In the ever-fluctuating financial landscape, understanding how to adjust fair value for inflation and changing interest rates isn’t just beneficial; it’s crucial for making informed investment decisions. As economies oscillate and market conditions shift, so to do the values of investments and assets. This dynamic environment demands that investors and financial professionals possess not only a robust comprehension of current economic indicators, but also the agility to adapt valuation methodologies accordingly. Ignoring these adjustments could lead to misguided financial strategies and potential losses, emphasizing the importance of mastering this complex process.

Imagine navigating through the labyrinth of financial metrics without a reliable compass, this is precisely what happens when inflation and interest rate changes are overlooked in asset valuation. With mounting pressure to stay ahead in the competitive financial world, understanding the intricacies of how to adjust fair value for inflation and changes in interest rates becomes not just a skill but a necessity. This blog post will delve into the core principles and essential techniques for adapting fair value assessments, providing you with the insights needed to thrive amidst economic volatility. Join us as we explore strategies to safeguard and enhance your financial standing in an ever-evolving market.

Impact of Inflation on Asset Valuation

Inflation erodes purchasing power and alters future cash flows, making nominal values misleading if not adjusted. When inflation rises, the real value of asset-generated returns diminishes unless valuations incorporate inflation expectations. For example, if a bond pays fixed coupons, the real return falls as inflation accelerates. Investors who fail to adjust for inflation effectively overestimate their real returns and may choose suboptimal assets. Recognizing this distortion is the first step toward mastering how to adjust fair value for inflation.

Moreover, asset classes respond differently to inflationary pressures. Real assets like real estate or commodities often serve as inflation hedges, appreciating as the general price level increases. Conversely, financial assets with fixed cash flows suffer declines in real terms. Understanding these dynamics allows financial professionals to calibrate discount rates, adjust terminal values, and normalize historical data when performing discounted cash flow (DCF) analysis. Properly accounting for inflation ensures that asset valuations reflect true economic value rather than nominal figures that mask underlying risks.

Impact of Changing Interest Rates on Asset Values

Interest rate fluctuations affect the cost of capital, discount rates, and ultimately present values of future cash flows. When central banks raise rates, discount rates used in valuation models increase, reducing the present value of anticipated earnings. Conversely, lower rates decrease discount rates and inflate asset values. For fixed-income securities like bonds, the inverse relationship between yields and prices is well-known: rising yields depress bond prices and vice versa. However, the impact extends beyond bonds to equities, real estate, and alternative investments.

Equity valuations, for instance, rely on the risk-free rate as a component of the capital asset pricing model (CAPM). A higher risk-free rate raises the required return on equity, shrinking valuation multiples. In real estate, mortgage rate hikes can dampen property demand, suppressing prices. For companies keen on debt financing, increased borrowing costs compress profit margins. Consequently, incorporating a realistic assessment of how future rate shifts will unfold is vital. Understanding change in interest rates and their ripple effects underpins accurate fair value estimates and robust investment decision-making.

Importance of Adjusting Fair Value for Inflation

Adjusting fair value for inflation ensures that valuations reflect the true economic worth of assets, rather than distorted nominal figures. Inflation-adjusted valuations deliver more realistic projections of future cash flows, safeguarding against overvaluation in rising-price environments. Investors who grasp this importance can better compare historical performance by converting past financial data into constant dollars, enabling apples-to-apples comparisons across different time periods.

Moreover, inflation adjustment aligns valuation practices with regulatory standards and accounting frameworks that emphasize fair presentation. Auditors and regulators frequently require disclosures on how inflation impacts asset values, especially in hyperinflationary economies. By proactively incorporating inflation adjustments into valuation models, financial professionals meet compliance requirements, enhance transparency, and build investor confidence in the accuracy and reliability of reported values.

Explore our most popular stock fair value calculators to find opportunities where the market price is lower than the true value.

- Peter Lynch Fair Value – Combines growth with valuation using the PEG ratio. A favorite among growth investors.

- Buffett Intrinsic Value Calculator – Based on Warren Buffett’s long-term DCF approach to determine business value.

- Buffett Fair Value Model – Simplified version of his logic with margin of safety baked in.

- Graham & Dodd Fair Value – Uses conservative earnings-based valuation from classic value investing theory.

- Intrinsic vs. Extrinsic Value – Learn the core difference between what a company’s really worth and what others pay.

