Prism of Fair Value Investing

“The key to making money in stocks is not to get scared out of them” –Peter Lynch

In the latest Stock market news, Coca-Cola is the most consumed soft drink in the world. Imagine if you could go back in time and invest in the company just as it was taking its roots. Our mind moves along similar lines when we bite into that McDonald’s burger or Domino’s pizza when we drive that new Ford, consume entertainment on that Netflix subscription, or play on that new PlayStation by Sony. If only we could get such stock market tips to find such best stocks.

Most long-time investors often have these thoughts when trying out a certain product. The excellent quality and top-notch service offered by the company often prompt a certain section of investors to begin looking at that company as a potential investment prospect. Our next investing legend made this activity into, well, a legend, and he not only did this for himself but for millions of investors in his flagship mutual fund, the Fidelity Magellan.

Credited with inventing one of the most popular valuation ratios, The PEG ratio that combines growth with value investing, this legend has not only generated consistent returns of 29.2% annually in the 13 years that he ran the mutual fund, but he has also authored books teaching amateurs and pros alike on how to beat the street. Emerging during a challenging period for the American economy, his investing style transformed how people viewed stocks: as a legitimate business and not as lottery tickets. His invention of the term “multi-bagger” and the slogan “Buy what you know” has ensured that his popularity becomes a multi-bagger too. That legendary investor, who helped investors show one up on Wall Street, is none other than Peter Lynch.

Buy What You Know

The philosophy is simple. Invest in companies whose business you understand. That’s it. No frills. No decorations. No large thesis and summaries to explain your investment. As a small investor juggling a job and a family and with limited time to conduct investment research, this single line can outline your investment success.

This was best demonstrated by Peter Lynch himself. Invest in ideas that you can explain in 90 seconds. Even better, invest in ideas that you can illustrate with a crayon. This idea, by default, eliminates complex businesses and sectors that you as an investor, cannot understand. The simplest example would be Domino’s.

Everybody loves pizza. Domino’s is often the go-to place for most people to consume pizza. It has a significant international footprint. As it makes its foray into unexplored territories in Africa and South America, it is obvious that it will sell more pizza which in turn would lead to more profits and thus appreciation in stock price. It is a simple business model and one with promising growth.

However, does this mean, one should buy the stock right away? The answer is no. Peter Lynch like Warren Buffett, believed in paying below value. In fact, he created the philosophy that combined growth investing with value investing to get the best of both worlds.

Growth At Reasonable Price (GARP):

This philosophy from Lynch, created at a time when inflation was high but the economy was still growing combines the best of growth and value investing, to ensure that investors manage to capture returns from fast-growing stocks by investing in them at a fair value. This led to the creation of the Price/ Earnings to Growth Ratio, i.e. the PEG ratio.

The PEG ratio, as the name suggests is the stock’s Price to Earnings or PE ratio divided by the growth rate of its earnings over a specified time period. Ideally, the simplest way to do it would be to divide the historical PE or current PE by the historical annualized growth rate. For e.g., if the PE of a company is 10 and it has grown its earnings at 10% annually over the last five years, its PEG ratio is 1.

This is a broad philosophy and you as investors are then left to decide and choose on what time frame you would consider growth for and which PE you would take. At fairvalue calculator, we compute using forward-looking growth values built from analyst consensus as markets are often forward-looking and we would want to ensure that our valuation reflects that.

Lynch believed that companies with a PEG ratio of less than 1 were undervalued and worth investing in, provided they met other fundamental criteria (which we shall highlight subsequently with examples) and companies with a PEG ratio of more than 1 were overvalued and avoided until their price or earnings corrected. One can refer to earnings reports for that or leave it to fair value calculator for market trends, portfolio management, and financial data.

Lynch’s Success:

Peter Lynch applied both the Buy What You Know and Growth At Reasonable Price together to analyze small companies with immense growth potential that would then multiply in stock price. You read it correctly. He was not looking for 10, 20, or 50% appreciation; he was not even looking for 100% appreciation. He was looking for a stock where the price would appreciate multifold. 10 times was his favorite number. Peter Lynch is credited with coining the term multi-bagger but what he always preferred was ten-bagger, a stock whose price has increased by 10 times.

