While mathematical models and financial metrics provide the foundation for determining a stock’s fair value, the actual market price often tells a different story. The gap between calculated fair value and market price reveals one of investing’s most fascinating aspects: human psychology. Understanding the psychology of stock valuation can help investors make more rational decisions and identify opportunities when market sentiment diverges from fundamental value.

When Emotions Override Logic in Stock Valuation

The psychology of stock valuation operates on a simple premise: markets are driven by people, and people are inherently emotional. Even with access to sophisticated valuation tools and comprehensive financial data, investors frequently make decisions based on fear, greed, overconfidence, and social pressure rather than cold, hard numbers.

This emotional decision-making creates systematic patterns where stocks become persistently overvalued or undervalued relative to their calculated fair value. These mispricings don’t occur randomly, they follow predictable psychological patterns that savvy investors can learn to recognize and potentially exploit.

Explore our most popular stock fair value calculators to find opportunities where the market price is lower than the true value.

- Peter Lynch Fair Value – Combines growth with valuation using the PEG ratio. A favorite among growth investors.

- Buffett Intrinsic Value Calculator – Based on Warren Buffett’s long-term DCF approach to determine business value.

- Buffett Fair Value Model – Simplified version of his logic with margin of safety baked in.

- Graham & Dodd Fair Value – Uses conservative earnings-based valuation from classic value investing theory.

- Intrinsic vs. Extrinsic Value – Learn the core difference between what a company’s really worth and what others pay.

- Intrinsic Value Calculator – A general tool to estimate the true value of a stock, based on earnings potential.

- Fama-French Model – For advanced users: Quantifies expected return using size, value and market risk.

- Discount Rate Calculator – Helps estimate the proper rate to use in any DCF-based valuation model.

The Psychological Drivers of Overvalued Stocks

Euphoria and the Fear of Missing Out

Overvalued stocks psychology often centers around euphoria and FOMO (fear of missing out). When a stock or sector experiences rapid price appreciation, investors become increasingly optimistic, sometimes irrationally so. This optimism creates a feedback loop where rising prices attract more buyers, pushing prices even higher above fair value.