- Intrinsic Value Calculator – A general tool to estimate the true value of a stock, based on earnings potential.

- Fama-French Model – For advanced users: Quantifies expected return using size, value and market risk.

- Discount Rate Calculator – Helps estimate the proper rate to use in any DCF-based valuation model.

Techniques for Adjusting Fair Value for Inflation

Below are three widely used techniques for how to adjust fair value for inflation. Each technique offers a unique approach to normalize cash flows and discount rates, helping to maintain accuracy when price levels fluctuate.

These methods are central to inflation-adjusted valuations and should be selected based on data availability, asset type, and market context.

Significance of Adjusting Fair Value for Changing Rates

Adjusting fair value for changing interest rates is critical because rates influence both the opportunity cost of capital and the perceived risk premium. When interest rates shift, discount rates in valuation models must be recalibrated to reflect updated borrowing costs, risk-free benchmarks, and market yields. Failing to do so can result in valuations that either understate risk in rising-rate environments or overstate value when rates fall.

Moreover, interest rate adjustments enhance comparability across assets and time periods. Investors can evaluate projects and securities on a like-for-like basis by incorporating consistent rate assumptions. This practice also aligns valuations with economic reality, ensuring that strategic decisions—such as capital allocation, mergers and acquisitions, or asset disposals—are based on credible, up-to-date fair value estimates.

