Prism of Fair Value Investing

When a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact” – Warren Buffett

The biggest success for a teacher is when the student surpasses their achievements. The next investor in our series on legends of value investing is one such student that learned from his master, Benjamin Graham, but tweaked and modified the principles to suit his style of investing and in doing so, surpassed the achievements of his teacher by a far margin.

The legend we are covering in part 2 of this series was one of the wealthiest people in the world, often placing the No.1 spot on the list of global billionaires. He started young, selling chewing gum, Coca Cola and magazines door to door for his first business. In a striking display of the genius that would make him the wealthiest man on the planet, this investor and his friend spent $25 to purchase a used pinball machine and placed it in the local barbershop. With the proceeds from this machine and some investments later, they had several machines in three different barber shops across his city, Omaha. The pinball machine business was later sold to a war veteran for $1,200, multiplying their initial investment 48 times. The investor, known as the Oracle of Omaha, is Warren Buffett.

Buffett displayed two distinct styles of investing covering two-time frames: management-oriented long-term investing and opportunity-oriented short-term investing. For most investors, it is often a choice between either of the two because the psychological and capital requirements for both styles differ significantly. However, Buffett with his partner, Charlie Munger, and the scale offered by the cash generated from his insurance business managed to achieve success in both and we shall see how their achievements and failures can help improve our investing.

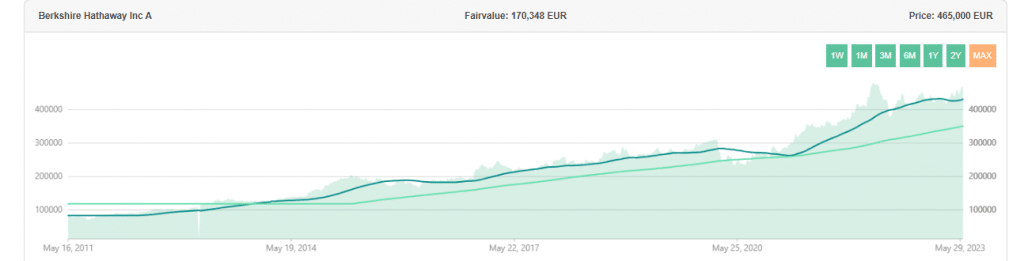

Almost all our readers and those who are investing have heard of Mr. Warren Buffett’s quotes and investments and the value of his flagship company, Berkshire Hathaway. In this series, we attempt to cover the basic principle behind some of his successful investments; principles that can help improve your value investing and with fair value calculator find the best stocks with potential.

Long-Term Management-Oriented Investing: My favorite holding period is forever

Buffett was a firm believer in the ownership concept of shareholding. He treated the share as proof of ownership of the business instead of a piece of paper and thus invested from the viewpoint of investing in the business as a whole which would have a high chance of doing well and then staying invested throughout for the long term or in his words; forever.

Buffett’s turn of fortune begins with an acquisition of a significant stake in GEICO (Government Employee Insurance Company) in the 1970s. Buffett had previously acquired a small stake in 1951 and sold it one year later. The company primarily sold auto insurance to government employees which it then later expanded to cover others as well.

The company did phenomenally well from its founding in the 1940s to the 1970s which is what led to the outsized gains in Benjamin Graham’s fortunes (Covered in the previous article which can be read here Hyperlink previous article here). However in the 70s, specifically in 1971, Nixon delinked the US Dollar from the gold standard. What followed was a decade of high inflation which in turn impacted the auto industry.

Market trends looked weak and auto insurance companies had to pay out higher and higher claims for accidents. Additionally, there was a regulatory cap on insurance premiums and states had to approve rate increases by insurers leading to a significant hit on profit margins. The stock price fell from $42 to $5 within the year.

Buffett cared deeply about his teacher and hero, Benjamin Graham who still held his largest position in GEICO shares. He also knew that the company had a phenomenal business model. Then GEICO got a new CEO. Buffett had his first brush with the dramatic change that can occur with good management. Jack Byrne the new CEO had a deep conversation with Buffett and Buffett was so impressed with that conversation that he immediately bought $4.1 million in shares.

Buffett then helped the company in raising outside capital and pledged to buy any outstanding shares from the offering. With the additional capital, the company managed to turn things around, made the business lean and efficient, and subsequently began outperforming others once again.

In 1995, Buffett made an offer to completely acquire GEICO and made it a fully owned subsidiary of Berkshire Hathaway. The biggest advantage of GEICO for Berkshire Hathaway was the float. Insurance companies collect premiums but don’t have to pay out claims on all the policies. The cash earned by the insurance companies is often invested in order to generate returns and help earn the money to pay out claims. Buffett made use of the free cash available from the insurance business to gain scale and make other similar long-term investments.

