Nestled in the heart of financial history, Banca Monte dei Paschi di Siena stands as a testament to banking resilience and transformation, having operated since 1472. For savvy investors, the allure of a centuries-old institution navigating the modern market is undeniably captivating. This Banca Monte dei Paschi stock analysis delves deep into the intriguing potential that this venerable bank offers today. With predictions of a net profit reaching €1.95 billion in 2024 but dropping to €1.02 billion in 2025, and an impressive dividend yield forecasted at over 11% for 2025, MPS might just be the hidden gem value investors crave.

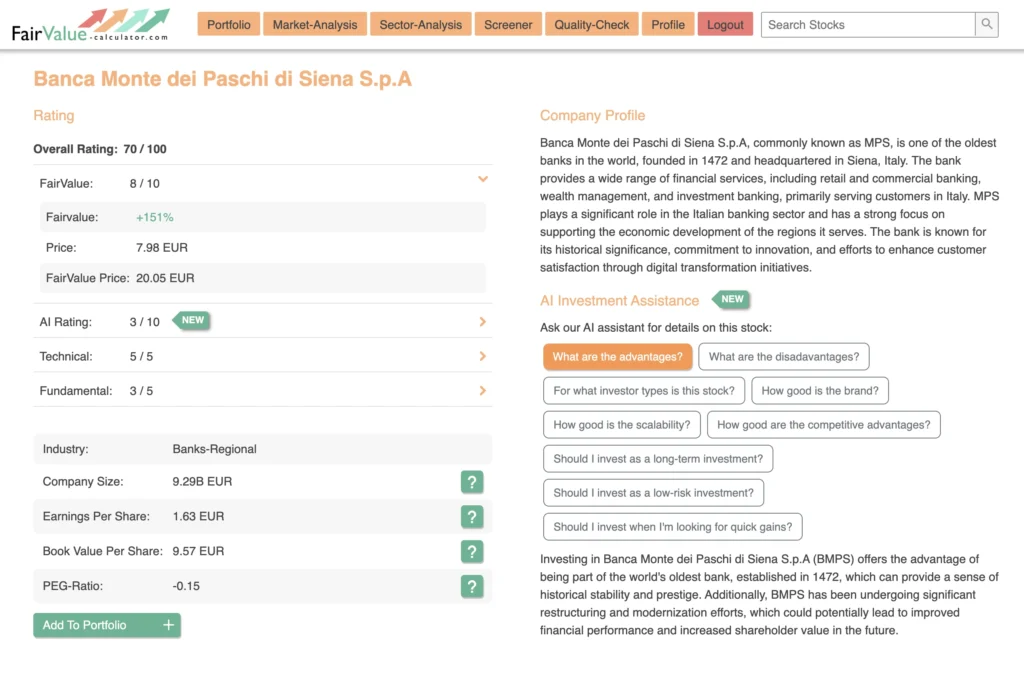

Beyond its rich history, MPS presents a compelling financial narrative under CEO Luigi Lovaglio’s strategic guidance, aiming for privatization and a critical acquisition of Mediobanca. Despite the risks such as substantial net debt and historical volatility, technical analyses show an encouraging uptrend since April 2025, supported by metrics like a Price-to-Earnings ratio forecast of 4.39 in 2024. With a Fair Value Calculator rating of 8/10, suggesting a 151% upside potential, investors are prompted to consider whether the current price of €7.98 undervalues a stock whose fair value could be €20.03. Explore how these factors combine to paint a promising picture that might invite you to reconsider the classic notion of value investing.

What is the oldest financial institution?

The oldest financial institution in continuous operation is Banca Monte dei Paschi di Siena, founded in 1472 in the Republic of Siena. Originally established as a mount of piety to offer low-interest loans to the poor, it evolved through centuries of Italian political upheaval, expansions, reorganizations, and technological revolutions. Few banks can claim such an uninterrupted lineage, making Monte Paschi an extraordinary case study in endurance and adaptation.

From its initial charitable mission, MPS has grown into a universal banking group covering retail, corporate, and investment banking. This Banca Monte dei Paschi stock analysis recognizes that its founding year—1472—places it ahead of other venerable institutions such as Berenberg Bank (1590) and Barclays (1690). Understanding its historic pedigree helps contextualize the bank’s strategic choices today, as management seeks to reconcile a centuries-old legacy with the rigors of modern financial markets.

Why are Italian banks in such a mess?