💡 Discover Powerful Investing Tools

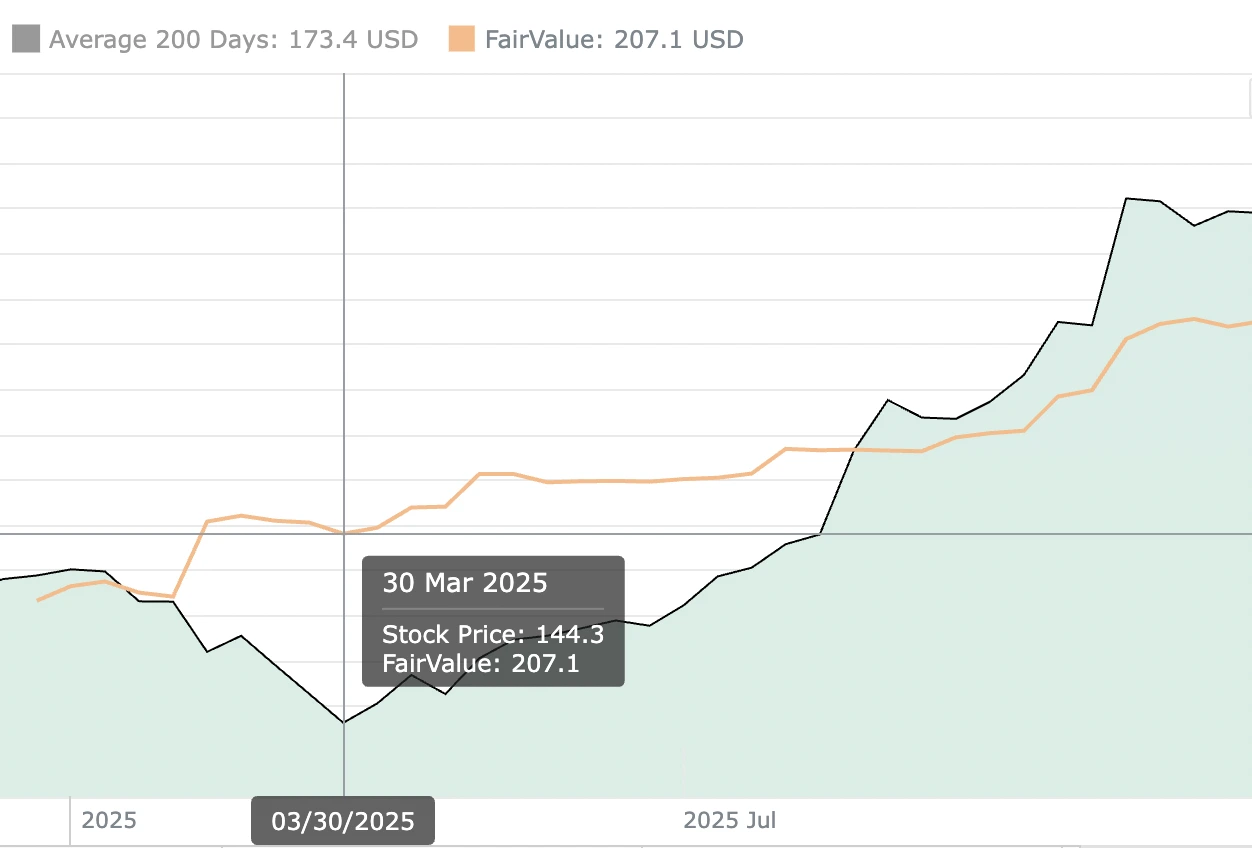

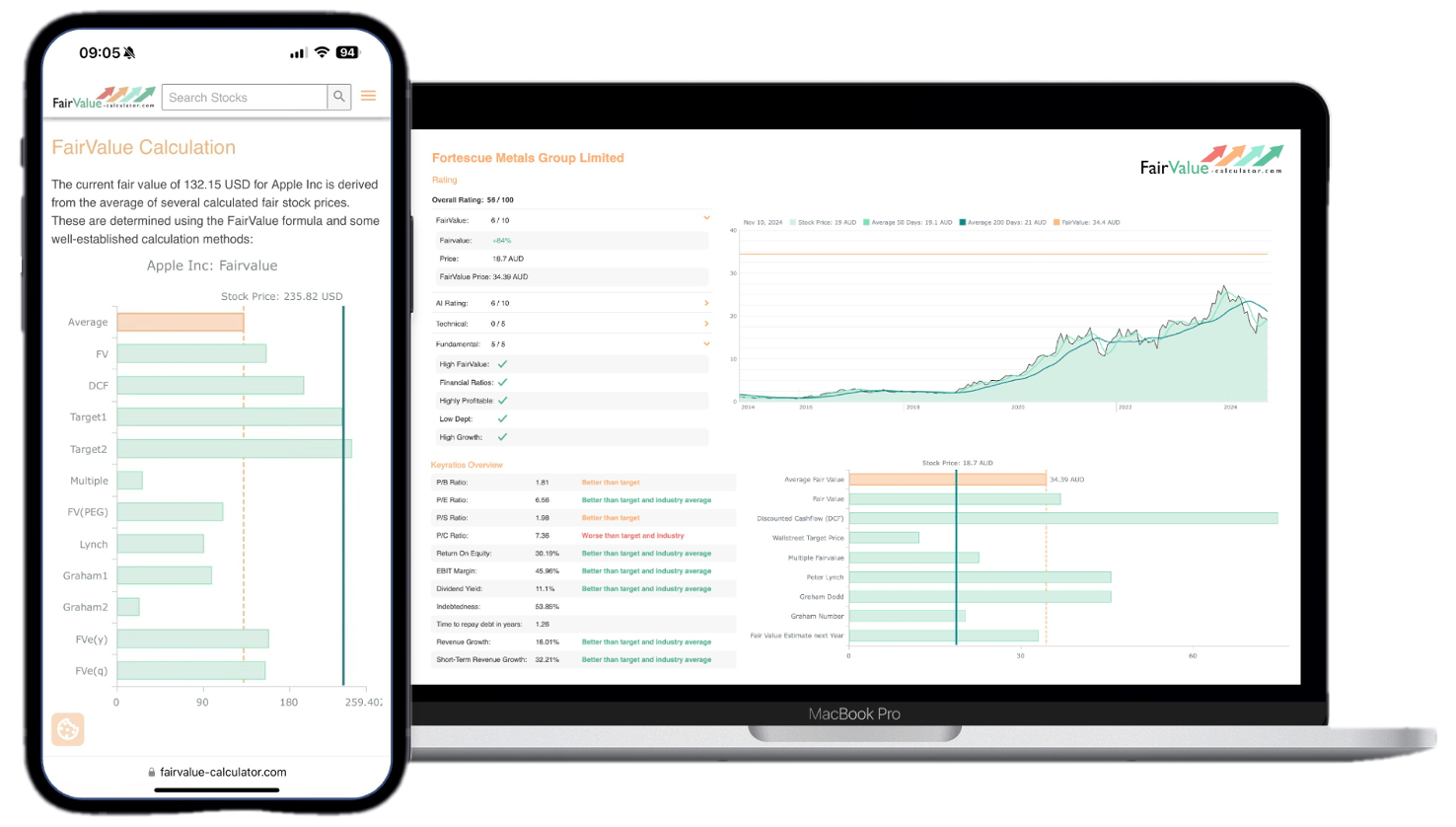

Stop guessing – start investing with confidence. Our Fair Value Stock Calculators help you uncover hidden value in stocks using time-tested methods like Discounted Cash Flow (DCF), Benjamin Graham’s valuation principles, Peter Lynch’s PEG ratio, and our own AI-powered Super Fair Value formula. Designed for clarity, speed, and precision, these tools turn complex valuation models into simple, actionable insights – even for beginners.

Learn More About the Tools →Methodologies for Adapting Fair Value for Changing Interest Rates

Below are three key methodologies illustrating how to adjust fair value in response to changing interest rates. Each offers a distinct lens for incorporating rate movements into valuation models.

Choosing the right methodology depends on the asset class, data availability, and desired level of precision.

Case Studies Demonstrating Adjusting Fair Value in Real Scenarios

Case Study 1: A manufacturing firm in a high-inflation economy used real DCF analysis to restate its five-year projections in constant currency. By subtracting forecasted inflation from nominal discount rates, it revealed that several long-term projects were underperforming once inflation was accounted for. This led leadership to reprioritize capital allocation toward shorter-term projects with quicker paybacks.

Case Study 2: A pension fund revalued its fixed-income portfolio after a sudden rate hike. Employing modified duration and convexity analysis, the fund estimated a 6% decline in bond values. This insight prompted a strategic shift into floating-rate notes and inflation-linked securities, reducing sensitivity to further rate increases and preserving portfolio stability.

Case Study 3: A real estate investment trust (REIT) revalued its property holdings using sector-specific cost indices rather than general CPI. This real asset revaluation captured construction cost inflation more accurately, leading to a 12% upward adjustment in asset values and a corresponding improvement in loan-to-value ratios—enhancing its borrowing capacity.

Best Practices for Mastering Fair Value Adjustments

1. Maintain Up-to-Date Economic Assumptions: Regularly update inflation forecasts, yield curves, and risk-free rates. Reliable, timely data ensure discount rates and cash flows reflect current conditions, reducing valuation errors.