💡 Discover Powerful Investing Tools

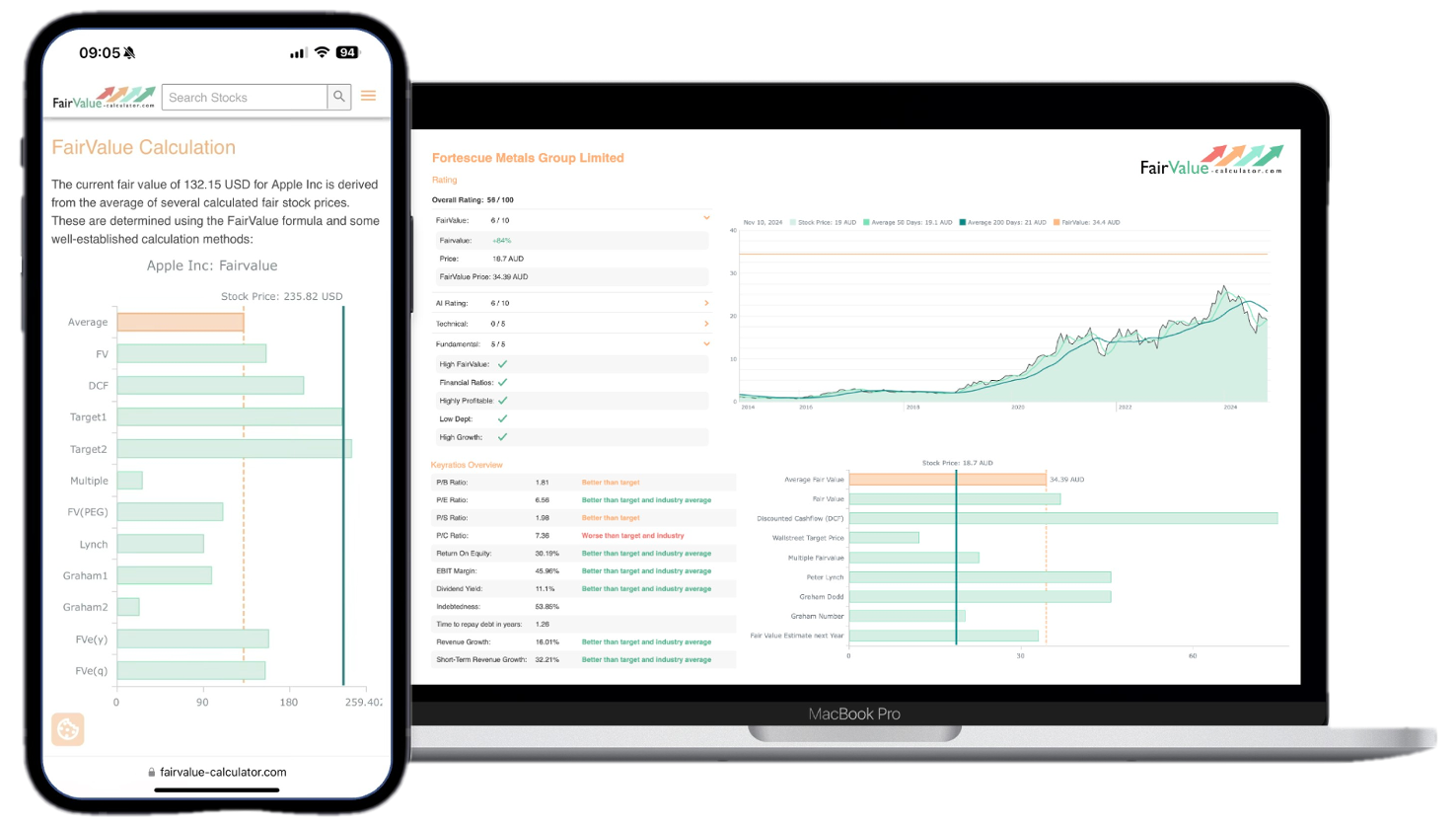

Stop guessing – start investing with confidence. Our Fair Value Stock Calculators help you uncover hidden value in stocks using time-tested methods like Discounted Cash Flow (DCF), Benjamin Graham’s valuation principles, Peter Lynch’s PEG ratio, and our own AI-powered Super Fair Value formula. Designed for clarity, speed, and precision, these tools turn complex valuation models into simple, actionable insights – even for beginners.

Learn More About the Tools →Tech stocks during the dot-com bubble exemplified this phenomenon. Companies with minimal revenue commanded astronomical valuations as investors projected unlimited growth potential. The psychology here involved extrapolating recent positive trends indefinitely into the future, ignoring fundamental valuation principles.

Confirmation Bias and Selective Information Processing

Investors holding overvalued stocks often fall victim to confirmation bias, seeking information that supports their optimistic view while dismissing negative data. They might focus obsessively on bullish analyst reports while ignoring concerning financial metrics or competitive threats.

This selective information processing creates an environment where market sentiment vs fair value can diverge dramatically. Investors become emotionally invested in their narrative about a stock’s potential, making it difficult to objectively assess whether the current price reflects realistic expectations.

Social Proof and Herd Mentality

The psychology of stock valuation is heavily influenced by social factors. When everyone seems to be buying a particular stock, individual investors often assume others possess superior information or insight. This herd mentality can drive prices well above fair value as investors prioritize fitting in over independent analysis.

Social media and financial news amplify this effect by creating echo chambers where bullish sentiment gets reinforced and amplified. The result is often speculative bubbles, where market prices lose all connection to underlying business fundamentals.

The Psychology Behind Undervalued Stocks

Fear and Pessimism Bias

While overvalued stocks are driven by excessive optimism, undervalued stocks often result from excessive pessimism. When negative news emerges about a company or sector, investors tend to extrapolate these problems indefinitely into the future, creating selling pressure that drives prices below fair value.

The psychology here involves loss aversion, the tendency for people to feel losses more acutely than equivalent gains. This makes investors more likely to sell at the first sign of trouble, even when the underlying business remains fundamentally sound.

Availability Heuristic and Recent Events Bias

Investors frequently overweight recent negative events when valuing stocks. If a company reports one disappointing quarter or faces a temporary setback, the availability heuristic causes investors to assume these problems are more significant and persistent than they actually are.

This creates opportunities for patient investors who can look past short-term volatility and focus on long-term fair value. While the market obsesses over recent bad news, rational analysis might reveal that the business fundamentals remain intact and the stock trades below its intrinsic worth.