Italian banks have grappled with structural challenges for decades, including fragmented consolidation, political interference, and sluggish economic growth. Post-financial crisis, non-performing loans (NPLs) swelled to over €350 billion, weighing on capitalization ratios and investor confidence. Weak domestic demand and tightly controlled monetary policy by the European Central Bank further pressured margins.

Recent regulatory reforms and state-led bailouts have stabilized some players, but legacy issues persist. High operating costs, low digital adoption compared to peers, and regional political risk have kept profitability muted. Against this backdrop, any Banca Monte dei Paschi stock analysis must account for systemic risks: while MPS benefits from a long history, it also carries a disproportionate share of Italy’s banking system’s wounds, making prudent, data‐driven evaluation critical for value investors.

Explore our most popular stock fair value calculators to find opportunities where the market price is lower than the true value.

- Peter Lynch Fair Value – Combines growth with valuation using the PEG ratio. A favorite among growth investors.

- Buffett Intrinsic Value Calculator – Based on Warren Buffett’s long-term DCF approach to determine business value.

- Buffett Fair Value Model – Simplified version of his logic with margin of safety baked in.

- Graham & Dodd Fair Value – Uses conservative earnings-based valuation from classic value investing theory.

- Intrinsic vs. Extrinsic Value – Learn the core difference between what a company’s really worth and what others pay.

- Intrinsic Value Calculator – A general tool to estimate the true value of a stock, based on earnings potential.

- Fama-French Model – For advanced users: Quantifies expected return using size, value and market risk.

- Discount Rate Calculator – Helps estimate the proper rate to use in any DCF-based valuation model.

What is the best bank in Italy?

“Best” can be measured across various metrics, capital strength, profitability, customer satisfaction, digital leadership, or value creation. Currently, Intesa Sanpaolo and UniCredit lead in market capitalization, strong CET1 ratios (>15%), and diversified international footprints. Intesa Sanpaolo’s robust retail network and UniCredit’s Central Eastern Europe exposure offer balanced revenues and risk mitigants.

However, for dividend investors and value seekers, MPS stands out due to its historically low valuation and high projected yield. While it may not top the list in terms of asset quality or tech innovation, its turnaround potential under CEO Luigi Lovaglio and an anticipated dividend yield above 11% for 2025 could rank it among the most attractive for yield-focused portfolios, provided the bank navigates integration and debt reduction successfully.

Who owns Monte Paschi?

Banca Monte dei Paschi di Siena’s ownership has evolved significantly, from municipal foundations to state intervention. Following the 2017 bailout, the Italian government—via the “Mediocredito Centrale” and the Ministry of Economy and Finance—held a majority stake exceeding 64%. This majority position ensured stability during recapitalizations and NPL workouts.

Under CEO Luigi Lovaglio’s privatization mandate, the Treasury has gradually reduced its shareholding, positioning MPS to return to private investors. Key institutional investors include Italian banking foundations and a consortium of domestic pension funds. Retail ownership remains under 15%, while ECB approval of a projected Mediobanca acquisition could further dilute or reshape the shareholding structure, reinforcing private sector involvement.

💡 Discover Powerful Investing Tools

Stop guessing – start investing with confidence. Our Fair Value Stock Calculators help you uncover hidden value in stocks using time-tested methods like Discounted Cash Flow (DCF), Benjamin Graham’s valuation principles, Peter Lynch’s PEG ratio, and our own AI-powered Super Fair Value formula. Designed for clarity, speed, and precision, these tools turn complex valuation models into simple, actionable insights – even for beginners.

Learn More About the Tools →Historical Resilience: The Legacy of Banca Monte dei Paschi di Siena

Banca Monte dei Paschi di Siena’s 550+ year history illustrates resilience through wars, regime changes, financial crises, and regulatory overhauls. Founded to uplift marginalized borrowers, its mandate expanded to national development, financing infrastructure projects during the Renaissance and unification of Italy. Each era tested its ability to adapt, from funding military campaigns to weathering hyperinflation and global banking crises.

Despite recurring crises, Monte Paschi’s core strength lay in prudent risk management—until the NPL surge in the 2010s challenged that legacy. Today’s MPS balances tradition with transformation, leveraging its deep regional roots in Tuscany and a storied brand to rebuild stakeholder trust. For value investors reading a Banca Monte dei Paschi stock analysis, the lesson is clear: longevity can be an asset if paired with modern strategic execution.

