Stock valuation is an essential part of investing.

Knowing how to value a stock can help determine whether it is overpriced, undervalued, or fairly valued. In this blog post, we will explore different stock valuation methods and provide examples of how to use them to find undervalued stocks. All the different methods are used automatically within our Premium Tools, leaving you only one job: leaning back and making profits. For now, let’s explore some different methods of stock valuation.

Price to Earnings Ratio (P/E Ratio)

Explore our most popular stock fair value calculators to find opportunities where the market price is lower than the true value.

- Peter Lynch Fair Value – Combines growth with valuation using the PEG ratio. A favorite among growth investors.

- Buffett Intrinsic Value Calculator – Based on Warren Buffett’s long-term DCF approach to determine business value.

- Buffett Fair Value Model – Simplified version of his logic with margin of safety baked in.

- Graham & Dodd Fair Value – Uses conservative earnings-based valuation from classic value investing theory.

- Intrinsic vs. Extrinsic Value – Learn the core difference between what a company’s really worth and what others pay.

- Intrinsic Value Calculator – A general tool to estimate the true value of a stock, based on earnings potential.

- Fama-French Model – For advanced users: Quantifies expected return using size, value and market risk.

- Discount Rate Calculator – Helps estimate the proper rate to use in any DCF-based valuation model.

One of the most commonly used methods of stock valuation is the Price to Earnings Ratio (P/E Ratio). This ratio compares a company’s stock price to its earnings per share (EPS).

💡 Discover Powerful Investing Tools

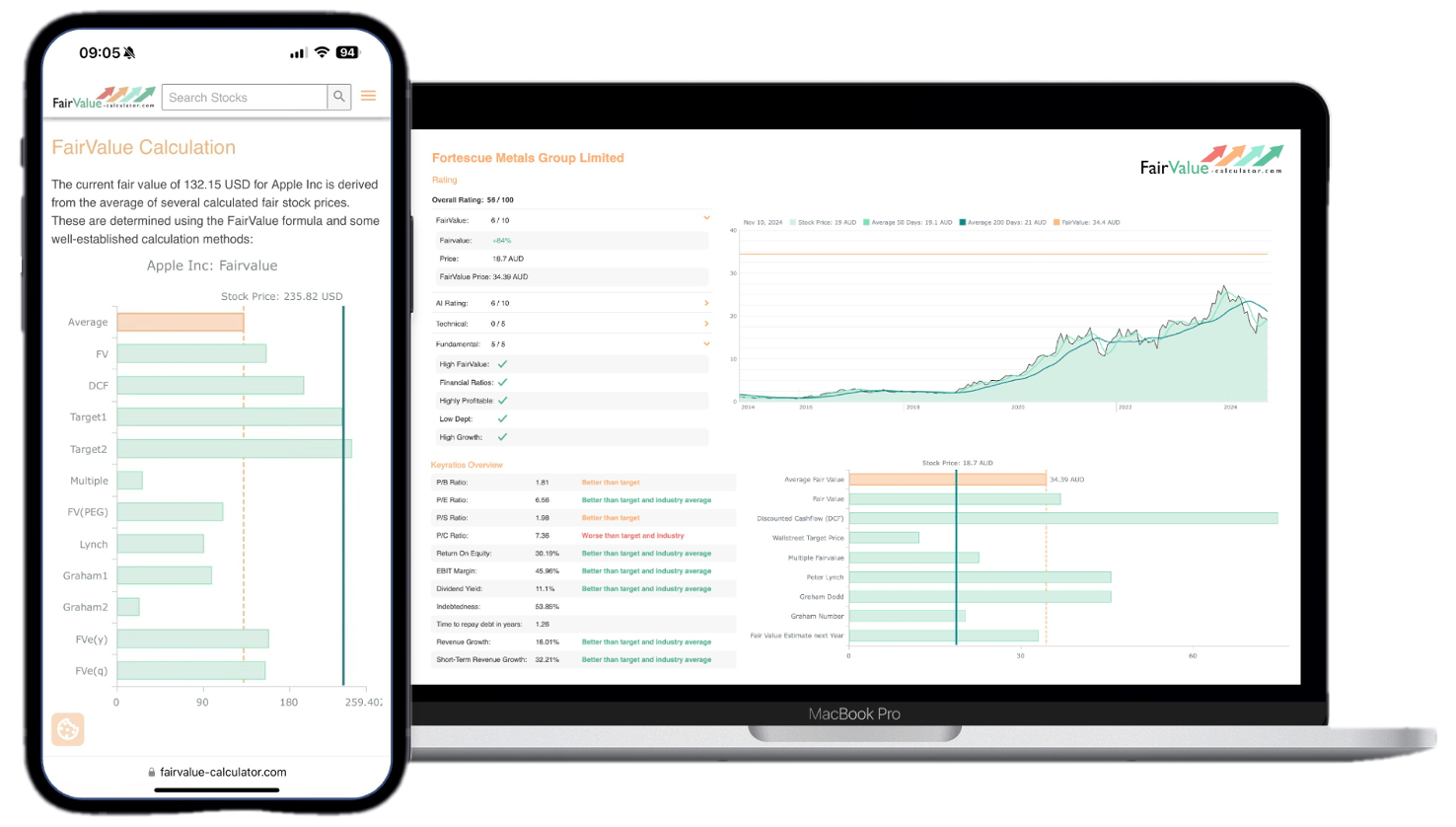

Stop guessing – start investing with confidence. Our Fair Value Stock Calculators help you uncover hidden value in stocks using time-tested methods like Discounted Cash Flow (DCF), Benjamin Graham’s valuation principles, Peter Lynch’s PEG ratio, and our own AI-powered Super Fair Value formula. Designed for clarity, speed, and precision, these tools turn complex valuation models into simple, actionable insights – even for beginners.