At 465.000 EUR per share, a share of Berkshire Hathaway is more expensive in absolute terms than a beachside house in most parts of the world.

Long Term Management Oriented Investing: Further successes

The taste of success in GEICO spurred Buffett to look at other opportunities for distressed companies with otherwise solid business models and excellent management. See’s Candies is one of the earliest such investments. Popular on the West Coast, Buffett mentions See’s at least once in his annual shareholder meetings. While extremely small in size as compared to Berkshire’s other investments, the company has returned 8000% since the investment in 1972.

In his shareholder letter of 1988, Buffett praises Chuck Huggins, the CEO of See’s Candies stating that they put him in charge 5 minutes after investing in the company. The company increased its profits tenfold under his reign as CEO. Today See’s Candies is a fully owned subsidiary of Berkshire Hathaway.

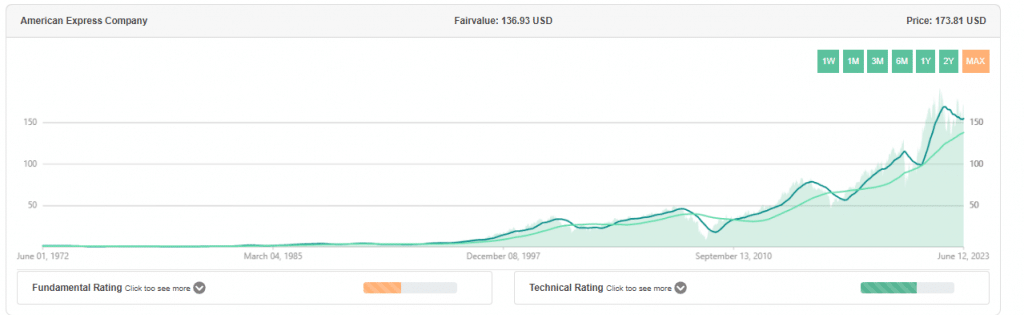

Another example of Buffett’s focus on the long term is its 20% ownership of American Express. American Express built a reputation for itself during the consumer credit growth phase of the American economy. It got caught in the “salad oil scandal” of Anthony De Angelis which led to a drop in share prices and which Buffett took full advantage of to acquire a 5% stake. This was a real demonstration of his principle of buying when others are fearful.

The subsequent credit card boom of the 70s and 80s made American Express the top player in the market and Buffett used this to increase his stake to 50 million shares which was at that time around 11.5% of total ownership. Subsequent buybacks by the company across the year increased his stake to 20%.

Buffett, like his mentor Graham, was a firm believer in companies paying dividends. However, he had a slightly nuanced approach to this philosophy. Graham believed that any spare cash not being utilized by the company must be returned back to the shareholders. Buffett believed that any spare cash not being utilized by the company must be put to use by the company first and if there is no possible utilization for the same, then must be returned back to the investors.

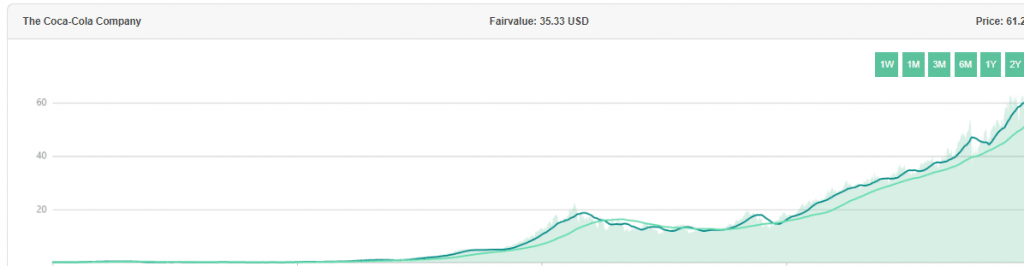

With this thought in mind, Buffett directed his attention toward Coca-Cola in 1987. The company shares had corrected significantly during the crash of 1987 and Buffett observed that the company fundamentals were pretty strong. It was still a market leader in beverages, absorbed all its competitors over the years, and paid a consistent dividend. It did not require cash to expand its operations and its business was not impacted by the stock market crash of 1987.

Buffett invested more than $1 billion in shares of the Coca-Cola Company in 1987. In 2022, Berkshire received $704 million in dividend income from Coca-Cola, almost 70% of its initial investment. Coca-Cola has paid a consistent dividend every year and has grown its dividend every year as well making this an amazing acquisition for Berkshire.

Opportunity Oriented Investing: Outsized gains in the short term

Buffett’s grip on opportunities was precise to a point and his long-term investments have proved that. Once the surplus cash exceeded his ability to deploy in long-term investment opportunities, he began to explore short-term distress opportunities as well. His two major short-term bets were the Goldman Sachs Bank and Bank of America just immediately after the Great Financial Crisis of 2008.

