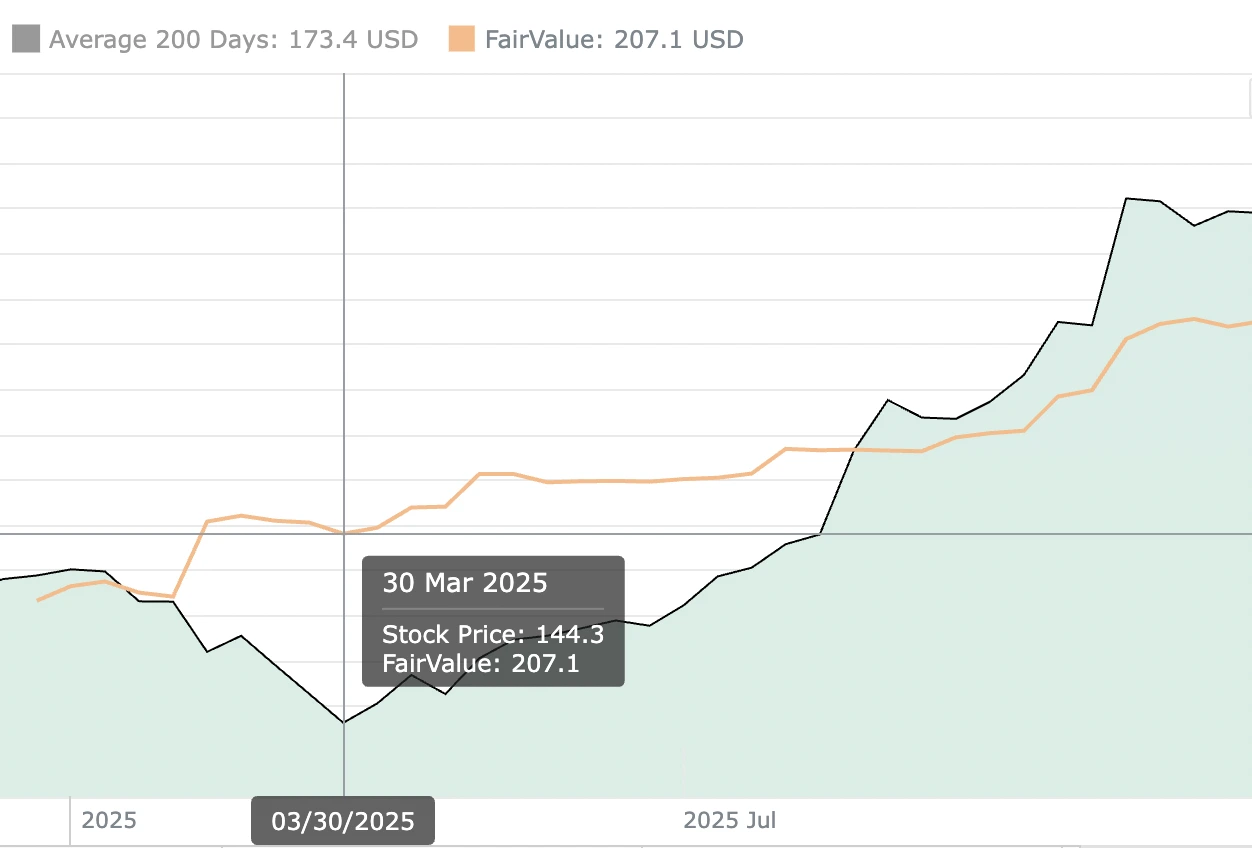

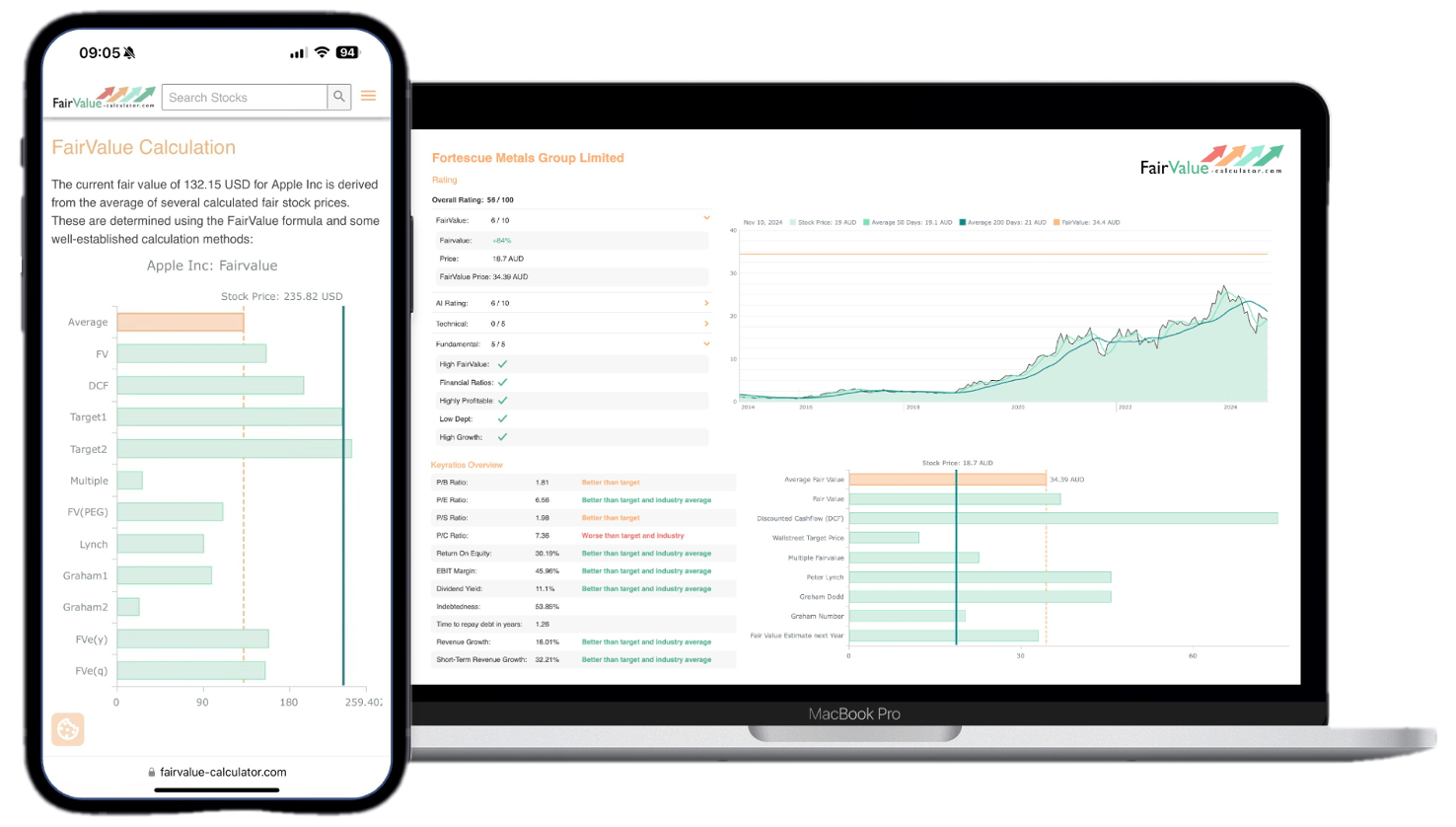

Explore our most popular stock fair value calculators to find opportunities where the market price is lower than the true value.

- Peter Lynch Fair Value – Combines growth with valuation using the PEG ratio. A favorite among growth investors.

- Buffett Intrinsic Value Calculator – Based on Warren Buffett’s long-term DCF approach to determine business value.

- Buffett Fair Value Model – Simplified version of his logic with margin of safety baked in.

- Graham & Dodd Fair Value – Uses conservative earnings-based valuation from classic value investing theory.

- Intrinsic vs. Extrinsic Value – Learn the core difference between what a company’s really worth and what others pay.

- Intrinsic Value Calculator – A general tool to estimate the true value of a stock, based on earnings potential.

- Fama-French Model – For advanced users: Quantifies expected return using size, value and market risk.

- Discount Rate Calculator – Helps estimate the proper rate to use in any DCF-based valuation model.

Investing

Investing is a powerful tool for growing your wealth and improving your personal finance over time. While saving money is important, simply keeping your money in a savings account may not be enough to achieve your long-term financial goals. Investing your money allows you to put your money to work and potentially earn a higher return than you would with a savings account. By investing, you can grow your wealth and achieve financial goals like buying a home, saving for retirement, or starting a business.