Financial Performance Projections: Analyzing the Net Profit Forecast

Analysts project MPS’s net profit to reach €1.95 billion in 2024 before moderating to €1.02 billion in 2025. The sharp decline reflects one-off gains in 2024—asset disposals and restructuring benefits—versus normalized earnings in the subsequent year. This anticipated drop warrants scrutiny for sustainable earnings quality.

Key drivers include:

- Recurring net interest income stabilizing as lending volumes recover in 2025

- Fee income growth tied to digital banking initiatives and Mediobanca synergies

- Cost-to-income improvements from branch rationalization and AI-driven back-office efficiencies

Understanding these projections is pivotal in any Banca Monte dei Paschi stock analysis. While the 2025 forecast suggests lower profits, it may represent a more normalized baseline for evaluating long-term value, especially when contrasted with deeper upside potential highlighted by fair value metrics.

Dividend Yield Potential: Evaluating the Attractive % Forecast for

Investors focus keenly on yield, and MPS’s projected dividend of €0.86 per share for 2025 translates into an 11.73–12.58% yield at the current price of €7.98. This forecast underscores MPS as a high-yield candidate among European banks, outpacing peers whose yields typically range between 4% and 7%.

Key points to consider:

- Dividend per share: €0.86

- Yield range: 11.73–12.58%

- Historical payout ratio: 30–40% of net profit

While a double-digit yield is alluring, it also raises sustainability questions. Any robust Banca Monte dei Paschi stock analysis must weigh dividend commitments against capital preservation, regulatory buffers, and integration costs with Mediobanca. Nevertheless, this yield forecast remains a compelling draw for income-oriented investors.

Strategic Direction: Luigi Lovaglio’s Influence on MPS’s Modern Market Navigation

Since his appointment, CEO Luigi Lovaglio has pursued a bold roadmap: privatization, operational streamlining, and an ECB-sanctioned acquisition of Mediobanca. His strategy aligns with value investing principles—unlocking hidden assets, optimizing capital allocation, and enhancing fee-based services to diversify revenues beyond traditional lending.

Lovaglio’s key initiatives include:

- Privatization plan reducing state ownership from 64% toward a <50% threshold

- ECB-approved acquisition of Mediobanca to expand wealth management and corporate advisory

- Digital transformation to boost cross-sell ratios and lower cost-income

These moves reflect a forward-looking posture in a sector often criticized for inertia. For investors conducting a Banca Monte dei Paschi stock analysis, Lovaglio’s stewardship is a crucial factor in assessing whether MPS can transition from crisis management to sustainable value creation.

Risks and Challenges: Examining the Net Debt and Historical Volatility Factors

High leverage and volatility remain top concerns. MPS’s net debt stands at €8.7 billion, with an equity ratio of just 9.5%, below Europe’s 12–14% benchmark for universal banks. This debt load constrains flexibility for acquisitions, share buybacks, or increased dividends beyond the 2025 forecast.

Additional risk factors:

- Integration risk with Mediobanca leading to execution delays or culture clashes

- Macroeconomic sensitivity: Italian GDP growth lags Eurozone average

- Regulatory scrutiny from ECB stress tests and Basel IV capital rules

Historical share-price volatility underscores these challenges. A comprehensive Banca Monte dei Paschi stock analysis must model downside scenarios, factoring in credit costs, interest-rate shifts, and execution on strategic priorities.

Technical Analysis Insights: Tracking the Uptrend since April

Technically, MPS has trended higher since April 2025, consistently trading above its 50-, 100-, and 200-day moving averages. This reflects improving investor sentiment as strategic milestones were met—such as the initial Mediobanca deal approval and better-than-expected Q1 earnings.

Key technical markers:

- Relative Strength Index (RSI) hovering around 60–65, indicating bullish momentum without overextension

- Moving Average Convergence Divergence (MACD) positive crossover in late April

- Volume spikes on breakout days, suggesting institutional accumulation

For traders and short-term holders, these indicators validate a constructive trend. However, value investors should integrate technical signals within broader fundamental analysis to time entries around strategic catalysts and risk events.

Valuation Metrics: Understanding the Price-to-Earnings Ratio Forecast for

Banca Monte dei Paschi’s P/E ratio stands at 4.39 for 2024, rising to an estimated 6.50 in 2025. These multiples are among the lowest in Europe’s banking sector, where peers trade closer to 8–12. A low P/E can signal undervaluation or heightened risk; discerning between the two is essential.