A small caveat for our readers, short-term does not mean 1 year or 3 years, or even 5 years. For an investor who is invested in most companies from the 70s and 80s, the short term is nothing less than a decade. Even then, from Buffett’s point of view, this is a short-term bet which helped it realize some outsized gains. In 2008, immediately post the crisis, Buffett invested $5 billion in Goldman Sachs in the form of preferred stock that paid a 10% dividend and some warrants that allowed it to buy common stock at a fixed price anytime in the coming five years.

Goldman Sachs recalled the preferred shares in 2011 paying a 10% premium on the initial amount i.e. $500 million and had paid $1.2 billion in dividends by that time. The warrants were renegotiated to give a smaller stake to Buffett for free which he then sold in 2020 to generate a net return of $3 billion dollars.

This similar chain of events occurred with Bank of America in 2011. Buffett keeps a huge surplus of cash and does not mind staying in cash until the right opportunity presents itself post which he goes all in on the deal.

Buffet’s Failures: Not investing in what you don’t understand

An astute investor, Buffett managed to string together significant successes to get his and the wealth of his investors to the level where they are right now. However, intertwined with this string of success are knots of failures that even an experienced investor like Buffett cannot escape.

Buffett’s biggest drawback has been his lack of investments in tech companies for a significant period of time. He did not participate in the rally leading up to the Dotcom Bubble in 2000 which in hindsight might look good but at that time led to lagging returns.

Even after the bubble burst, he still considered tech companies with skepticism leading him to miss out on some genuinely good companies like Apple. However, being the successful investor that he is, he learned from his failures and made course corrections soon after.

Buffett made his first tech investment of $11 billion in IBM in 2011 followed by an initial acquisition of Apple in 2016. Since then, Buffett’s investment in Apple has grown to $148 billion comprising roughly 40% of Berkshire’s stock holdings. He took the failure of missing out on tech and turned it on its head building his largest-ever position in tech. This pivoting skill is the mark of a successful investor.

Philosophy Caveat

Warren Buffett’s philosophy has not only led to him becoming one of the wealthiest people in the world but has also resulted in significant wealth creation for his investors in Berkshire Hathaway. However, a lot of his success can be attributed to scale, a scale that almost no small-value investor might possess.

A lot of his successful investments have been a result of strong negotiations and favorable deal terms leading to outsized gains which retail investors might not be able to participate in. There are a lot of bad investments that Buffett makes from time to time like the Conoco Philips deal where he lost $3 billion or the Dexter shoe co which cost another $3 billion. He keeps the losses low and his gains far outpace the losses which is a good principle to adopt but as a retail investor, most of us will not be making deals of size anytime soon.

Application in the real world

Buffett’s strategies rely completely on good management and entry opportunities. He is a long-term investor willing to wait for decades for his investments to realize value. As value investors, if we can accept the fact that wealth creation is a long-term game, we will have won half the battle.

Guess at what age did Buffett become a billionaire? For a successful investor like him, you would place a guess at 40 or 50. Buffett became a billionaire for the first time in 1990, at the age of 60. It takes a long time for compounding to work and one must have the patience to stick with their investments in the long term (as long as the company is financially sound and has a robust business model. If your investment is like Enron, best say goodbye to it right away).

As value investors, we must stay focused on companies with good management and then wait patiently for the company or the markets as a whole to enter a distressed scenario. No harm in waiting in cash till then. The outsized returns generated from entering during distress scenarios will make up for the waiting period in cash.

One can read up on company management via their annual reports and 10k. What is the management promising?

- What is their vision?

- Have they made any progress on the promises made last year?

- Do they have criminal cases against them?

- Have they been accused of fraud?

Identify management that has demonstrated a successful track record and that has avoided any of the above questions. Once that is done, now we wait for the company price to drop below fair value.

How do you realize when the company is trading below fair value? That is where the fair value calculator comes in. We help you find the best stocks with potential and market trends to make value investing easier with risk management.