Value Traps and Contrarian Psychology

Not all undervalued stocks represent good investment opportunities—some are “value traps” where low valuations reflect genuine business deterioration. The psychology of identifying true undervaluation versus value traps requires understanding why the market has abandoned a stock, and whether those reasons are temporary or permanent.

Successful contrarian investing requires strong emotional discipline to buy when others are selling and maintain conviction when market sentiment remains negative.

Market Sentiment vs Fair Value: Bridging the Gap

The Role of Time Horizon in Psychological Bias

Market sentiment vs fair value disparities often correlate with different time horizons. Short-term traders and momentum investors focus heavily on recent price action and sentiment indicators, while long-term value investors prioritize fundamental metrics and calculated fair values.

This creates a natural tension where short-term market movements may have little relationship to fair value, but long-term returns tend to converge toward intrinsic worth. Understanding this dynamic helps investors maintain perspective during periods when market sentiment overwhelms rational valuation.

Emotional Regulation and Decision-Making

The most successful investors develop emotional regulation skills that allow them to separate their feelings from their investment decisions. This involves recognizing when psychological biases might be influencing their judgment and developing systematic processes for evaluating opportunities.

Using quantitative fair value models serves as an emotional anchor, providing objective reference points when market sentiment creates extreme valuations. These tools help investors maintain discipline during both euphoric and panicked market conditions.

Practical Applications for Investors

Identifying Psychological Extremes

Smart investors learn to recognize when overvalued stocks psychology or undervaluation psychology reaches extreme levels. Some warning signs include:

For overvalued situations:

- Widespread media coverage promoting a stock or sector

- Valuations that require unrealistic growth assumptions

- Investor discussions focused on price momentum rather than business fundamentals

- New investors entering the market specifically to buy trendy stocks

For undervalued situations:

- Universal pessimism about a company’s prospects

- Selling pressure driven by forced liquidation rather than fundamental analysis

- Media coverage focused exclusively on negative aspects

- Good businesses trading at historically low multiples without clear justification

Developing a Systematic Approach

The psychology of stock valuation suggests that successful investing requires systematic approaches that minimize emotional decision-making. This might involve:

- Regular fair value calculations using consistent methodologies

- Pre-defined criteria for buying and selling decisions

- Diversification strategies that reduce the impact of individual psychological mistakes

- Periodic portfolio reviews focused on objective metrics rather than recent performance

Using Psychology as a Contrarian Indicator

Understanding market psychology allows investors to use sentiment as a contrarian indicator. When market sentiment vs fair value shows extreme divergence, it often signals potential opportunities for patient investors willing to bet against prevailing emotions.

This doesn’t mean automatically buying every unpopular stock or selling every popular one, but rather using psychological extremes as starting points for deeper fundamental analysis.

The Future of Behavioral Finance and Stock Valuation

As markets become increasingly efficient through technology and information flow, the psychology of stock valuation continues to evolve. Social media creates new channels for sentiment transmission, while algorithmic trading can amplify psychological patterns or create new ones.

However, the fundamental human emotions driving overvalued stocks psychology and undervaluation remain constant. Fear, greed, overconfidence, and social pressure will continue to create mispricings that patient, rational investors can potentially exploit.

Final Words

The psychology behind overvalued and undervalued stocks reveals that successful investing requires both analytical skills and emotional intelligence. While fair value calculations provide crucial objective anchors, understanding market psychology helps investors recognize when sentiment has pushed prices away from intrinsic worth.

The key insight is that market sentiment vs fair value disparities are not random occurrences but predictable outcomes of human psychology. By recognizing these patterns and maintaining emotional discipline, investors can make better decisions and potentially capitalize on the market’s psychological inefficiencies.

Remember that even with perfect understanding of market psychology, investing involves risks and uncertainties. The goal is not to eliminate all mistakes, but to improve decision-making by accounting for both rational analysis and emotional factors that drive market behavior.

Disclaimer: This article is for educational purposes only and should not be considered personalized investment advice. Always conduct your own research and consider consulting with financial professionals before making investment decisions.

website

Awesome! Its genuinely remarkable post, I have got much clear idea regarding from this post

website

I like the efforts you have put in this, regards for all the great content.

temp mail ninja

I do not even understand how I ended up here, but I assumed this publish used to be great