Other valuation metrics:

- Price-to-book (P/B) ratio: 0.7, suggesting market value significantly below accounting book equity

- Cost of equity: estimated at 9–10%, yielding a P/E cap of ~10× for fair value modeling

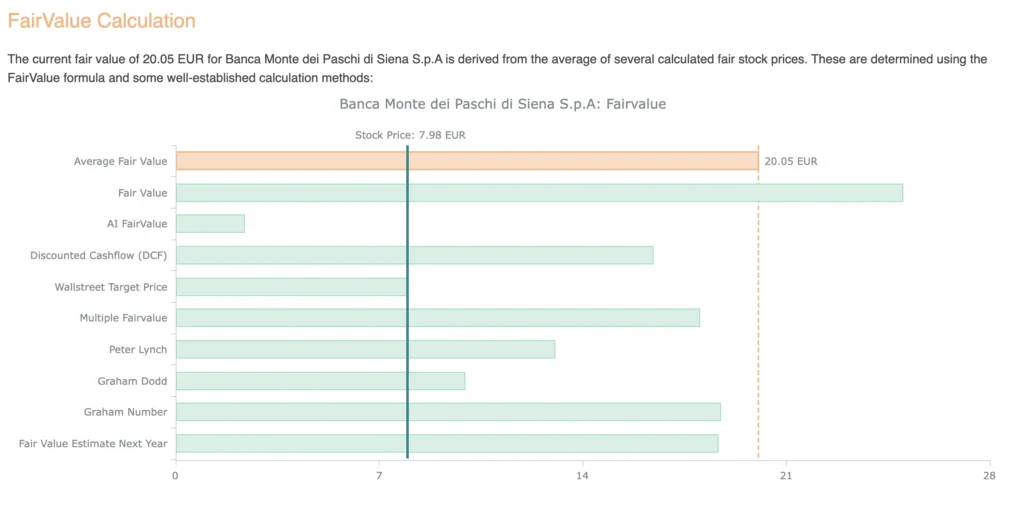

- Dividend discount model (DDM) implied fair price: €17–€21, aligning with the Fair Value Calculator’s €20.03 output

Any Banca Monte dei Paschi stock analysis must weigh these ratios against peers, considering Italy’s country risk premium. Yet, such low multiples underscore the potential reward for disciplined, long-term investors willing to tolerate near-term volatility.

Fair Value Assessment: Exploring the Rating and Upside Potential

Using a proprietary Fair Value Calculator, MPS scores an 8/10 rating. This translates into a fair value estimate of €20.03 per share versus the current market price of €7.98, implying a +151% upside potential. Inputs include normalized earnings, sustainable dividend projections, and tangible book value adjustments.

Highlights of the fair value assessment:

- Normalized EPS: €1.50 after removing one-off gains

- Sustainable dividend yield: 6–8% as a conservative pay-out assumption

- Discount rate: 9.5%, balancing cost of equity and Italian sovereign risk

This robust upside scenario positions MPS as one of the most undervalued banking stocks in Europe, making it a compelling target for value investors seeking deep-value plays in a sector ripe for consolidation.

Investment Considerations: Reassessing MPS’s Current Stock Price Against Fair Value

When comparing the current price (€7.98) to the fair value (€20.03), MPS appears deeply discounted. Key considerations before initiating a position include balance sheet repair progress, successful closing of the Mediobanca deal, and macroeconomic stability in Italy. A waterfall analysis also suggests multiple catalysts—dividend declarations, regulatory approvals, and further deleveraging—that could unlock shareholder value.

In summary, this Banca Monte dei Paschi stock analysis highlights a potent risk-reward profile: upside potential exceeding 150%, an 11–12% dividend yield, and low valuation multiples. However, investors must remain vigilant on execution risks, capital adequacy, and market sentiment. For those with a long-term horizon and a tolerance for sector-specific volatility, MPS could be a cornerstone of a value-oriented portfolio.

Conclusion

Banca Monte dei Paschi di Siena’s transformation from historic lender to modern turnaround story offers an exceptional case for disciplined value investors. With a projected dividend yield above 11%, a low P/E multiple, and a fair value upside of over 150%, MPS stands out amid Europe’s banking sector.

While risks such as high net debt, integration hurdles, and macro volatility persist, CEO Luigi Lovaglio’s strategy and encouraging technical trends support a cautiously optimistic outlook. Savvy investors seeking deep value would be well-served to incorporate this Banca Monte dei Paschi stock analysis into their due diligence.

See the full analysis and try the Fair Value Calculator, the ultimate tool to uncover undervalued stocks before the market does, in my bio or at fairvalue-calculator.com.