One of his earliest successes was Dunkin’ Donuts. We all love our morning coffee, don’t we? Lynch loves it too. As a starting point for most of his successful investments, Lynch has found more reliability in local knowledge than in reading up on it in magazines. Lynch was extremely impressed with Dunkin’ Donuts’ coffee.

Assuming others would love its coffee as well; he then studied up on company financials and visited other outlets of the company. He found all locations in Boston, where Lynch worked to be always busy. After ensuring that company financials were in place, he then invested in Dunkin’ Donuts which turned out to be one of his most successful investments. He also regrets selling the company early, claiming it would have been a fifty-bagger. He identified the best stocks with potential, checked company financials, financial data, and market trends, and then with adequate risk management, loaded up.

Another of its success was brought to his notice by his wife. Hanes, a clothing brand was trying out a new product called L’eggs, a brand of pantyhose packed in the shape of an egg. His wife brought a sample home and after wearing them began praising and raving about it. L’eggs stole market share from inexpensive, drugstore competitors, prompting Lynch to make it a sizeable position in his fund. The stock eventually went up by 30 times before being acquired by Consolidated Foods. Magellan fund holders benefited significantly from this acquisition.

Lynch’s Failures

Like all successful investors, Lynch’s stellar investing career is also lined with small pockets of underperformance and failure. One of his failures, which happened decades after he retired from Fidelity but was managing other trusts, was not investing in Apple.

Like Buffett, Lynch chose to stay away from tech stocks because they would not be easy to understand or explain as well as fit within the traditional as well as new parameters. Lynch even mentions in an interview that his daughter bought the iPod for $250 and he understood that Apple was making very high margins on it but he still did not invest in it.

Lynch’s investment strategies also had a peculiar style to it that might not be called a failure but a quirk of its time. Lynch was a firm believer in diversification which is in quite a contrast to what a lot of other successful investors believe in which is concentration. In fact, Buffett once famously quoted that diversification was protection against insurance.

By the time Lynch retired from Fidelity in 1990, the fund had grown from $18 million in assets to $14 billion, a hundred bagger here as well. However, the most striking aspect of the fund was that it held more than 1,000 individual stock positions.

Now, anyone who has invested knows how unwieldy the investment portfolio becomes once the number of positions goes up. There are two aspects of this strategy that must be brought to notice here.

Lynch’s strategy involved investing in small companies that had the potential to grow. A lot of his investments were concentrated in small-cap companies. Again, for investors, a small-cap company by its nature is small in size. It does not have enough shares available to invest or trade in and mutual funds often face regulations regarding the maximum holding they can have in a single security.

Small company investments coupled with a large size AUM meant that Lynch had to invest in several hundreds of companies at one go in order to generate the returns that he did. This required an intense work schedule which in turn took a toll on his health and family life prompting his early retirement in 1990. For our interested readers, Lynch worked for 12-14 hours, 6 days a week, and had begun working on Sunday mornings as well near the end of his career at Fidelity.

As small investors, we might not have to undergo these extreme situations, but it serves as a lesson for us to ensure that our investments are sized properly and that we are adequately diversified in case we have a larger size.

Philosophy Caveat:

Lynch’s strategy was a function of his time. Facing an inflationary environment coupled with a growing domestic economy, he found a way to mix growth and value investing. However post the great financial crisis, the economy has been in a low-interest rate environment, leading to growth stocks outperforming and value investing taking a backseat.

This has resulted in a lot of high-performance companies having PEG greater than 1 because the growth estimates would not take into account 100% growth in earnings, making the stock look overvalued currently but undervalued in hindsight. However, before you decide that this strategy is dead, we are now back in an inflationary environment where interest rates are high and value investing seems to be making a comeback. It would be a good time to revisit this strategy and the fair value calculator will help you do just that.

Application in the real world:

It is as simple as it sounds. There is nothing much to it. Pay attention to all the products you buy, the services you use, and the stuff you consume. Is there something that stands out, something that you go to again and again? Forget established names. Think smaller, local. Is there a store that is always busy? A food chain that has hours of waiting but which serves delicious food that makes the waiting worth it. Is there a cosmetic brand that feels wonderful on the skin? Where it is difficult to find fresh inventory and any new product is sold out immediately?

Once you have the answers to all these questions, check out if the company is publicly listed. It is quite possible that the company is still small and has not issued shares to the public. In that case, one can keep the company on their radar and wait for it to become publicly traded. Occasionally, one may get an opportunity to invest in an unlisted company when insiders look to exit and one can make use of that, but for most investors, it is better to wait for the company to become public and then invest.