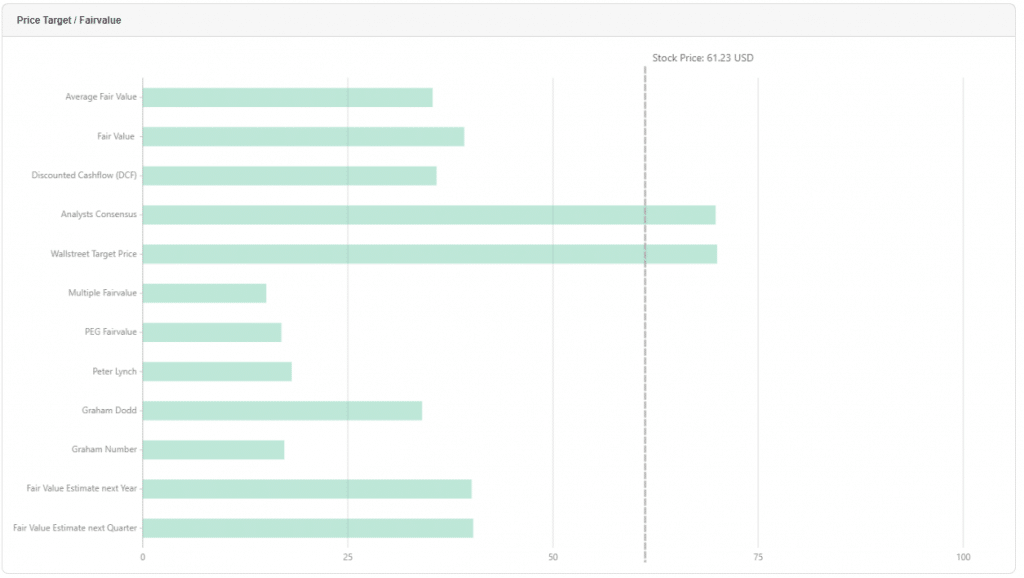

The fair value calculator uses various methods to calculate the fair value and posts a consolidated picture of the same along with the last traded price. Refer screenshot below

This is Coca-Cola, one of Buffett’s favorite companies (He makes sure he has a can of coke in each meeting he makes in public and has often claimed that he drinks cans of coke).

As fair value calculator shows, Coca-Cola is trading at a price that is far above its fair value on most parameters. As a user, do you know what is the fair value for Coca Cola? One can take an average of all fair values to arrive at a value as well. There is no single absolutely correct way of finding success in the markets. Take your pick but the fact remains that the current price remains above fair value in most scenarios.

As an investor, one must wait patiently for the price to correct below its fair value before investing. This might happen over a decade, or it might happen tomorrow. One must be prepared and ready for action but until the call to action comes, stay patient.

Alternatively, we at fair value calculator can help you out a little. While you wait for your shortlisted companies to come to fair value, instead of waiting in cash, deploy your money in other stocks trading below fair value.

Fair value investing

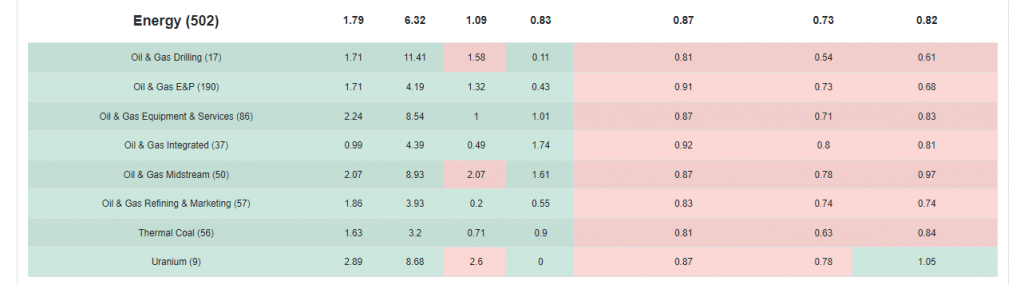

As a premium user, you my dear investor can access the sector analysis tab on the website.

This gives you a brief highlight of sectors currently trading below fair value. Clicking on a sector that you understand will give you a list of companies that are trading below fair value. Pick the largest and begin from there. Read up on the management. Satisfy all the questions we have asked above and once you shortlist a management style that you like, invest in the same.

Fair value calculator will also track your portfolio for you and will inform you if the stock you have invested in has reached its fair value or exceeds its fair value which will be your signal to exit and move to better opportunities. This takes care of your risk management aspect as well.

Last Words

Investing is a marathon. Value Investing is an even longer one. There are outsized returns to be made, but a price in the form of time is to be paid. At fair value calculator, we can help you minimize the wastage of time, but the patience has to come from you, my dear investor.

The core principles of Buffett’s investment strategies are sound so while you may not have his scale, you have something which he doesn’t have, size and execution ability. Buffett has now grown to such a size that he cannot find good investment opportunities anymore. He has $130 billion in cash and very few companies or opportunities can handle that much cash.

As a retail investor on the other hand, you can be nimble and quick, a small fish feeding amongst the sharks and the sharks will be unable to do anything to you. As long as you are patient and have done your research on management, success is just a matter of time.

In the next part of this series, we look at a legend that managed to combine growth elements in his value investing strategy, making the best of both worlds and consequently making a lot of money for his investors. His flagship fund was the best-performing mutual fund over 13 years during his tenure, He was also responsible for encouraging investors to not be afraid of professionals but instead, get one up on Wall Street and there was a strong chance of retail investors of beating the street. So stay tuned for the next entry in the series. Until then, join our premium membership and figure out some value bets of your own.