2. Use Multiple Techniques: Apply at least two inflation-adjustment methods (e.g., real DCF and CPI indexing) or interest rate approaches (e.g., WACC updates and duration analysis). Cross-validation builds confidence in fair value estimates.

3. Document Methodology and Assumptions: Transparency in model inputs, data sources, and assumptions enhances credibility with auditors, regulators, and stakeholders, and facilitates future updates.

4. Stress-Test Valuations: Scenario analysis and sensitivity testing for inflation and interest rate shocks reveal valuation vulnerabilities, guiding risk management and strategic decision-making.

5. Leverage Technology: Valuation software and automation tools streamline model updates, reduce manual errors, and enable rapid recalibration when economic indicators shift.

Conclusion: Navigating Economic Volatility Through Informed Valuation

Mastering how to adjust fair value for inflation and change in interest rates empowers investors and financial professionals to make sound decisions amid economic uncertainty. By integrating rigorous techniques, such as real DCF, CPI indexing, duration analysis, and updated discount rates, valuations become more accurate and resilient.

Staying vigilant with up-to-date assumptions, diversifying methodologies, and stress-testing outcomes further ensures robust fair value assessments. In a world of shifting price levels and rate cycles, these practices serve as your compass, guiding you toward informed strategies and sustainable financial performance.

Understanding Fair Value in Financial Context

Fair value represents the price at which an asset could be exchanged between knowledgeable, willing parties in an arm’s-length transaction. It reflects current market conditions, including supply-demand dynamics, interest rates, risk perceptions, and expected cash flows. Unlike historical cost accounting, fair value aims to provide a real-time snapshot of an asset’s worth, offering investors and stakeholders a more transparent view of financial health.

In practice, fair value measurements leverage observable market data, such as quoted prices for identical assets, or employ valuation models when direct market information is unavailable. These models integrate assumptions about future performance, discount rates, and, crucially, adjustments for inflation and interest rate movements. Understanding fair value in financial context is foundational to analytics, reporting, and strategic decision-making, ensuring that balance sheets and performance metrics align with the evolving economic reality.