Once you ascertain that the company is public, head over to fairvalue investing and we will do the needful for you.

Fairvalue investing

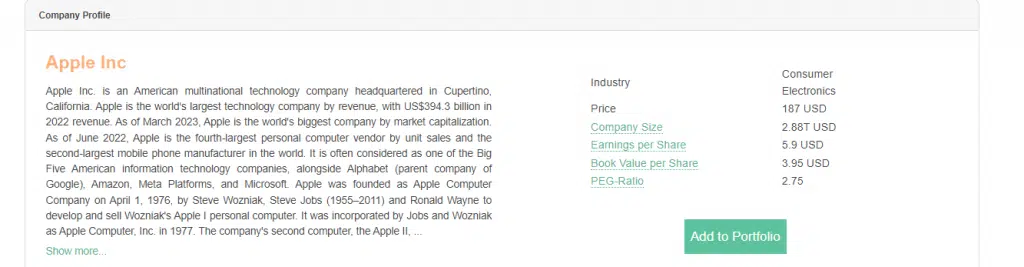

At fairvalue calculator, we have data on 30,000+ stocks listed across the world with automatic financial analysis. As our premium user, all you have to do is search for the listed company and you will find all the information you need. Here is a snapshot of one of the most famous giants in the world, Apple.

The company profile also provides you with the PEG ratio which for Apple is 2.75 making it highly overvalued. One can also view a consensus of other fair value estimates to see if the stock is trading at fair value or not.

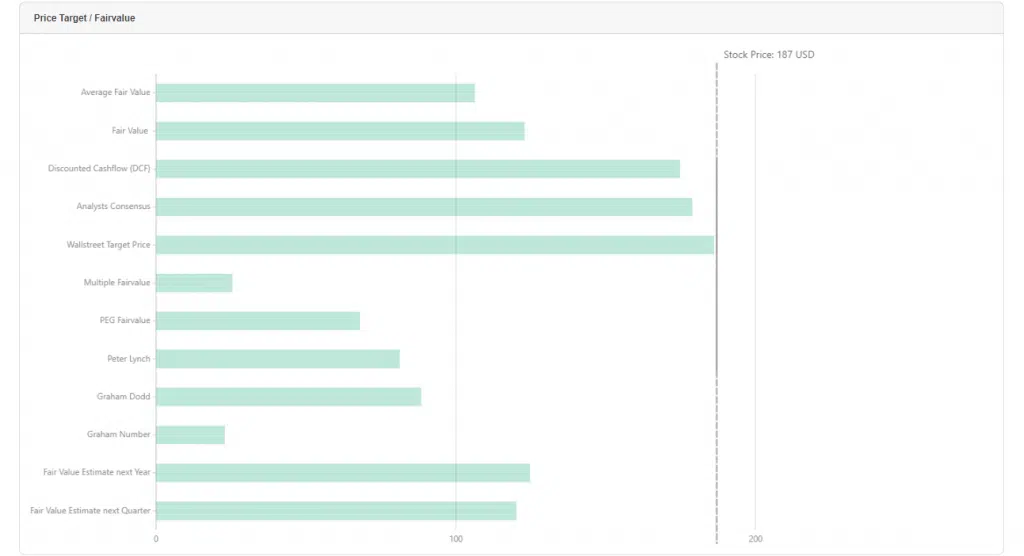

In the above chart for Apple, we have fair value basis for the PEG ratio, given in the chart as Peter Lynch. If the stock price trades below Peter Lynch’s number, it is undervalued otherwise its overvalued.

So what happens if the company you like is overvalued? You can wait for its growth numbers to correct or for a revision in its price-to-earnings ratio or earnings numbers to improve.