Investing can also help protect your finances from inflation. Over time, inflation erodes the purchasing power of your money. While savings accounts typically offer low-interest rates that may not keep pace with inflation, investing in assets like stocks, bonds, and real estate can potentially provide higher returns that keep up with or even exceed inflation. By investing, you can help ensure that your money maintains its value over time and continue to grow your wealth.

💡 Discover Powerful Investing Tools

Stop guessing – start investing with confidence. Our Fair Value Stock Calculators help you uncover hidden value in stocks using time-tested methods like Discounted Cash Flow (DCF), Benjamin Graham’s valuation principles, Peter Lynch’s PEG ratio, and our own AI-powered Super Fair Value formula. Designed for clarity, speed, and precision, these tools turn complex valuation models into simple, actionable insights – even for beginners.

Learn More About the Tools →Investing with Fairvalue-Calculator.com

At Fairvalue-Calculator.com, we provide premium tools to help you find the right stocks and investments for your portfolio. Our tools help you make informed investment decisions. By investing wisely, you can improve your financial situation and achieve your long-term financial goals.

In conclusion, taking control of your personal finances is essential for securing your financial future. By creating a budget, investing wisely, saving money, and reducing debt, you can improve your financial situation over time. And with the premium tools available at Fairvalue-Calculator.com, you can make informed investment decisions that help you achieve your financial goals.