Learn More About the Tools →To calculate the P/E Ratio, you divide the current stock price by the EPS. For example, if a stock is currently trading at $50 per share and its EPS is $5, then the P/E Ratio would be 10. Generally, a low P/E Ratio suggests that a stock is undervalued, while a high P/E Ratio suggests that a stock is overvalued. This method is a fairly simple one and we suggest including other valuations in your investment strategies and decisions.

Discounted Cash Flow

This leads us to another common method of stock valuation: the Discounted Cash Flow (DCF) analysis. This method involves estimating the future cash flows of a company and then discounting those cash flows back to their present value. The idea is that the sum of all future discounted cash flows represents the intrinsic value of the company. This method requires a bit more work than the P/E Ratio, but it can provide a more accurate estimate of a company’s value.

To use the DCF method, you first need to estimate the company’s future cash flows. This can be done by analyzing the company’s financial statements and projecting its future earnings. Once you have estimated the future cash flows, you then discount them back to their present value using a discount rate. The discount rate is typically the company’s cost of capital, which is the rate of return that investors require to invest in the company.

For example, let’s say you are valuing a company that is expected to generate $10 million in cash flow next year and is expected to grow at a rate of 5% per year for the next 10 years. If you use a discount rate of 10%, then the present value of the company’s future cash flows would be approximately $76 million. If the company’s market capitalization is currently $50 million, then it may be undervalued based on the DCF analysis.

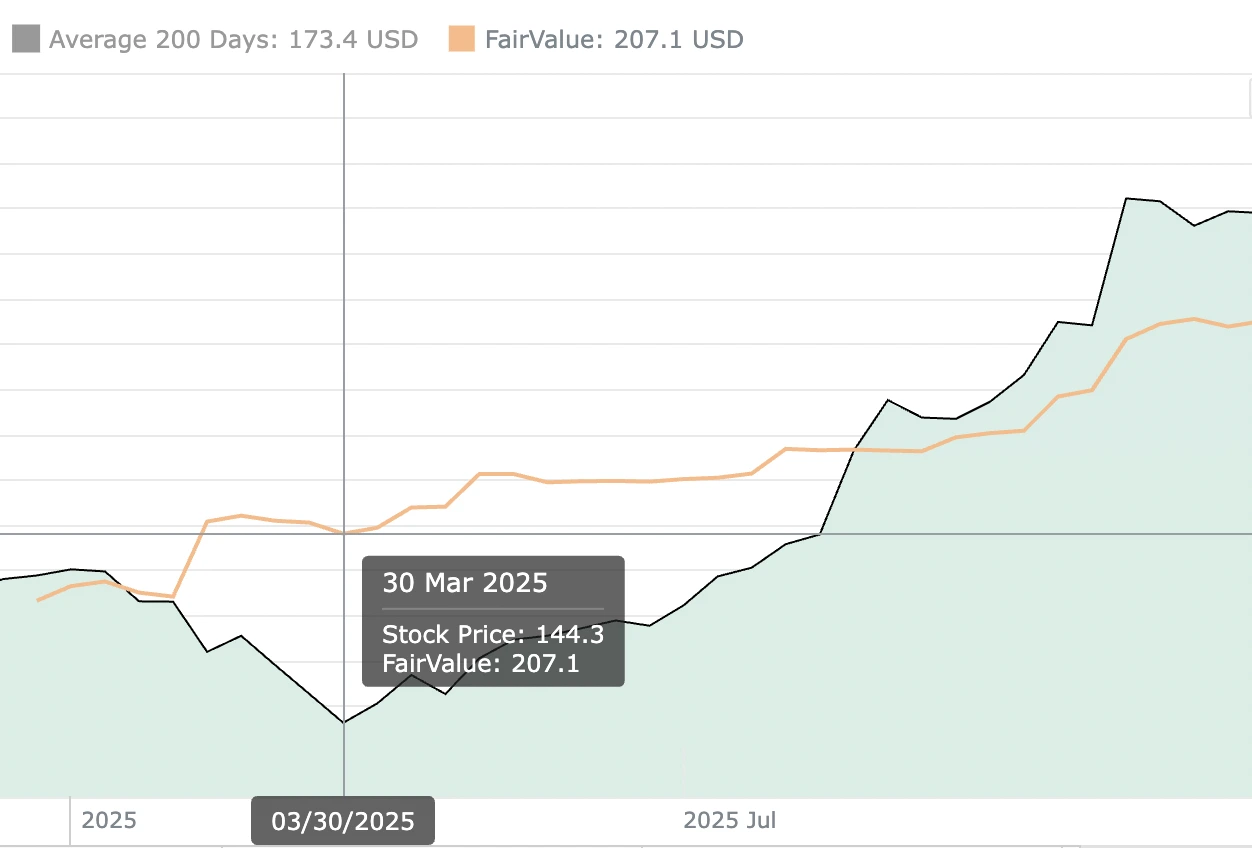

At Fairvalue Calculator, we provide premium tools to help investors value stocks using different methods, including the P/E Ratio and DCF analysis. Our Premium Tools help you determine whether a stock is undervalued, overvalued, or fairly valued based on your input assumptions automatically. We also provide analysis of key financial metrics, such as revenue growth and profitability, to help you make informed investment decisions. All you have to do is Sign Up and enjoy the benefits of our formula and algorithms.

In conclusion, stock valuation is a critical part of investing. The P/E Ratio and DCF analysis are two popular methods for valuing stocks. By using these methods, you can determine whether a stock is undervalued or overvalued. At Fairvalue-Calculator.com, we provide premium tools to help you value stocks and make informed investment decisions.