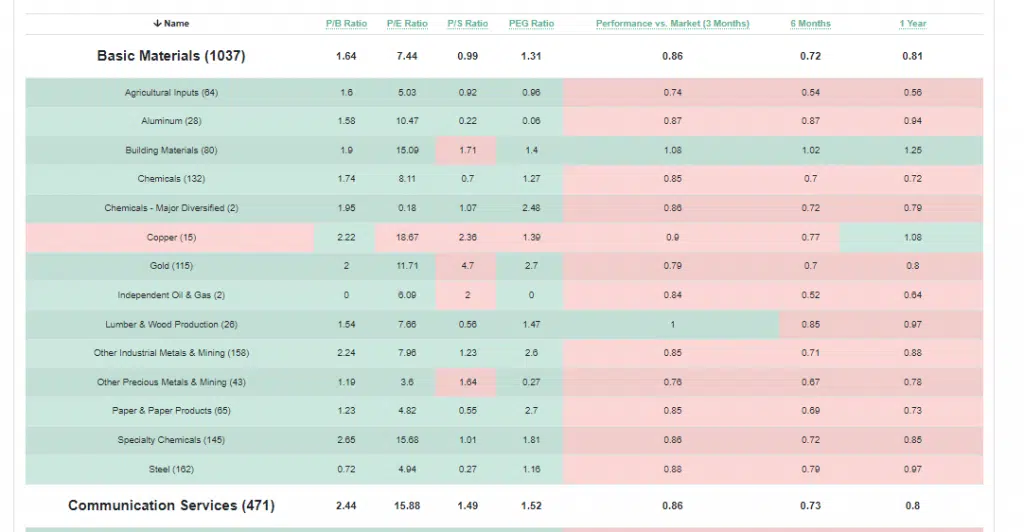

Alternatively, you can visit our sector analysis stock screener and simply look for stocks that are trading below a PEG ratio of < 1

You can find each sector with their PEG ratios and on clicking a sector can get details of companies in that sector.

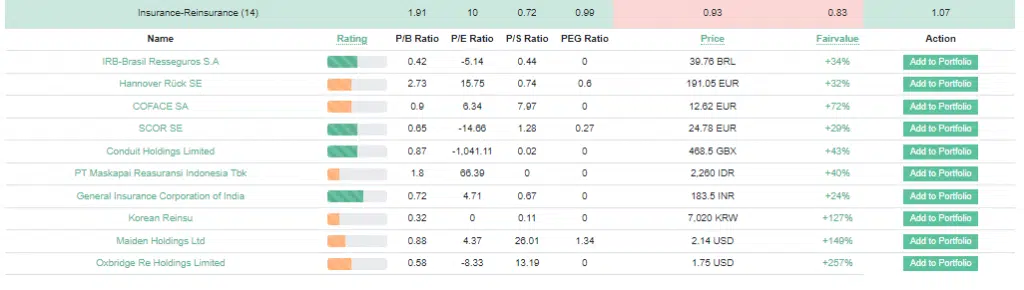

Here we look at the insurance sector with a PEG of 0.99. Companies with a PEG ratio of 0 should be ignored as it implies negative earnings. However there are companies with a PEG ratio of less than 1 which makes them undervalued and they can be explored further to make a case for investment.

Last Words:

Investing in Peter Lynch’s style is quite simple if you know it. All you have to do is pay attention. Each stock holds a business behind it. It is not a lottery ticket but simply a potential for you to become wealthy on the back of a successful business.

If you like a product or service, visit other stores, try to gauge feedback from other users of the product and service and if it seems to be very successful, have a look at the financials. Take complete measures of growth of earnings and the amount of profits the company makes. Companies with high profit margins tend to grow organically whereas companies that spend a lot of money to grow tend to have high growth but come at the cost of profit margins.

This also gives you, as a small investor an edge over the larger, institutional investors as you can gauge the potential of the companies much before they come to the attention of the large investors. Finally, institutional investors are often limited by the size of the company. It has to grow to a certain size before they can begin investing in it. This gives you, the investor an ultimate edge. Invest when the company is small and growing and exit when the institutional investors come in, handing over your position to them and making a tidy profit in return. To do that, we at fairvalue will always be there to help you.

In the next part of the series, we move a little bit closer to our time and now take a look at some of the modern legends of value investing. These are investors that not only invest at value but have also built a streak of vigilantism while doing it. Like Graham, who would often take a sizeable position in undervalued companies holding sizeable cash and bonds and then force them to distribute it to their investors, our activist investors take up positions in stocks to force the companies to unlock their true value. Our next investor, who is one such vigilante, named his flagship investment firm after Gotham, where the one true vigilante, Batman resides. So does our investing vigilante find success? Stay tuned for the next entry of the series. Until then, join our premium membership and unlock some local value gems of your own.